Bitcoin is experiencing significant difficulties in surpassing $85,000 this week, with the price stagnating below this major resistance level.

Bitcoin enthusiasts are becoming increasingly frustrated as the cryptocurrency struggles to maintain its upward momentum. Along with price stagnation, the noticeable decrease in open interest and ETF outflows reflects growing market uncertainty.

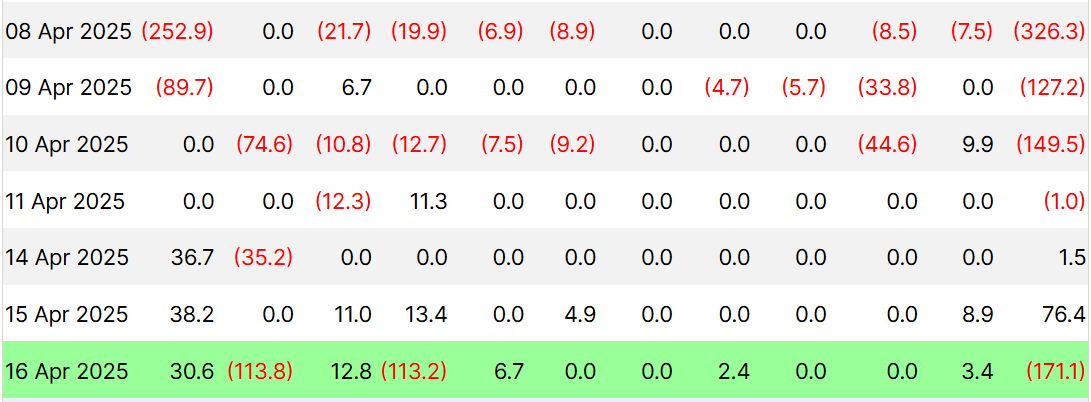

Bitcoin Spot ETF Flow Concerns

Spot Bitcoin ETFs have recently experienced massive outflows, recording $171.1 million in outflows on Wednesday, April 16th, marking the week's highest. This change indicates that investor confidence in Bitcoin is weakening as market conditions remain bearish. As more investors withdraw funds, it emphasizes the declining confidence in Bitcoin's short-term outlook.

Continued outflows suggest that the market's overall sentiment towards Bitcoin is deteriorating. Large-scale fund movements from Bitcoin ETFs show that investors are becoming more cautious, which is attributed to Bitcoin's failure to secure above $85,000. The lack of price growth has created uncertainty and hesitation among traders.

