The cryptocurrency market is showing signs of a potential altcoin season. Market observers mention that technical, psychological, and macroeconomic factors could drive a significant altcoin surge.

This outlook came after a notable decline in the altcoin market. It dropped approximately 37.6% from its peak in early December 2024. According to the latest data, the market capitalization is 1.1 trillion dollars.

Is the Altcoin Season Coming?

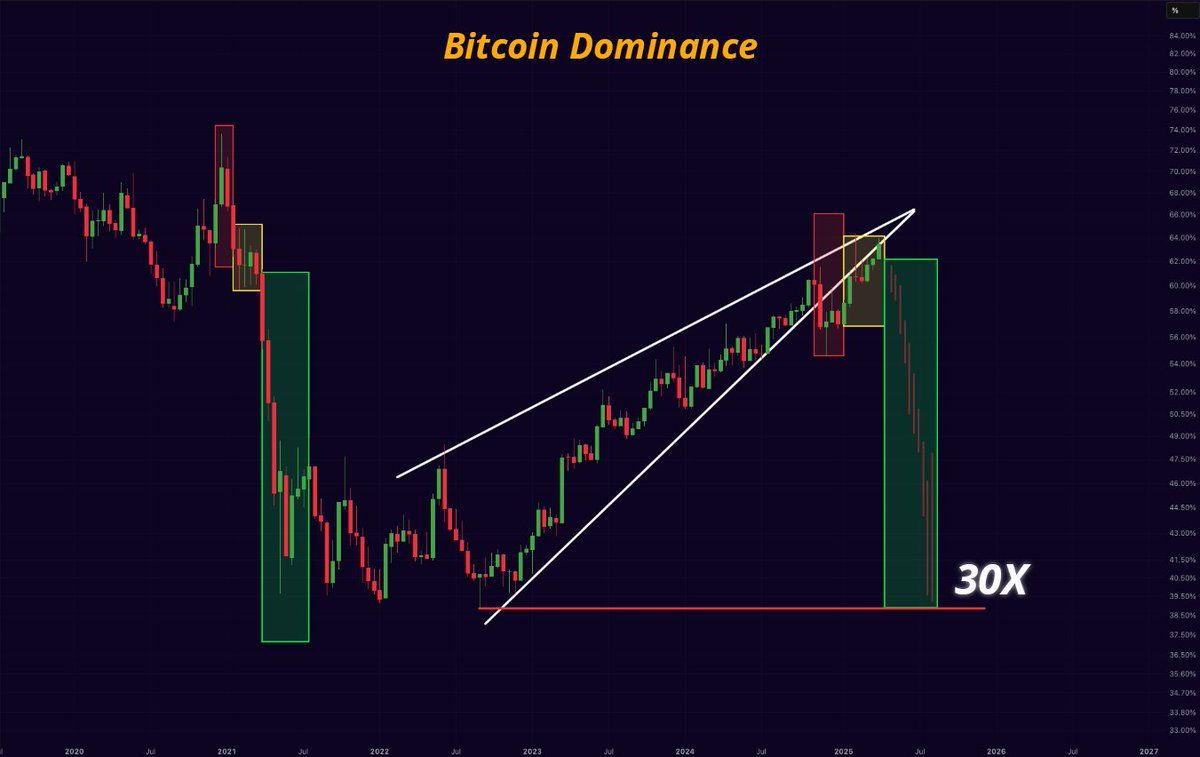

From a technical perspective, BTC dominance appears to be at a critical turning point, which compares Bitcoin's market share to the entire cryptocurrency market.

A recent chart shared by crypto analyst Mr. Crypto on X emphasized that Bitcoin dominance has reached resistance following an ascending wedge pattern. This pattern is typically considered a bearish signal and often leads to a sharp retreat.

"Bitcoin dominance will collapse. The altcoin season is coming. We will all get rich this year!" he wrote.

Additionally, another analyst confirmed these findings and mentioned that Bitcoin dominance has reached its peak, thus predicting a subsequent decline.

However, the altcoin season index has dropped to 16. This index analyzes the performance of the top 50 altcoins against Bitcoin, currently indicating poor altcoin performance.

Notably, this level reflects the altcoin bottom observed around August 2024, which preceded a major altcoin surge. During this period, the index reached 88 in December 2024.

Lastly, from a macroeconomic perspective, market confidence has been restored as Donald Trump's tariff implementation was delayed by 90 days. This delay is perceived as a positive signal and could potentially stimulate capital inflow into altcoins.

"90-day tariff pause = 90-day altcoin season," an analyst argued.

Moreover, analyst Crypto Rover identified quantitative easing (QE) as a catalyst for the altcoin season. According to him, when central banks begin injecting money into the economy through QE, altcoins could experience significant price increases benefiting from increased liquidity and investor optimism.

"When QE starts, the altcoin season will return massively!" he said.

However, in the latest report, Kaiko Research emphasized that the traditional altcoin season might no longer be feasible. Instead, potential gains could be selective, with only a few altcoins experiencing substantial growth. The focus will be on real-world use cases, strong liquidity, and assets with revenue-generating potential.

"The altcoin season might become a thing of the past, and the correlation between crypto asset returns, growth factors, and liquidity is changing significantly over time, requiring a more granular classification beyond the simple 'altcoin' categorization," the report read.

Kaiko Research noted that liquidity concentration in a few altcoins and Bitcoin might hinder the typical capital flow to altcoins during market rallies. Additionally, as Bitcoin is more widely adopted as a reserve asset by institutions and governments, its market position is further strengthened.

Ultimately, while signs suggest the possibility of an altcoin surge, the future of altcoins may involve more nuanced market dynamics.