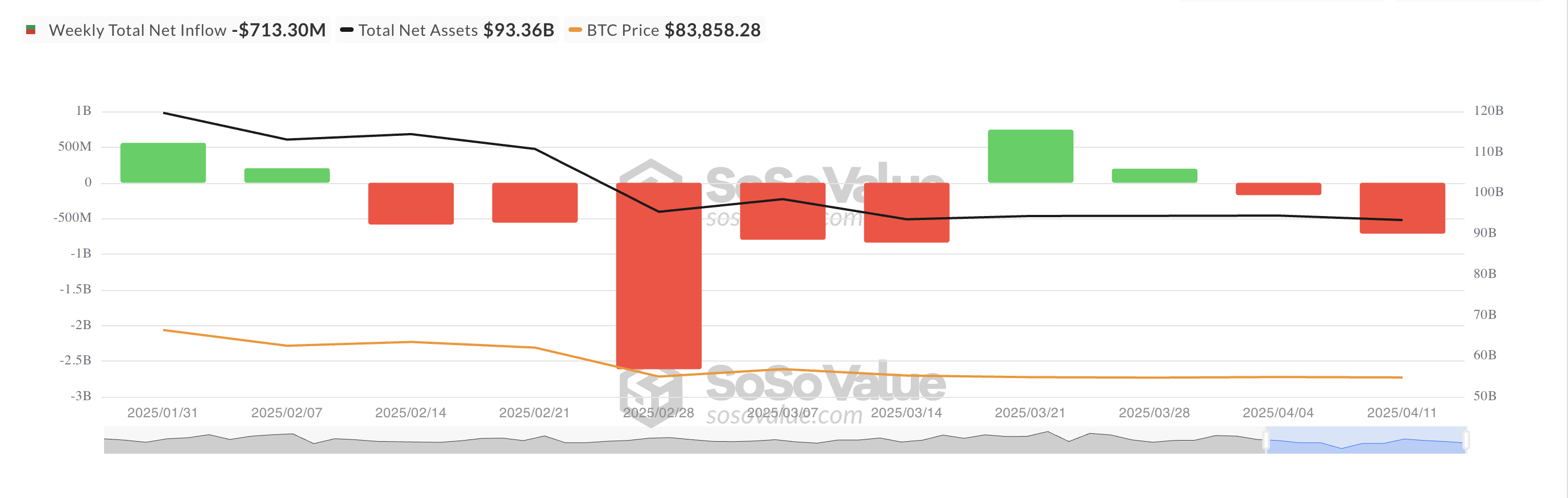

Last week, the spot Bitcoin ETF experienced a daily net outflow of $713 million, which is more than three times the $172.69 million outflow from the previous week.

In the derivatives market, Bitcoin's open interest decreased at the start of the new week, but the funding rate remains positive.

Bitcoin ETF, Investor Confidence Shaken by Market Volatility

Between April 7 and April 11, institutional investors withdrew some capital from Bitcoin funds. This movement primarily caused Bitcoin's price to drop below $85,000 due to overall market issues, with several declines reaching as low as $74,000.

During the review period, total net outflow reached $713 million, a 314% increase compared to the previous week's $172.69 million outflow.

The largest weekly outflow occurred in BlackRock's IBIT, recording a net outflow of $343 million, accounting for 48% of the total withdrawal. Grayscale's GBTC recorded an outflow of $161 million, bringing its total net outflow to $2.278 billion.

Although the ETF market is depressed, some funds recorded inflows last week. According to SosoValue, Grayscale's Bitcoin Mini Trust attracted $2.39 million, the highest net inflow among Bitcoin spot ETFs last week.