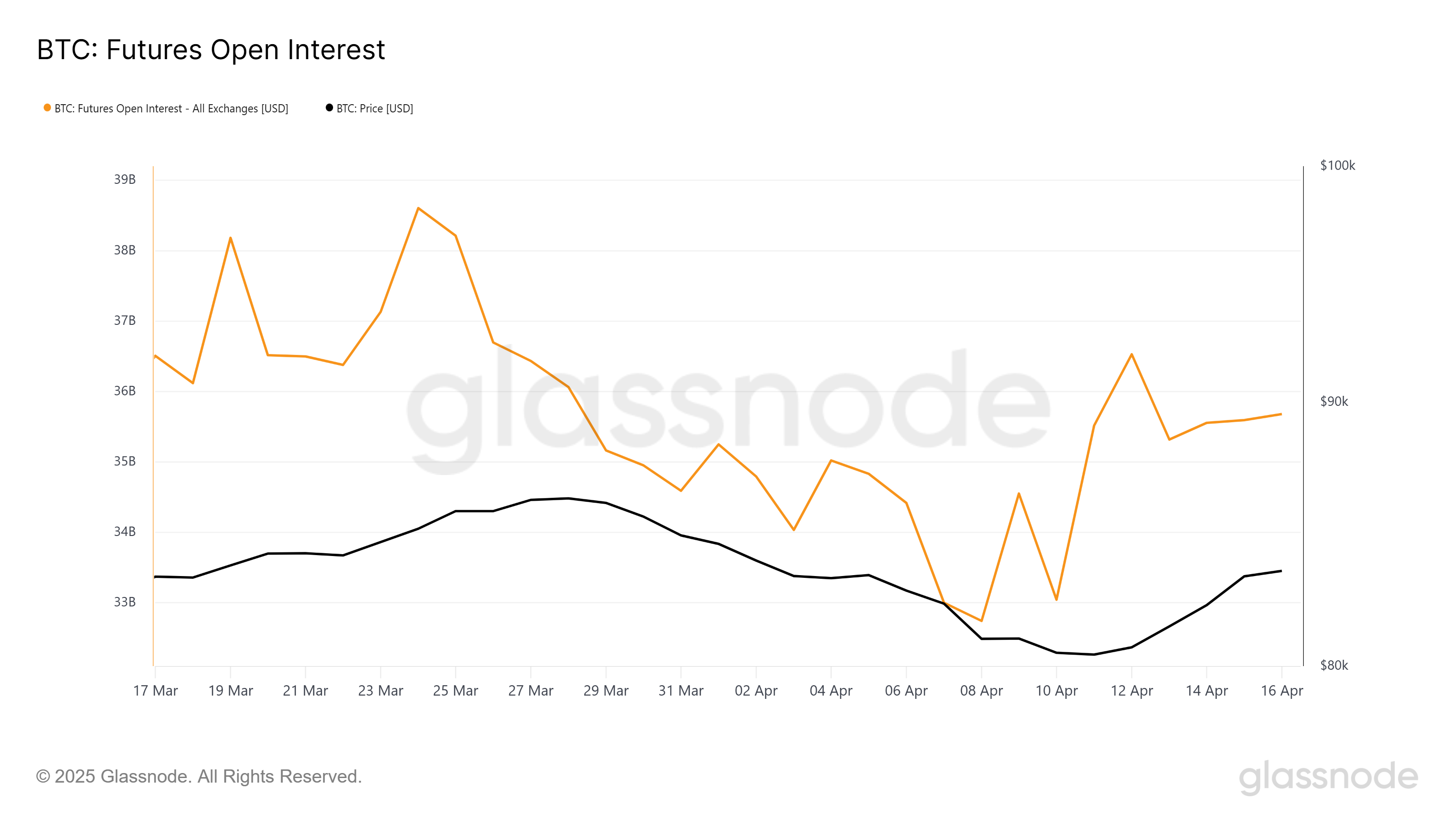

Open Interest Needs Momentum

Bitcoin's open interest remains below $36 billion, indicating that traders are skeptical about Bitcoin's immediate future. Despite early optimism at the beginning of the year, there has been no recovery or significant price movement, leaving open interest stagnant.

The stagnation of open interest suggests that Bitcoin is at a decisive moment in the market. Traders seem hesitant to make aggressive bets in either direction due to price stagnation and market conditions. If open interest does not increase, Bitcoin may find it difficult to break out of its current range.

