Bitcoin (BTC), which had rebounded to $86,000 the previous day, has fallen back to the $83,000 range. As BTC maintains a relatively stable trend, analysis suggests concerns about entering a bearish market with a 'death cross' forming on the daily chart.

According to CoinMarketCap, a global virtual asset market site, BTC was traded at $83,789.22 as of 8 am on the same day, a 0.83% decrease from the previous day. At the same time, Ethereum (ETH), the leading altcoin, recorded a 1.9% drop at $1,589.97. XRP dropped 1.75% and was traded at $2.095 per coin. Solana (SOL) recorded a 2.51% decline at $126.22.

Related Articles

- Virtual assets 'surge' with tariff suspension... Bitcoin at $83,000 [Decenter Market Conditions]

- Virtual assets decline due to US-China tariff conflict... Bitcoin retreats to $76,000 range [Decenter Market Conditions]

- Bitcoin 'crash' stabilizes... Recovery near $80,000 [Decenter Market Conditions]

- 'Tariff shock' Bitcoin collapses below $80,000... Altcoins plummet over 10% [Decenter Market Conditions]

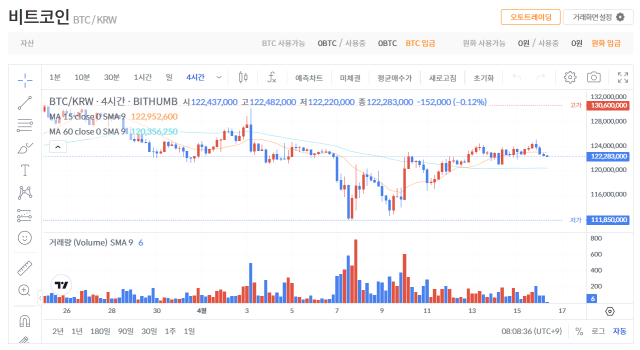

Major virtual asset prices also slightly declined across domestic exchanges. On Bithumb, BTC recorded a 0.18% decrease at 122,421,000 won. ETH dropped 1.27% to 2,323,000 won, and XRP was trading at 3,066 won, a 0.94% decline.

Despite the US announcing mutual tariff suspension, the virtual asset market continues to remain relatively stable as no clear progress in negotiations is visible. Meanwhile, concerns about price decline are growing as BTC shows a death cross. According to Cointelegraph, a death cross formed on the BTC daily chart on the 6th. In technical analysis, the death cross is a representative pattern indicating the end of an upward trend, formed when the 50-day moving average (MA) falls below the 200-day moving average.

Ju Ki-young, CEO of CryptoQuant, assessed that "BTC has already entered the beginning of a bearish market." Focusing on the gap between realized market capitalization and current market capitalization, he analyzed that "if the market price declines or stagnates while the realized market cap increases, it signals a structural bearish trend despite capital inflows."

However, there are also warnings against excessive interpretation of this death cross. James Butterfield, Research Director at asset management firm CoinShares, said, "According to the data, Bitcoin's price is on average -3.2% in the month following a death cross, which is minimal, and it often rises after three months."

Virtual asset investment sentiment remains subdued. The Crypto Fear and Greed Index by alternative asset data analysis company Alternative.me rose 7 points from the previous day to 38 points, indicating a 'fear' state. This index means investment sentiment is constrained when closer to 0 and market overheating when closer to 100.

- Reporter Kim Jung-woo

- woo@sedaily.com

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >