Over the past few days, a wave of liquidation across the cryptocurrency market has shaken investors' confidence, with many traders feeling anxious. As selling pressure intensifies, many Bitcoin holders are distributing their coins.

Long-term Bitcoin holders (LTHs), who are generally known for holding coins for a long time, have recently started selling, already adding additional pressure to an already cautious market. What might this mean for the coin in the short term?

To Old BTC Exchanges... Have Long-term Holders Lost Confidence?

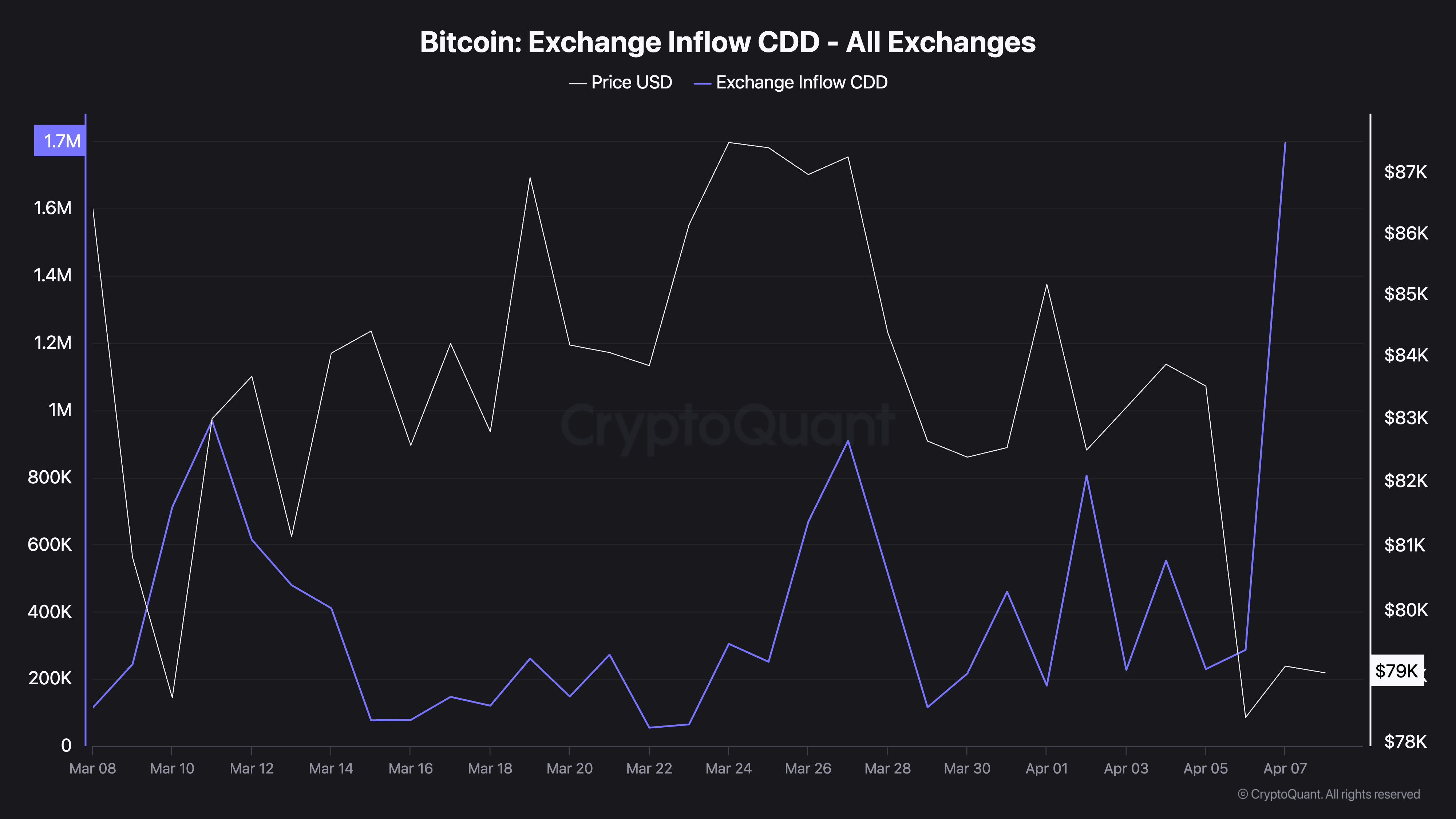

Bitcoin's Coin Days Destroyed (CDD) on exchanges has reached its highest point in 30 days.

According to the on-chain cryptocurrency platform CryptoQuant, it currently stands at 1.79 million dollars and has surged by over 850% since early April. This surge indicates that long-held coins are being transferred to exchanges, which is a typical precursor to potential selling.

BTC's exchange inflow CDD tracks the movement of old coins to exchanges. It is calculated by multiplying the amount of BTC moved by the number of days those coins have been held.

When this indicator spikes, it suggests LTHs are moving coins to exchanges, potentially for selling. This trend is noteworthy because this investor group has "strong hands". They only sell when market conditions are concerning. Therefore, when they sell, it indicates weakening confidence and suggests potential further price decline.