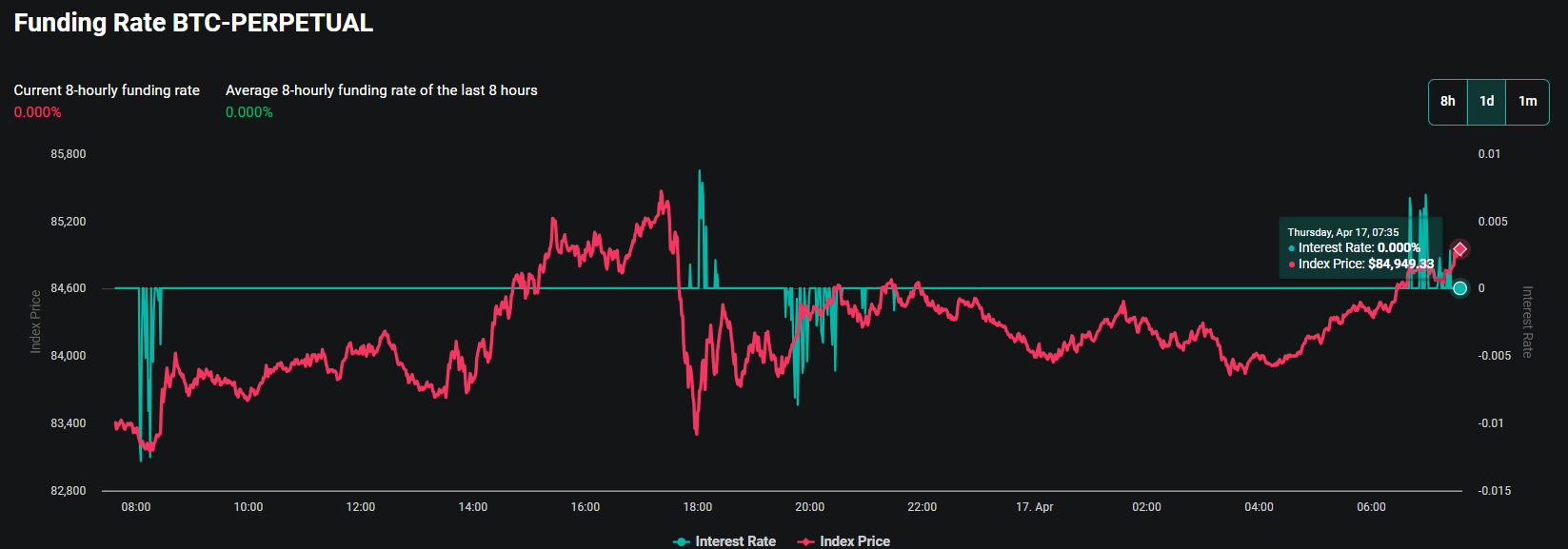

Funding Rate Recovery

Despite skepticism, Bitcoin's funding rate has shown recent changes. The funding rate, which had been negative for some time, has recently turned positive in the past few hours, reflecting a slight increase in market optimism.

The positive funding rate indicates new optimism, but it remains to be seen whether this sentiment will lead to sustained upward price movement. A consistent positive funding rate could suggest that Bitcoin might see a larger rebound if market conditions improve.

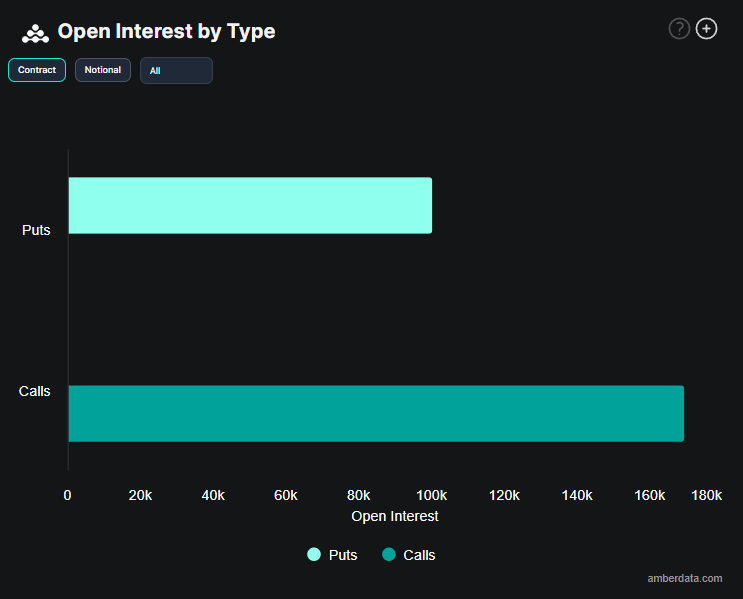

Calls vs Puts

Open interest data supports this optimistic change, with call options dominating the market, with over 169,760 call contracts being executed.

The prevalence of call options suggests that market participants are expecting an upward movement, despite the recent lack of progress in Bitcoin's price. Whether this optimism will be realized depends on the overall market trend and Bitcoin's ability to break through the $85,000 barrier.