Bitcoin price continues to struggle below the psychological level of $85,000, failing to break through this important level for the past two months.

Despite attempts to rise, major cryptocurrencies remain stagnant, putting pressure on Long-term Holders (LTH). These investors once enjoyed solid returns but are now seeing their unrealized gains decrease.

Bitcoin Investors Retreating

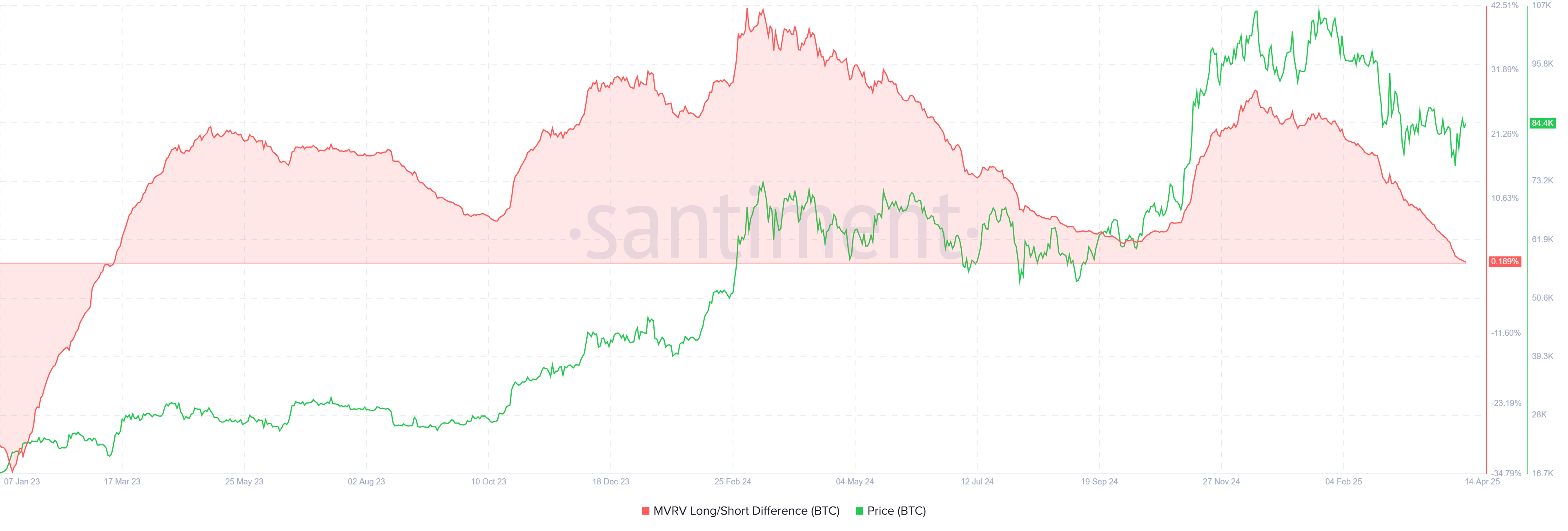

The MVRV Longing/Short difference, a key indicator measuring market sentiment, shows a concerning trend for LTH. This indicator has reached its lowest point in two years, indicating that Long-term Holders' returns are at their lowest level since March 2023. This change suggests that market conditions are becoming increasingly unfavorable for LTH.

As Bitcoin price fails to recover, Short-term Holders (STH) are taking the lead by leveraging price fluctuations. Meanwhile, Long-term Holders (LTH) are hesitant to make additional purchases or hold as their profits decline.

