Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has faced sharp criticism from the community as it confronts significant price challenges this year. This has been impacted by escalating geopolitical tensions and widespread market uncertainty.

However, market observers believe a recovery could be imminent. They point to several catalysts that could drive price momentum from now on.

Will Ethereum's Price Recover? Expert Opinions

Analyst Ted Pillows highlighted a series of major events scheduled for May 2025 that could potentially boost Ethereum's price, including a surge in tokenization. In a post on X (formerly Twitter), Pillows noted the Pectra upgrade expected on May 7th. This upgrade introduces several key improvements including staking, deposit processing, blob capacity, and account abstraction.

Additionally, he pointed to the potential introduction of an ETH staking ETF. Following the spot ETH ETF introduction last year, their performance was disappointing compared to the spot Bitcoin (BTC) ETF.

In fact, many believe the lack of staking yields for Ethereum ETFs has hindered their growth. Nevertheless, this could change soon. In February 2025, Cboe submitted a request to the SEC to allow the 21Shares Core Ethereum ETF to stake ETH held in trust.

A similar request for the Fidelity Ethereum Fund followed the next month. Additionally, NYSE submitted an application on behalf of the Bitwise Ethereum ETF at the end of March.

"Each event could push ETH up by $1,000," Pillows wrote.

Pillows also mentioned that Ethereum is currently the "most hated token", drawing a comparison similar to Solana (SOL) after its drop to $8. However, his observation is not without merit, reflecting substantial pessimism in the community towards altcoins.

"If I had invested $10,000 in Ethereum 7 years ago, I would still have $10,000. Trump, you ruined us!" a user mentioned.

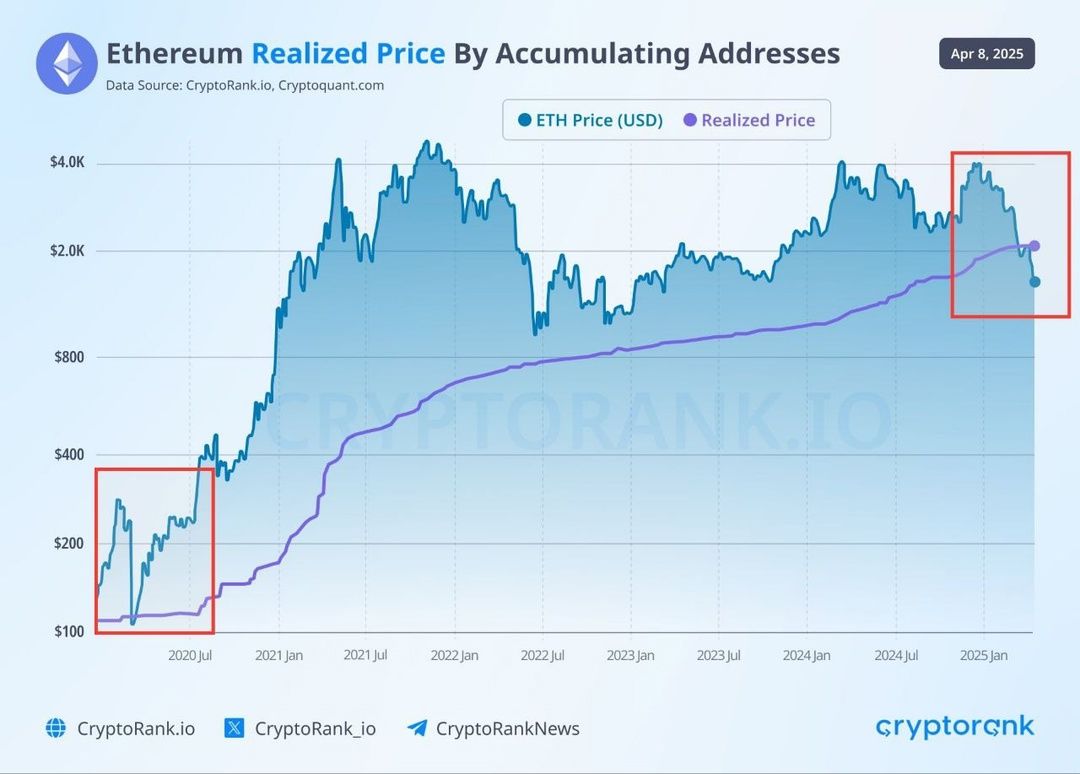

Nevertheless, many see ETH's low price as an opportune moment to buy. According to one analyst, ETH is currently undervalued. He emphasized that the market price has fallen below the realized price for the first time since 2020.

"Generational ETH buying opportunity!" the analyst claimed.