Bitcoin Derivatives Market, Cautious Optimism

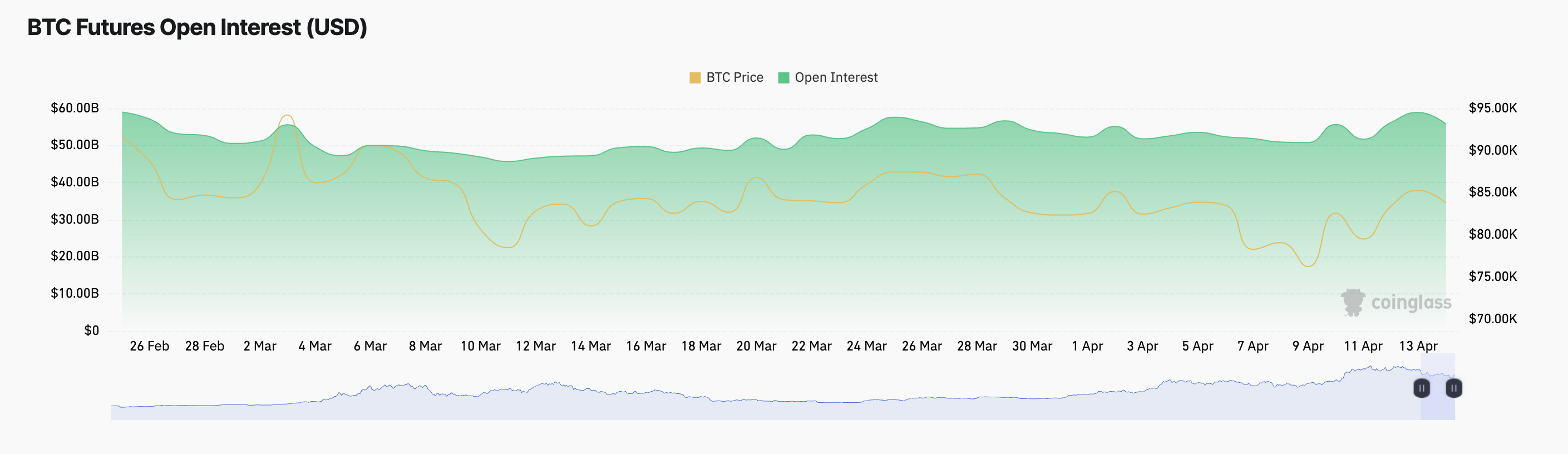

On the derivatives side, Bitcoin's futures open interest is showing a downward trend at the start of the new week.

Currently standing at $55.73 billion, it has dropped 5% in the past day. This occurs amid the market's recovery attempt, with Bitcoin's value rising 1% in the past day.

The decrease in open interest while Bitcoin's price rises indicates short-term caution among derivatives traders. This suggests that traders are closing existing positions rather than entering new ones.

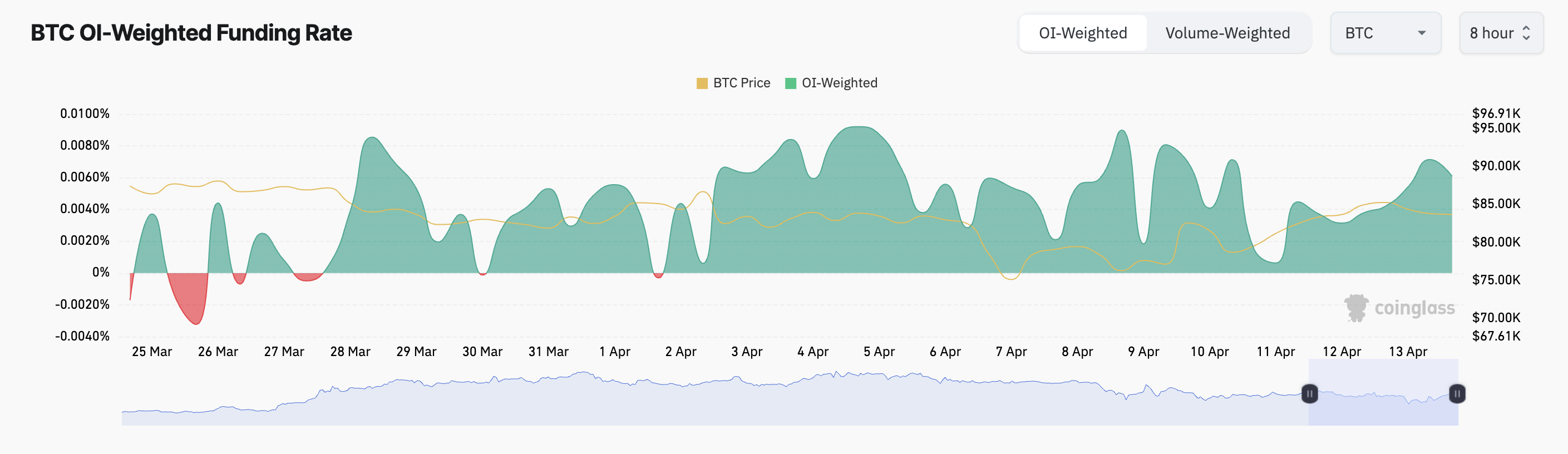

Nevertheless, the funding rate remains positive, indicating that long positions are still prevalent among perpetual futures traders, though with a more cautious attitude.

