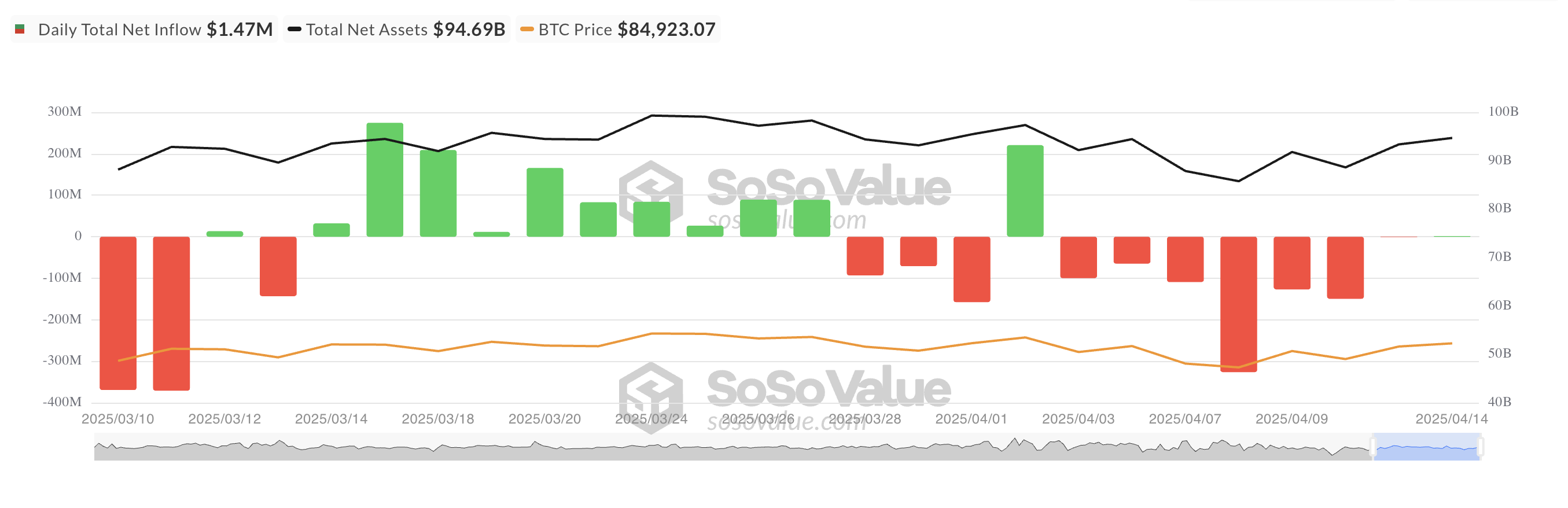

After 7 consecutive days of fund outflows, institutional investors seem to have reignited interest in the Bitcoin ETF. For the first time since April 2nd, the US-listed spot Bitcoin ETF recorded a net inflow of $1.47 million on Monday.

Although this figure is small, it is the first signal of increasing institutional interest in Bitcoin exposure through regulated funds.

Bitcoin ETF Ends 7-Day Outflow... Slight Inflow

Last week, Bitcoin investment funds recorded a net outflow of $713.3 million. This occurred amid difficulties in the cryptocurrency market due to Donald Trump's trade war investigation.

However, the situation may be starting to change.

On Monday, the US-listed spot BTC ETF recorded a net inflow of $1.47 million. This is the first time funds have flowed in since April 2nd. Although small, this amount suggests that institutional sentiment towards BTC may gradually be changing after nearly two weeks of stagnation.

The largest daily net inflow occurred in BlackRock's IBIT, which raised $36.72 million. This increased the total cumulative net inflow to $39.6 billion.

In contrast, Fidelity's FBTC recorded the largest net outflow on Monday, losing $35.25 million in a single day.

