According to Coinbase, the cryptocurrency market may experience volatility or downward pressure over the next 4-6 weeks.

The Coinbase monthly outlook for April 2025 provides a balanced view of caution and optimism compared to other predictions, offering a clear roadmap for the cryptocurrency market.

Expected Short-Term Market Volatility

Coinbase predicts that cryptocurrency prices could stabilize in the mid to late second quarter (May to June 2025) and establish a strong foundation for growth in the third quarter (July to September). This period is expected to provide significant opportunities for investors.

Similarly, the QCP Capital report predicts potential cryptocurrency strength in the second quarter based on traditional financial market trends. However, Coinbase anticipates negative market volatility from April to mid-May.

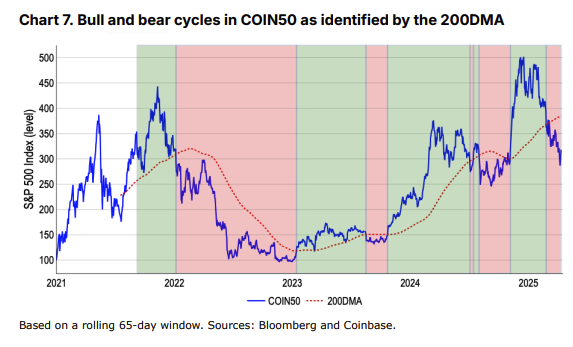

Bitcoin (BTC) and the COIN50 index have recently fallen below the 200-day moving average (200DMA), which could signal the beginning of a bearish market cycle. The Coinbase 50 index or COIN50 tracks the performance of the 50 largest and most liquid digital assets by market capitalization.

Volatility stems particularly from global economic uncertainties, such as new tariff policies. Tight fiscal policies and macroeconomic factors also put pressure on risk assets, including cryptocurrencies. Coinbase recommends that investors exercise caution and adopt defensive risk strategies.

This short-term outlook aligns with the Morningstar Q1 2025 review, predicting continued volatility in the second quarter due to trade policies and interest rate expectations. Escalating US-China trade tensions, the CNY exchange rate at an 18-year low, and the "extreme fear" shown by the Fear and Greed Index at the beginning of 2025 further exacerbate market uncertainty.

Q3 Recovery and Growth

Despite the gloomy short-term outlook, Coinbase remains optimistic about the medium-term perspective, predicting price stabilization in the mid to late second quarter due to strong supporting factors. Historically, markets often stabilize in the second quarter after a sharp first-quarter correction. For example, after Bitcoin fell from $10,000 to $3,850 in March 2020, it stabilized between $6,000 and $7,000 from May to June and then surged by the end of that year.

ARK Invest's Big Ideas 2025 report predicts 2025 as a year when cryptocurrencies will experience "unprecedented growth" driven by institutional adoption and technological advancements. According to Morningstar's Q1 2025 review, loose monetary policies and declining bond yields in early Q2 could further support risk assets.

Increasing institutional adoption is another key driver. Coinbase's 2025 Cryptocurrency Market Outlook emphasizes growing institutional participation, particularly through spot Bitcoin ETFs. ARK Invest mentions that blockchain innovation and clear US regulations will enhance market stability and growth.

Coinbase expects the third quarter of 2025 to be a period of strong growth, building on the foundation of the second quarter. A crucial factor is the Bitcoin halving cycle, which historically triggers significant price increases. The third quarter of 2025 aligns with this cycle, promising substantial gains.

Additional catalysts include more cryptocurrency ETF approvals and improved regulations in the US, which could further drive the market as predicted in Coinbase's 2025 cryptocurrency market outlook.