Donald Trump's recent tariff suspension decision triggered a rise in stock, bond, dollar, and cryptocurrency markets. However, experts believe this tariff suspension is creating a "dead cat bounce" in the market.

This recovery occurred after Trump imposed reciprocal tariffs on all countries, particularly imposing a high 104% tariff on Chinese imports. This announcement shook the market, causing a significant decline.

Cryptocurrency Market Surge, Dead Cat Bounce?

BeInCrypto reported that Trump's 90-day tariff suspension excluded China. Importantly, tariffs have now risen to 125% following Beijing's retaliatory measures.

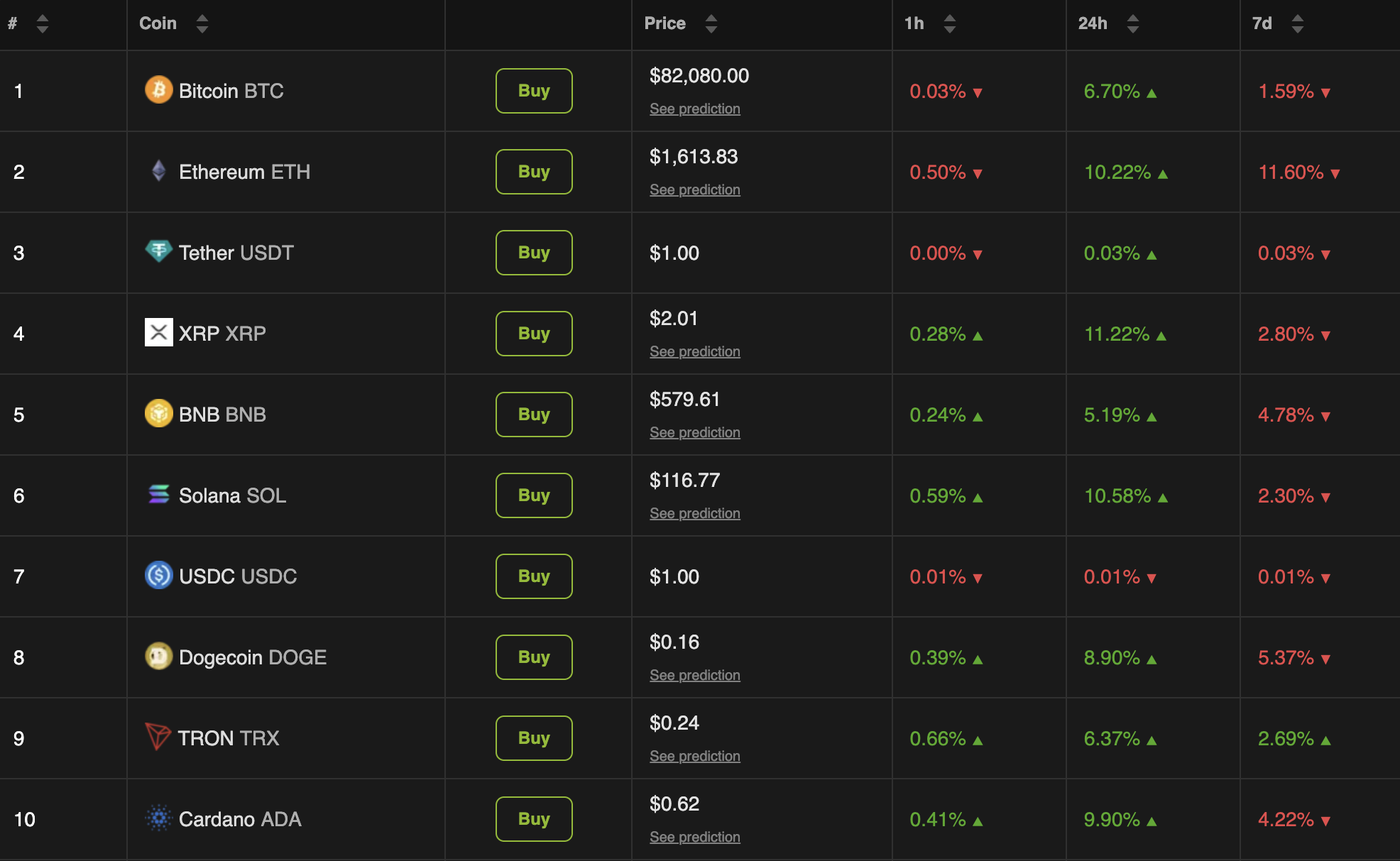

Nevertheless, this measure injected significant vitality into the market. The total cryptocurrency market capitalization rose 5.5% in the past 24 hours. Bitcoin (BTC) recovered to $80,000.

Other major cryptocurrencies like Ethereum (ETH), XRP (XRP), Solana (SOL) also recorded double-digit increases. This indicates an optimistic investor sentiment.