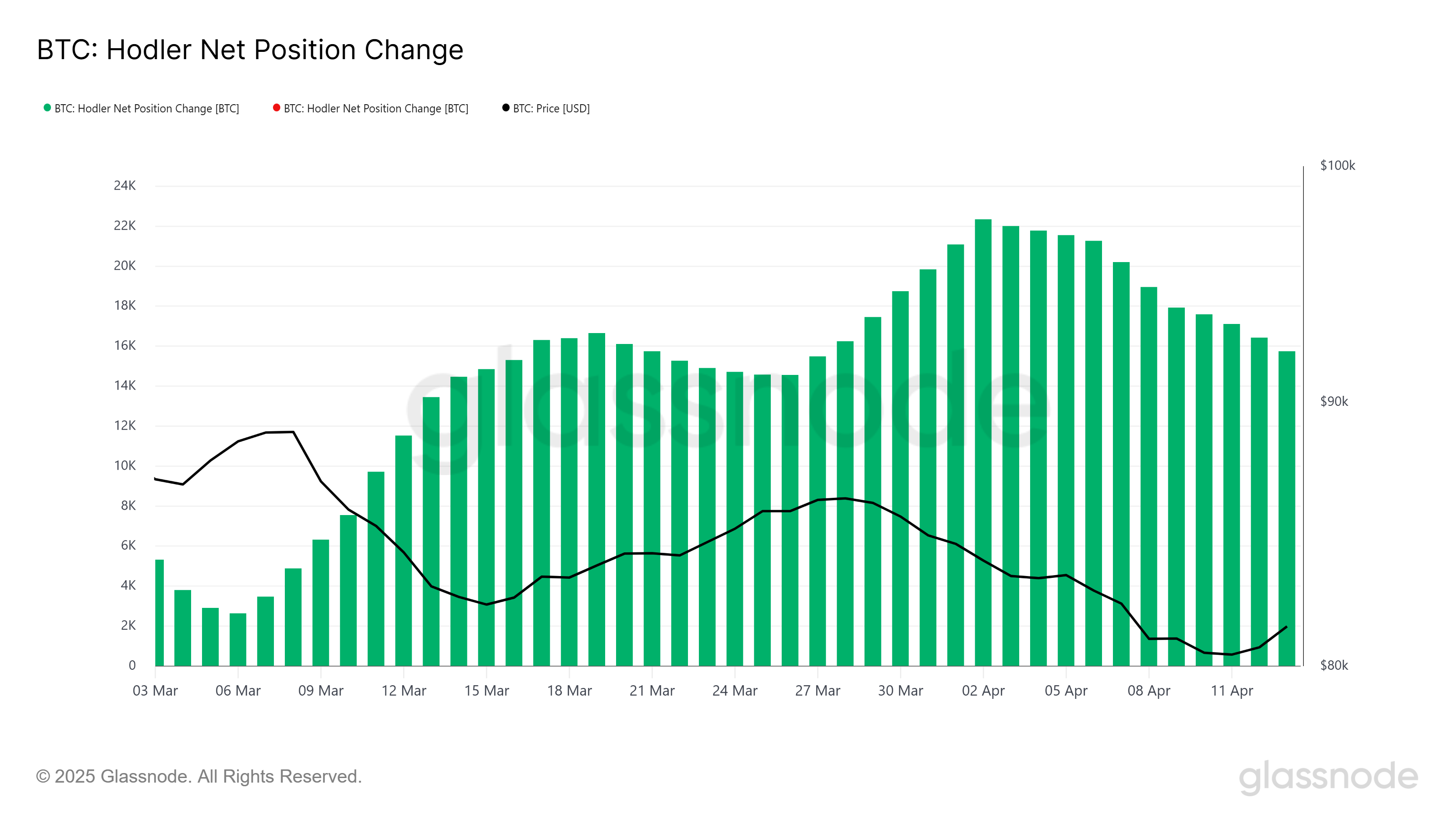

Bitcoin's overall momentum is measured by technical indicators, reflecting a downward signal. HODLer net position change supports this narrative, showing that LTH have sold a significant amount of holdings over the past two weeks. Total sales exceed 6,596 BTC, equivalent to over $550 million.

While this number may not seem enormous, the psychological shift of LTH is more concerning. This lack of confidence could delay Bitcoin's recovery and cause price stagnation. It may further restrict market activity and worsen the current downward trend.

BTC Price Facing Decline

Bitcoin price is trading at $84,421, hovering just above the critical support level of $82,619. The price remains trapped below the major resistance of $85,000, and failure to break through could result in additional pressure. If Bitcoin loses support at $82,619, it may potentially drop to the next major psychological support level of $80,000.

If the downward trend continues, the price could fall further, with $78,841 emerging as a critical level to watch. Losing this support could trigger a more significant decline, intensifying Bitcoin's bearish outlook.

However, if Bitcoin breaks through $85,000 and maintains it as support, it could trigger a recovery, potentially pushing the price back to $86,848. Sustained growth above $85,000 would invalidate the current downward trend and pave the way for a potential surge to $89,800, helping to restore investor confidence.