BTC Derivatives Market Lively... Option Flow Cautious

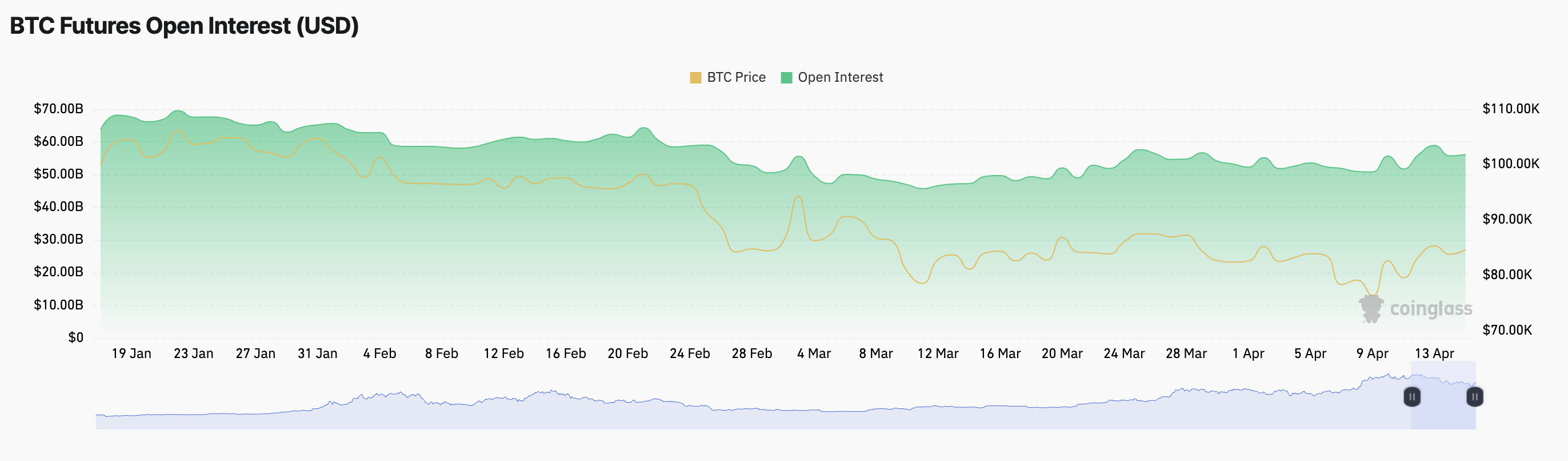

On the derivatives side, BTC's futures open interest increased over the past 24 hours. This indicates increased derivatives activity.

At the time of reporting, this reached $56 billion, increasing by 2% over the past day. During the same period, BTC's price rose by 1.22%.

BTC's futures open interest represents the total number of unsettled futures contracts. An increase during price rises can suggest new funds entering the market, supporting the upward trend.

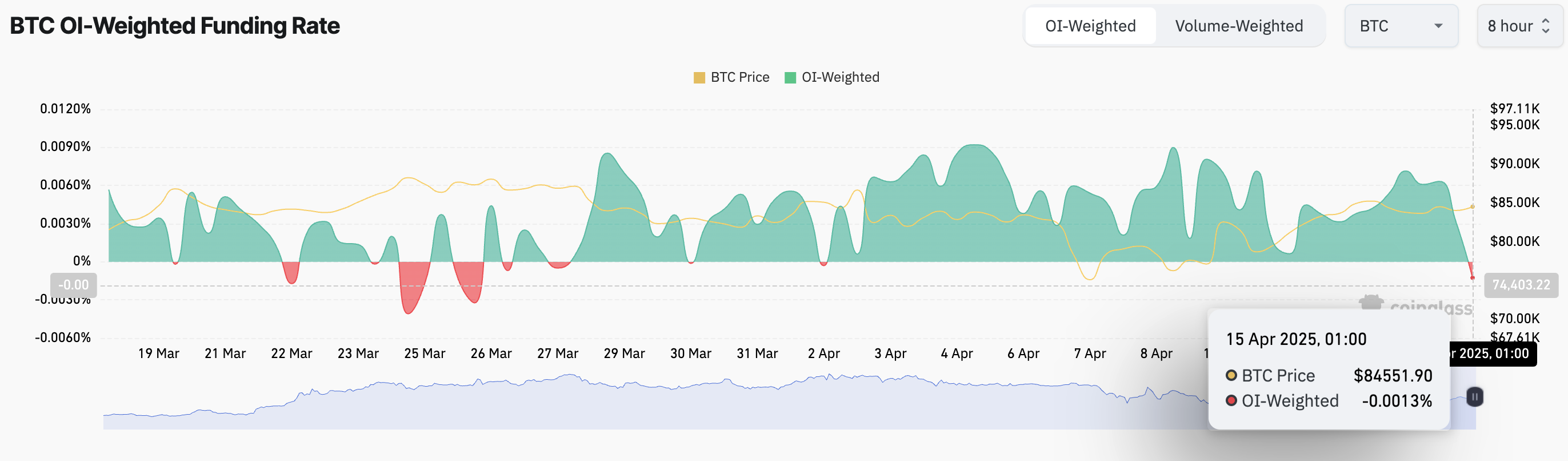

However, there's a point of caution. While BTC futures open interest has increased, the nature of these new positions appears bearish. This is revealed by the funding rate turning negative for the first time since April 2nd.