However, skepticism still exists behind this upward trend. Jacob King, analyst and CEO of WhaleWire Newsletter, warned that the tariff suspension is setting a trap for retail investors.

"We have officially entered the dead cat bounce phase: suspending tariffs and luring retail investors back to prepare for the next decline." He posted.

He predicted that institutions would quietly sell while retail investors rush into the market. Many agree with King's concerns. Economics professor Steve Hanke was even more direct.

"If Trump continues to play the tariff card, this rise will be nothing more than a dead cat bounce." Hanke said.

Indeed, some investors plan to sell to avoid losses.

"This is a 90-day dead cat exit bounce. Sell and leave in May." Another analyst wrote.

Nevertheless, investor and analyst Amit presented a different perspective. He suggested that previous market rebounds were dead cat bounces because they were not based on fundamental reasons.

The analyst pointed out that this time there might be genuine reasons for market optimism.

"If tariffs are truly suspended, there is a fundamental catalyst for the market." He said.

He explained that the initial 10% tariff has already been factored into the market. However, if the 90-day tariff suspension is indefinitely extended and leads to negotiations with China, the market could stabilize.

"We also assumed these tariffs would be implemented and did a lot of selling. Employment data is okay. If tariffs aren't the problem, we don't necessarily need to visit 7000 spx soon, but this catalyst could be long-term, so it might not be a dead cat." Amit added.

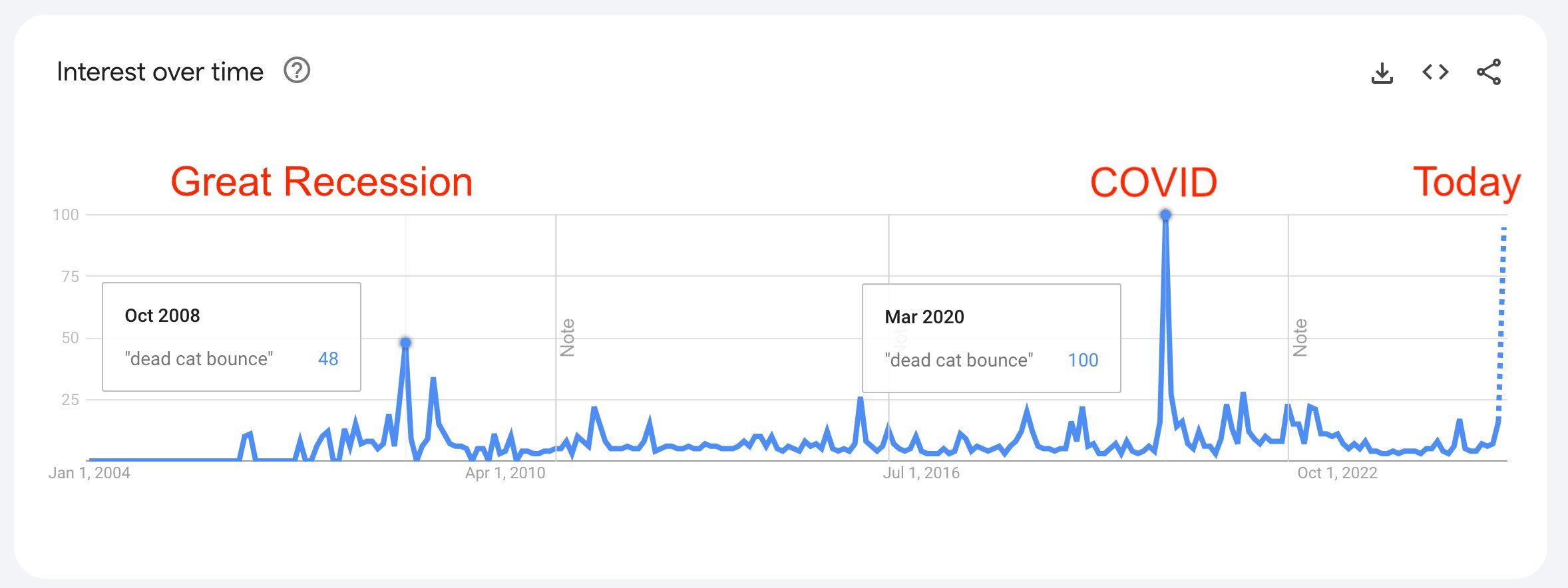

The term "dead cat bounce" refers to a temporary recovery in asset prices after a sharp decline. It surged in online searches following the COVID-19 pandemic.

During that period, markets like Bitcoin and stocks showed V-shaped recovery through quantitative easing (QE). BeInCrypto reported that this time, the Fed is increasingly likely to return to QE in response to market volatility and financial instability.

If quantitative easing revives, it could significantly impact financial markets, especially cryptocurrencies. This sector could see a strong rebound similar to previous QE periods. Previously, former BitMEX CEO Arthur Hayes predicted Bitcoin could reach $250,000 by the end of 2025.