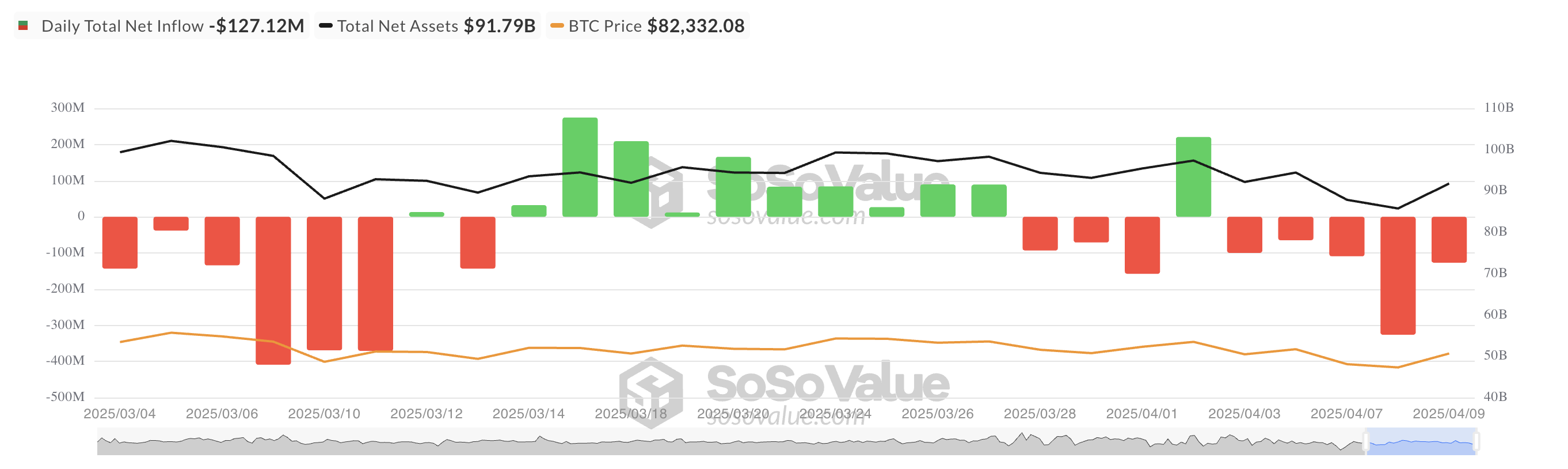

Bitcoin Spot ETF Records Another Fund Outflow on Wednesday, Continuing 5 Consecutive Days of Withdrawals

These persistent fund outflows particularly indicate a weakening of investor confidence among institutional investors in the short term.

April ETF Data Shows Decreased Bitcoin Interest

Since the beginning of April, this fund has only recorded fund inflows for a single day. This trend confirms that institutional investors are withdrawing funds from Bitcoin spot ETFs in response to rapidly changing macroeconomic conditions.

On Wednesday, the fund outflow from spot BTC ETFs totaled $127.12 million. According to SosoValue, Bitwise's ETF BITB recorded the highest net inflow that day at $6.71 million, with the fund's historical net inflow reaching $1.98 billion.

BlackRock's ETF IBIT recorded the highest net outflow on Wednesday, totaling $252.29 million. At the time of writing, its total historical net inflow remains $39.57 billion.

This trend of institutional investors withdrawing funds from spot BTC ETFs suggests a weakening confidence in the short-term price path of the coin due to macroeconomic uncertainty amid Donald Trump's global trade war.