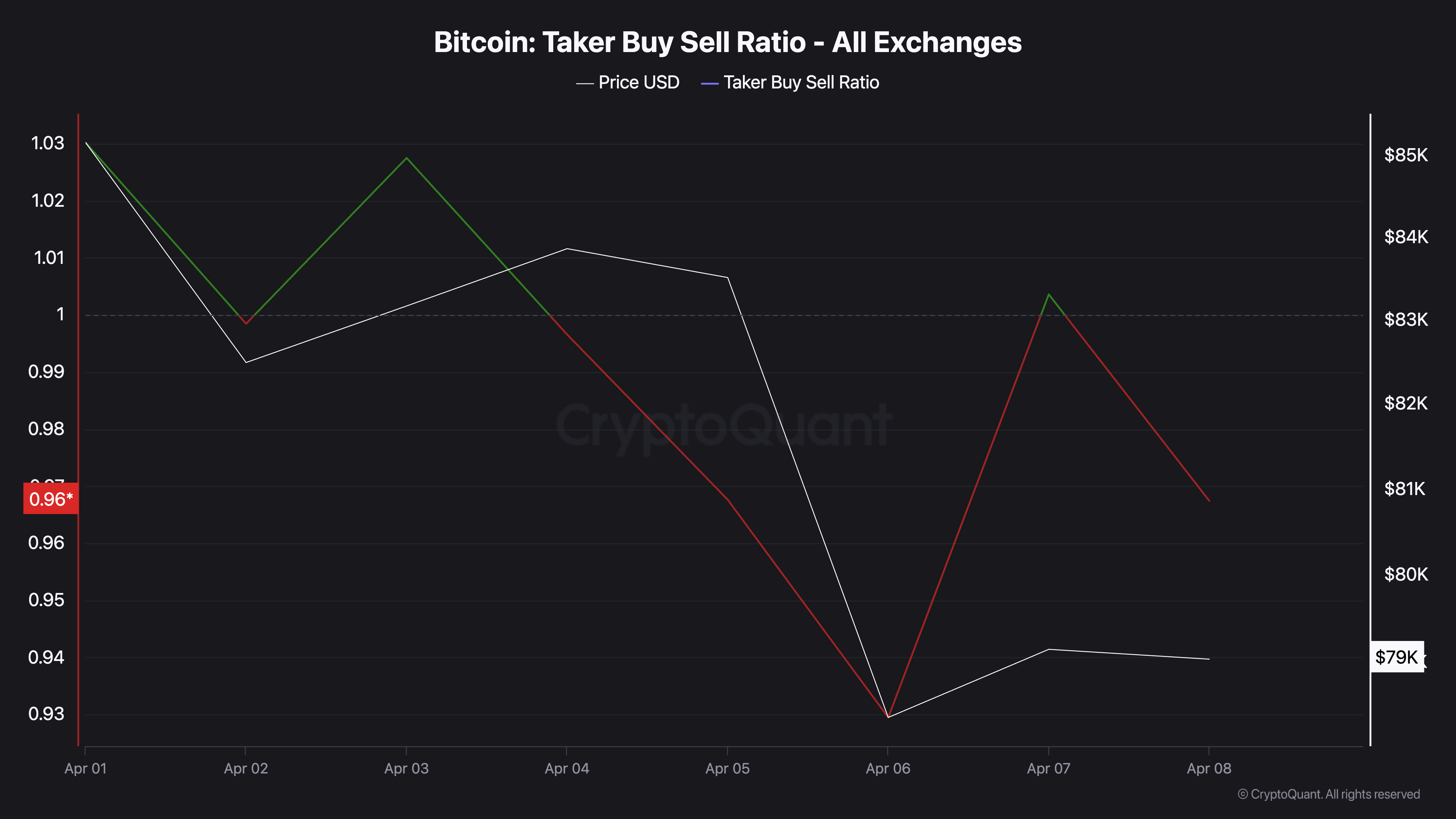

Selling momentum is also reflected in the derivatives market. BTC's taker buy-sell ratio is currently below 1, indicating that sell orders exceed buy orders in futures and perpetual contracts.

Bitcoin Taker Buy-Sell Ratio. Source: CryptoQuant

This suggests that derivative traders of the coin are preparing for further decline, amplifying the current bearish sentiment.

BTC Uptrend Faces Resistance Due to Weakening Buying Pressure

The market has attempted a slight recovery over the past few hours, with the total cryptocurrency market cap increasing by 48 billion dollars in the last day. This increased activity has caused BTC's price to rise by 4% in the last 24 hours.

However, the coin's Chaikin Money Flow (CMF) is sending a warning signal by showing a downward trend. At the time of reporting, CMF has fallen below the zero line to -0.15, continuing its decline.

Bearish divergence occurs when an asset's price rises while CMF falls. This indicates that buying pressure is weakening despite price increases. If this trend continues, BTC could lose its recent gains and trade at $74,389.

However, if the coin witnesses a revival of new demand, it could maintain its uptrend and rise to $80,776.