Welcome to the US Morning Crypto News Briefing. We will inform you about today's important cryptocurrency developments.

Check how the financial markets are moving while having coffee. This could be the beginning of a global risk aversion shift as monetary tightening is again in focus in Asia and the West.

Japan's 30-Year Bond Yield Reaches Decades-High

Japan's 30-year bond yield has surged to its highest level in 20 years. This is emerging as today's major US cryptocurrency news. Specifically, it rose by 12 basis points to reach 2.345%, the highest since 2004. This indicates increasing stress in the global fixed income market.

This is bearish for Bitcoin (BTC) and risk assets. Agne Ringge, growth lead at decentralized on-chain bank WeFi, agrees that rising bond yields pose a short-term threat to cryptocurrencies.

In an email to BeInCrypto, Ringge said there could be major changes in risk assets. She referenced Japan's macroeconomic trends in relation to the current surge in 30-year bond yields.

"As bond yields jump to a 30-year high at 2.345%, more risk-averse institutional investors might shun Bitcoin and other speculative assets," Ringge said.

As Japan's long-term bond yields surge, pressure is mounting on the Bank of Japan (BoJ) to respond through interest rate hikes. Analysts suggest this action could occur by the end of April.

If BoJ tightens policy, it would represent a significant change for a central bank that has maintained ultra-loose monetary conditions for decades.

"If this prediction plays out, liquidity could dry up in traditional financial markets. Since cryptocurrencies depend more on excess monetary liquidity, this could impact asset performance," she added.

Ringge mentioned the yen carry trade as one risk mechanism. In this strategy, global investors borrow yen at low rates to invest in high-yield assets overseas. This trade thrives when Japanese rates are low and international risk appetite is strong.

What Does This Mean for Bitcoin?

As Japan's yields rise and BoJ's rate hike likelihood increases, the incentive to borrow yen diminishes. This could lead to carry trade liquidation, potentially depleting liquidity in global markets.

These outcomes will amplify downside risks for cryptocurrencies and other risk assets. This aligns with BeInCrypto's recent report that Bitcoin's price is at risk due to reverse yen carry trade liquidation.

"The issue today is that borrowing costs are becoming increasingly expensive. Traders who had access to essentially free capital for years are now sitting on expensive margin positions and may need to liquidate," said Michael A. Guide, five-time Dow & Founders Award winner and portfolio manager.

Meanwhile, the Federal Reserve (Fed) is facing pressure to cut rates. Consumer inflation data from US CPI and PPI supports this. Ringge observes that US dovish signals might partially offset Japan's hawkish stance.

"Since the US is a larger market, the world might react more to US monetary policy than Japan's," Ringge added.

If the Fed loosens monetary conditions while Japan tightens, the global liquidity environment could become mixed. This could trigger volatility as investors reassess cross-border capital flows.

Nevertheless, the yen carry trade remains particularly vulnerable to a decisive hawkish shift by BoJ. This could trigger a global risk reassessment, suppressing speculative flows and weakening the liquidity backdrop that cryptocurrency markets have benefited from in recent years.

Amid these concerns, traders and analysts remain optimistic. Analysts from cryptocurrency derivatives exchange Deribit observed that the market recently transitioned from surrender to an aggressive rebound.

"BTC surged to 75-85k as protective/bearish BTC 75-78k puts were dumped and 85-100k calls rose," they wrote.

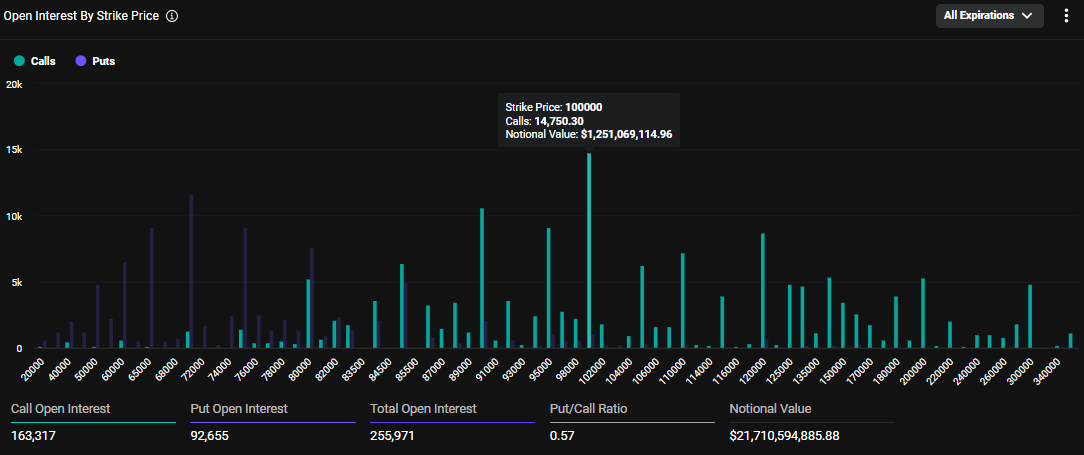

Deribit cryptocurrency derivatives exchange data supports this observation, with the $100,000 strike call option recorded as the most popular option. This suggests betting that Bitcoin might be heading towards this psychological milestone.

Today's Chart

Today's Key News

- Cryptocurrency outflows reached $795 million last week. Trump's tariffs are significantly impacting investor sentiment.

- BTC is expected to reach an all-time high in 2025. Experts predict a 77% probability based on mathematical data.

- Ledger, Gemini, Robinhood users' personal data is being sold on the dark web. This is reigniting security concerns in the cryptocurrency sector.

- BTC funds saw a 314% surge in weekly outflows. The derivatives market is experiencing a decrease in open interest.

- RFC Token surged over 1000% in April. This was triggered by memes, Musk, and whales.

- FLR Token hit a weekly high, surging 57%. Indicators suggest further potential increase.

- Pi Coin showed double-digit growth after Chainlink integration.

Cryptocurrency Stock Pre-Market Overview

| Company | April 11th Closing Price | Pre-Market Overview |

| Strategy (MSTR) | $299.98 | $312.00 (+4.00%) |

| Coinbase Global (COIN) | $175.50 | $180.42 (+2.80%) |

| Galaxy Digital Holdings (GLXY) | $15.28 | $15.30 (+0.13) |

| Marathon Holdings (MARA) | $12.51 | $13.03 (+4.16) |

| Riot Platforms (RIOT) | $7.06 | $7.06 (+3.97%) |

| Core Scientific (CORZ) | $7.07 | $7.26 (+2.69%) |