BeInCrypto's latest analysis confirmed ETH's undervalued status. This shows the MVRV ratio is located in the "opportunity zone".

Notably, ETH's recent recovery has sparked optimism. After the SEC approved options trading for BlackRock's iShares Ethereum ETF (ETHA), altcoins showed positive price movement.

Additionally, Trump's decision to suspend almost all tariffs for 90 days also led to a broad market recovery. That's not all. Trump further heightened market sentiment by declaring:

"Now is a good time to buy!"

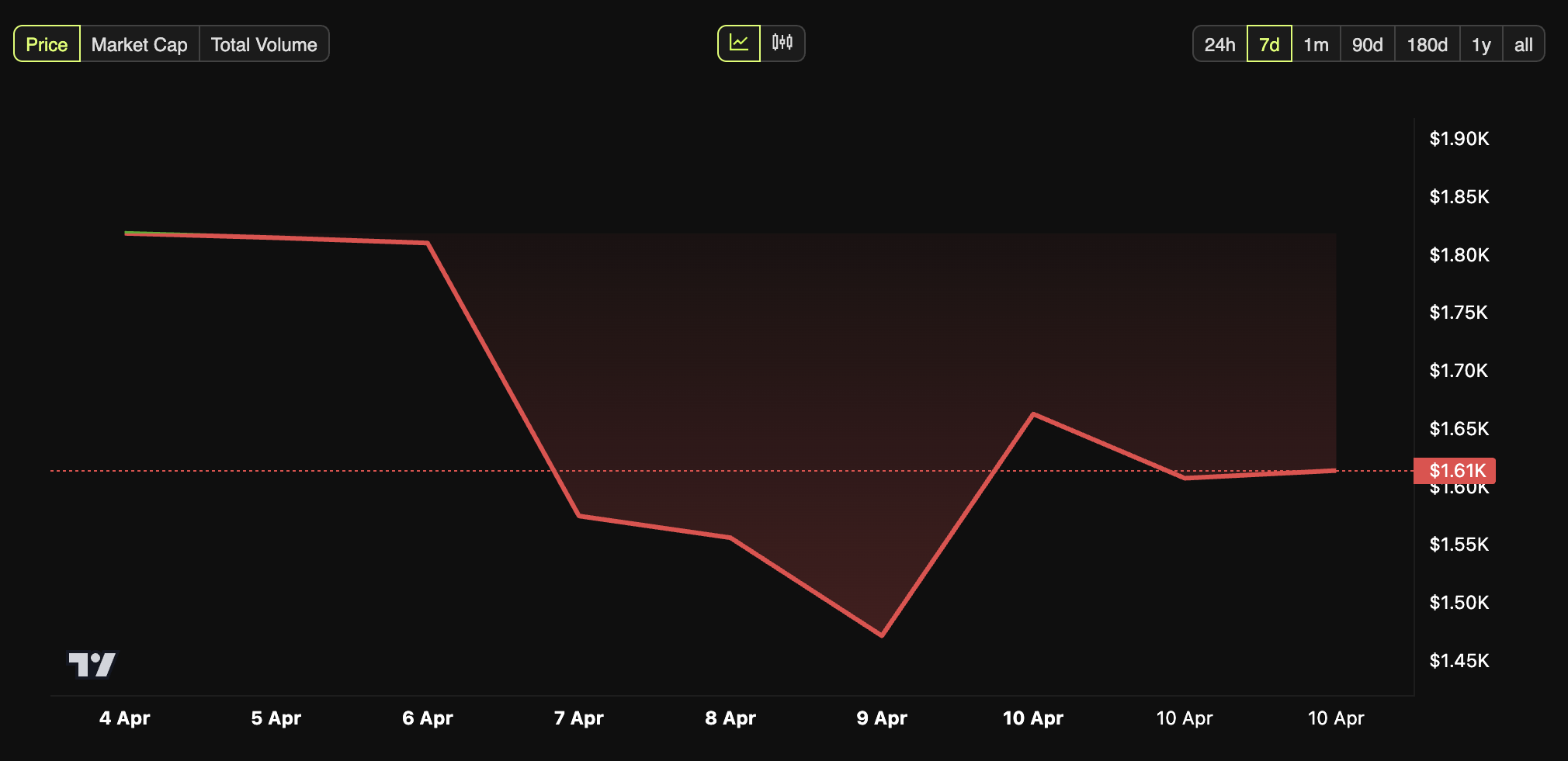

As a result, ETH surged by double digits in the past day. At the time of reporting, it was trading at $1,613, reflecting a 13.7% increase.