Escalating trade war tensions are triggering market volatility, raising concerns among investors. However, one analyst suggests that this uncertainty could serve as a catalyst for Bitcoin (BTC) value appreciation.

While Bitcoin struggles to gain momentum, both traditional and cryptocurrency markets are showing widespread losses.

Trade War: An Opportunity for Bitcoin's Leap? Five Factors for Value Growth

In a detailed analysis posted on X (formerly Twitter), Ben Sigman, CEO and analyst of Bitcoin Libre, explained five factors that tariff conflicts could trigger Bitcoin value increase.

His first point concerned the potential path of the US dollar. According to him, the trade war will strengthen the dollar, but a subsequent collapse will reverse this.

"Tariffs will spike the dollar. Emerging markets collapse due to $12 trillion in dollar debt. Fiat trust erodes. Capital rushes for fixed supply safety," he said.

Sigman suggested that capital might seek refuge in fixed-supply assets like Bitcoin, positioning it as a safeguard against financial instability.

Next, he highlighted Bitcoin's potential as an inflation hedge. Tariffs often disrupt global supply chains, increasing commodity costs and hindering economic growth. In response, central banks, including the Federal Reserve, may lower interest rates to devalue national currencies.

Sigman argued that Bitcoin's inherent scarcity and global accessibility make it an attractive hedge in such scenarios.

Third, he emphasized the accelerating de-dollarization trend. He explained that countries like China now process 56% of trade invoices in yuan, increasingly seeking alternatives to the US dollar.

According to him, the BRICS (Brazil, Russia, India, China, South Africa) alliance will also develop an alternative financial system. However, these changes carry risks of capital outflow.

"Bitcoin thrives as a neutral, global option in a fragmented world," he claimed.

Fourth, Sigman predicted market panic. He estimated that a single tariff cycle could erase $5 trillion in market value, flatten bond yields, and make traditional safe assets like gold less attractive.

In such an environment, Bitcoin's volatility could attract investors seeking high risk and high rewards, potentially inducing significant capital inflow.

Finally, Sigman argued that trade wars could expose systemic vulnerabilities in global institutions. Tariffs might trigger debt defaults and weaken trust in fiat-based systems, potentially redirecting investors towards Bitcoin.

"Bitcoin was made for this – no permission needed, no borders, no banks," he concluded.

However, not all analysts share Sigman's optimism. Another prominent commentator, Fred Krueger, recently presented nine predictions about the possibility of over 100% tariffs on China. He predicted that this measure could lead to significant declines in Bitcoin and other cryptocurrencies like Solana (SOL).

"We all go down together. It ends sometime. When? Trump is unfortunately crazy and getting bad advice," he wrote.

When asked if Bitcoin would go to zero, he joked,

"I'll buy all at $1."

As trade tensions escalate between the US and China—with additional tariffs on Chinese goods and broader geopolitical friction—Bitcoin's role in the global financial sector continues to be closely examined. How the largest cryptocurrency will perform long-term remains to be seen.

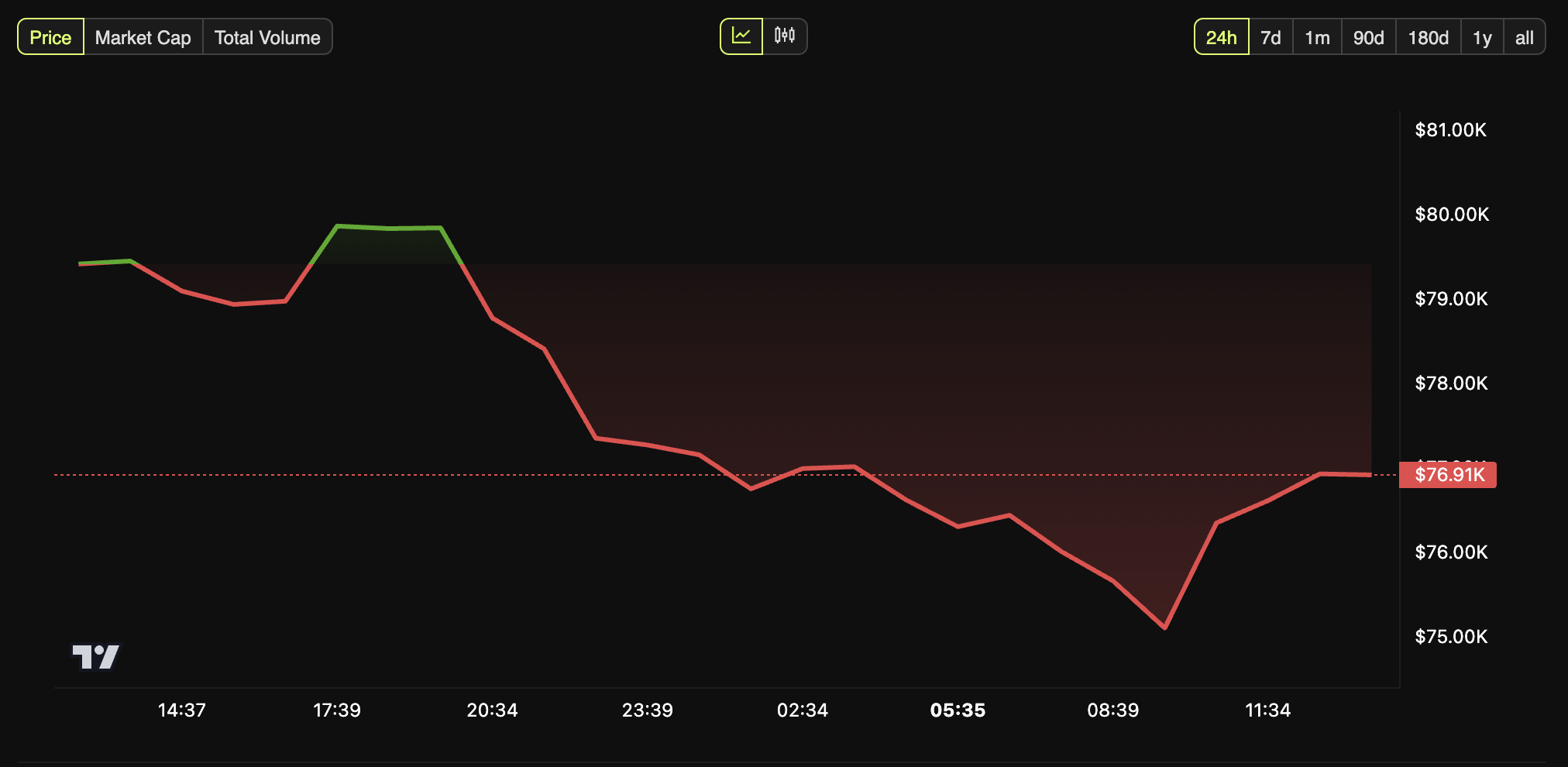

Currently, the market is showing considerable weakness. According to BeInCrypto data, BTC declined by 3.1% over the past day and was trading at $76,914 at the time of writing.