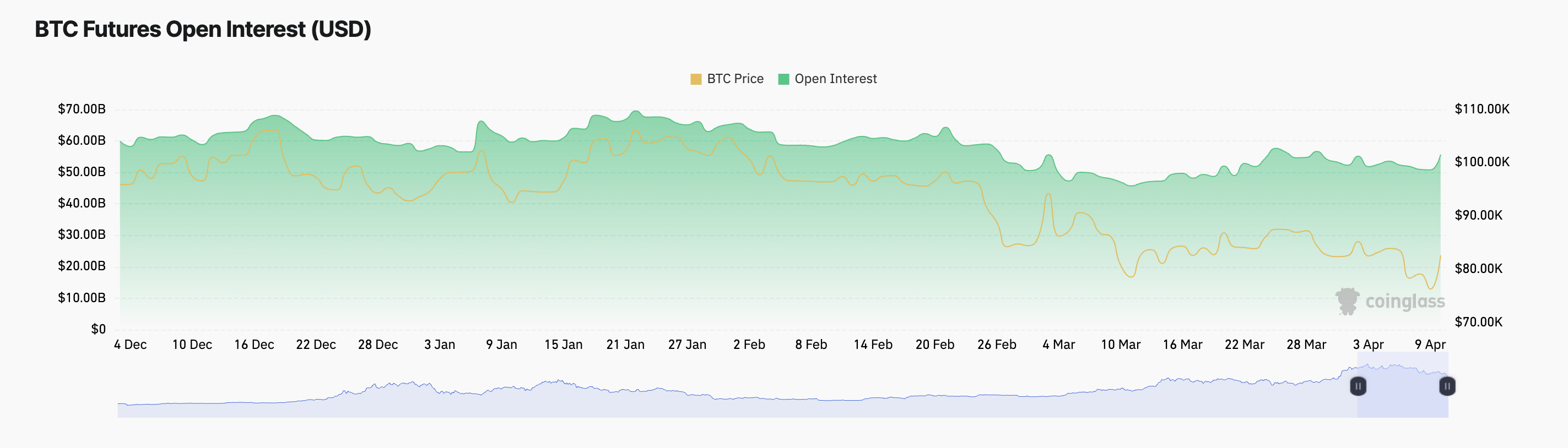

BTC Futures Remain Active Despite ETF Outflows

Despite the downward trend in spot ETF flows, the broader derivatives market is showing resilience. BTC futures open interest continues to increase, highlighting the daily number of new positions.

According to CoinGlass, BTC futures open interest reached $55 billion, increasing by 10% in the past day. Such an increase in open interest indicates more new positions are being opened in the derivatives market, signaling increased trading activity and investor interest.

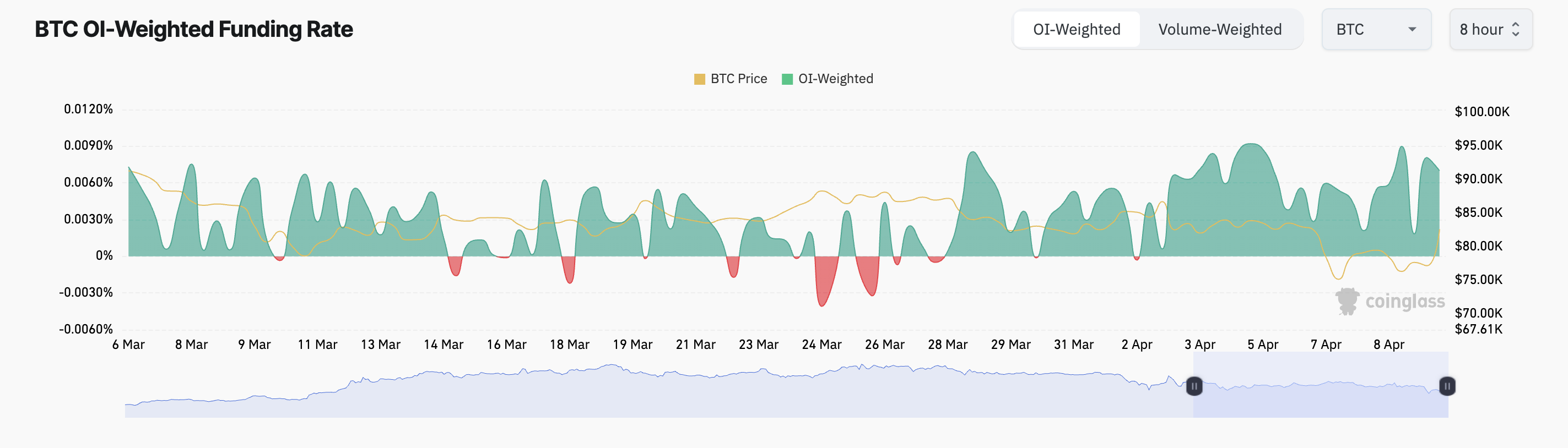

Moreover, the coin's funding rate remains positive, staying at 0.0070% despite overall market sentiment weakening.