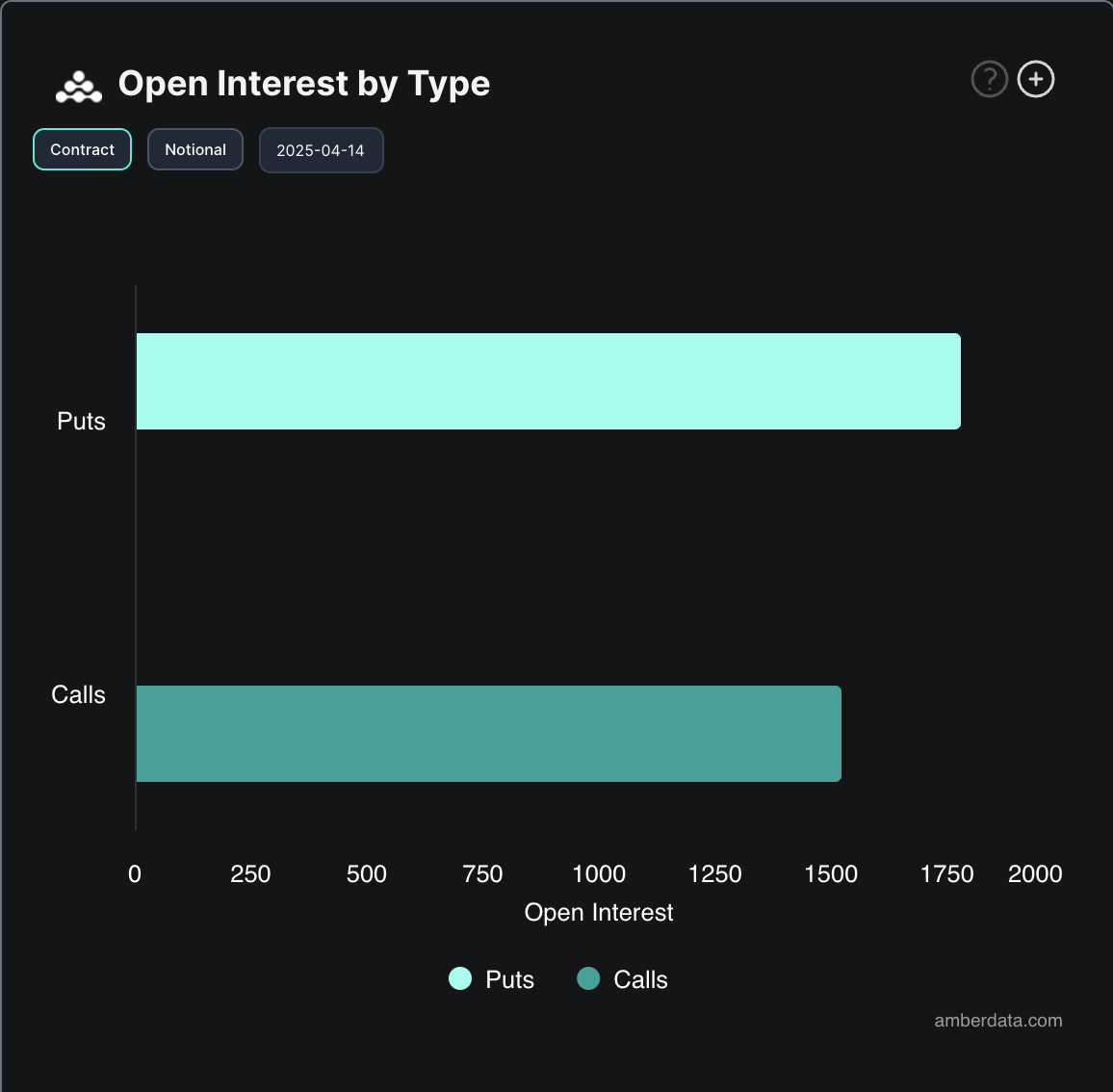

Meanwhile, in the options market, put contracts currently outnumber call contracts, indicating a bearish sentiment among traders. This high put/call ratio suggests that more Bitcoin traders are betting on potential downward movements or actively hedging against short-term losses.

ETF outflows, decreased open interest, and bearish option positioning indicate an overall cautious sentiment in the Bitcoin market.

While the coin's funding rate suggests some optimism, traders are still preparing for potential increased volatility.