This means more BTC traders are paying to maintain short positions rather than long positions. Despite the small spot ETF inflow, this suggests market participants are anticipating potential declines.

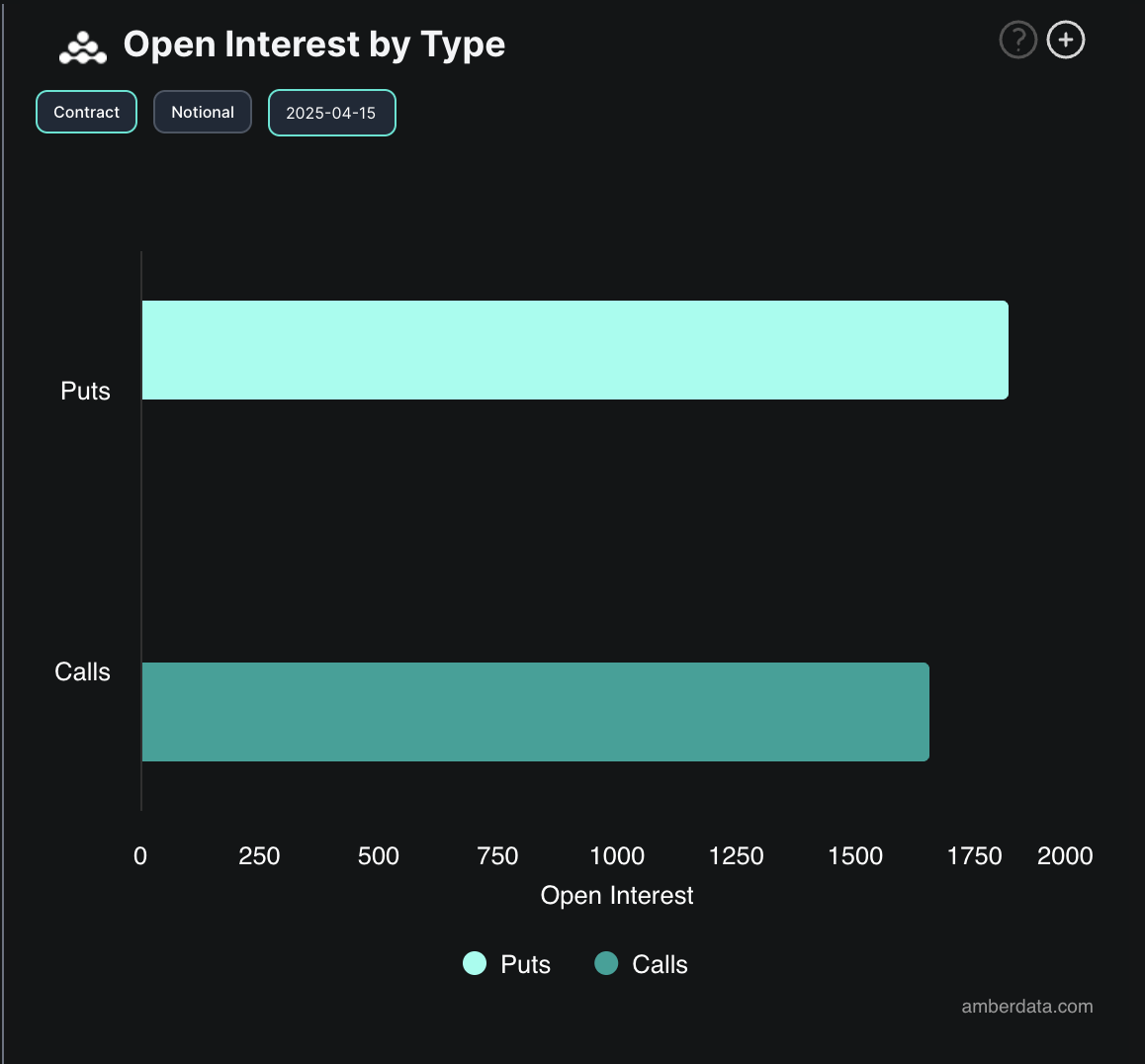

Moreover, on the options side, the mood is cautious. Today, put contracts outnumber call contracts, indicating some traders are hedging bets or anticipating further decline, despite other indicators turning bullish.

Nevertheless, any inflow to the BTC ETF feels like a victory after two weeks of silence. As the market's overall sentiment towards the coin gradually turns bullish, we'll have to wait and see if this trend continues for the rest of the week.