In Korea, the 'Kimchi Premium', where cryptocurrency prices are higher compared to overseas markets, has turned negative, showing a weak trend compared to the global market.

As of 8:29 AM on the 10th, according to CryptoPrice, the Kimchi Premium (Upbit<><>Binance) was recorded at -0.87%.

Turning negative from 0.92% the previous day, it indicates an overall contraction in domestic investment sentiment and a slowdown in buying pressure.

Major altcoins also continued to show weakness, recording negative premiums. Particularly, XRP showed the largest reverse premium at -0.95%, indicating strong selling pressure.

Kimchi Premium Status by Coin

Bitcoin (BTC) $82,835 ₩121,760,000 -0.87%

Ethereum (ETH) $1,658.49 ₩2,437,000 -0.91%

Solana (SOL) $118.72 ₩174,500 -0.88%

XRP $2.056 ₩3,020 -0.95%

Doge Coin (DOGE) $0.1611 ₩237 -0.78%

Kimchi Premium is a phenomenon where cryptocurrency prices are higher on Korean exchanges, caused by sudden domestic demand or lack of overseas liquidity. The reduction or negative conversion of Kimchi Premium indicates weakening domestic buying pressure or weakness in domestic prices compared to global rates.

Bitcoin Technical Analysis

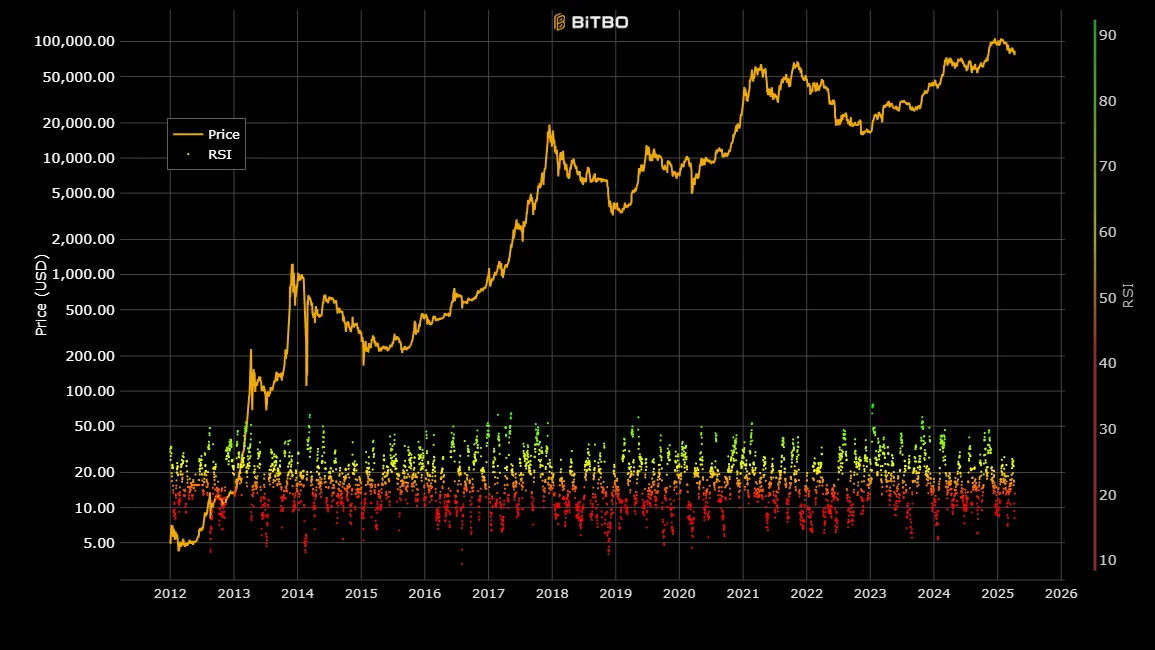

Looking at technical indicators, the current Bollinger Band upper limit is set at $89,364, and the lower limit at $77,760.

Bitcoin is trading at $82,944, up 8.63% from the previous day. Located near the band's upper limit, it shows an overheating signal and suggests the possibility of short-term profit-taking. The breakthrough of the upper limit is expected to be a watershed for additional increases.

The '20-day moving average', which determines the strength and direction of the trend through the average price over a certain period, is currently located at $83,562.

Bitcoin price is currently staying below the moving average. With upward momentum slowing down, it appears to have entered a breathing phase in front of a short-term resistance line. Whether it breaks through and settles on the moving average is emerging as the key point for short-term trend reversal.

The RSI (Relative Strength Index), which measures the strength of price increases and decreases, is 45.52, quickly rising from 33.05 the previous day. It has opened up the possibility of a rebound by escaping downward pressure, but is still far from the overbought zone. It is expected to continue exploring direction within a neutral flow for the time being.

RSI above 70 indicates an overbought state with an increased possibility of adjustment (decline), and RSI below 30 indicates an oversold state with an increased possibility of a rebound.

The negative conversion of Kimchi Premium and major technical indicators reflect the temperature difference between domestic and foreign markets and changes in investment sentiment. The domestic market is significantly influenced by global rates amid a wait-and-see attitude, and Bitcoin is currently exploring direction in a technically neutral zone.

In the short term, it is a selling-dominant phase, but the breakthrough of the moving average and global liquidity flow are expected to be key variables determining the future market direction.

[This article does not provide financial advice, and the investment results are the responsibility of the investor.]

News in real-time...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>