Despite price issues, BTC's steady positive funding rate indicates that traders remain optimistic and willing to pay a premium to maintain long positions. This suggests expectations of a short-term rebound.

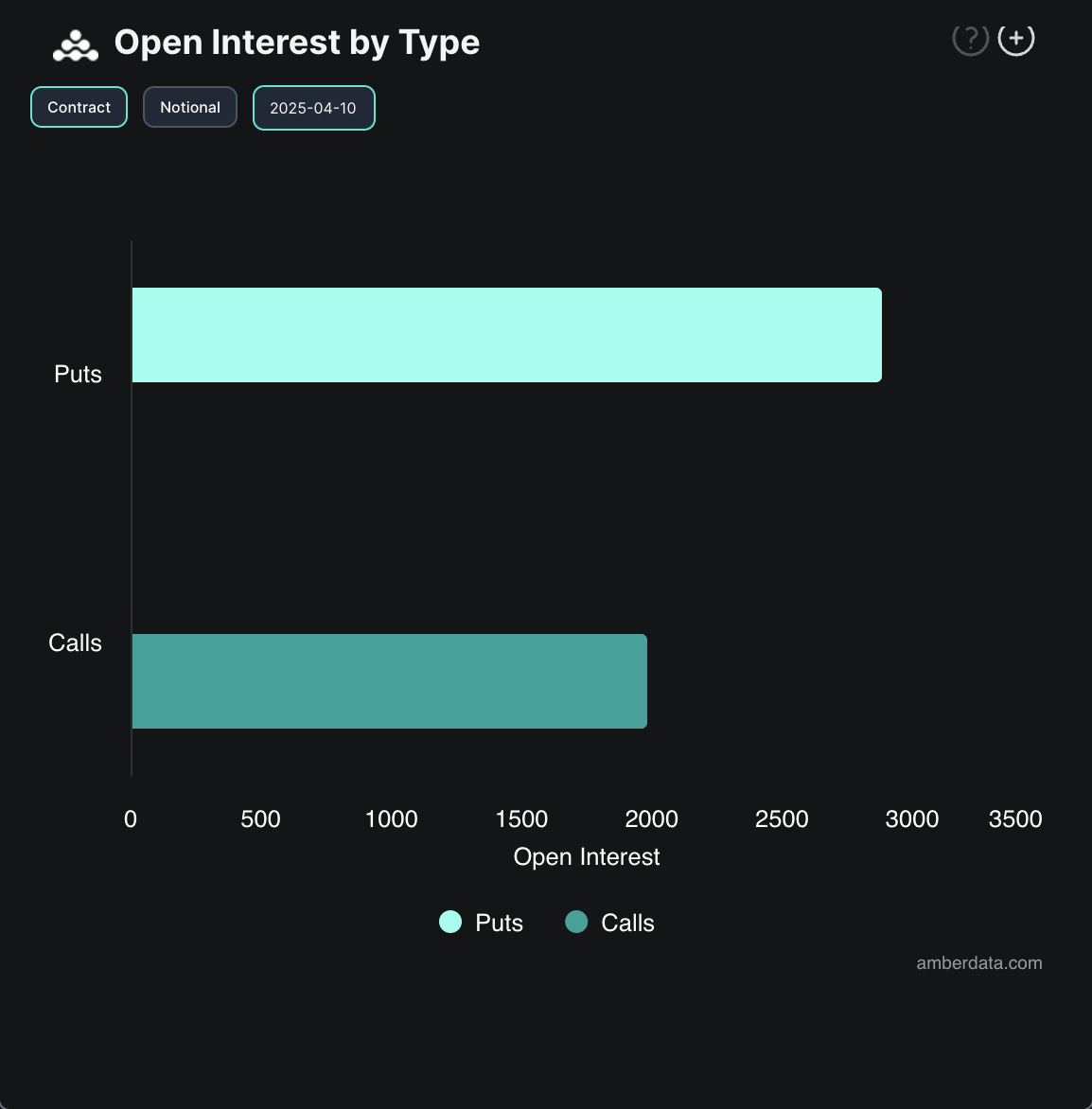

Caution is advised. Today's increase in call option demand suggests positioning in anticipation of a BTC price decline.

The continuing contrasting dynamics between BTC ETF flows and futures market activity highlight an interesting situation where short-term caution coexists with long-term optimistic speculation.