Welcome to the US Morning Crypto News Briefing. We will comprehensively summarize today's important cryptocurrency developments.

Prepare your coffee to check experts' opinions on the BTC price forecast. Major investment strategies are leading the next direction of pioneering cryptocurrency.

Bitcoin, About to Break Through 90,000?

The cryptocurrency market continues to be affected by Trump's volatility, which is placing a significant burden on investor sentiment. Traders and investors are preparing for macroeconomic headwinds that are suppressing weak upward movements.

One of these is the Trump tariff confusion, which triggered China's retaliatory stance. Adding another complexity to US cryptocurrency news, Federal Reserve Chairman Jerome Powell mentioned economic uncertainty and trade policy risks while ruling out short-term rate cuts.

According to reports, China is liquidating confiscated cryptocurrencies through private companies to support local government finances amid economic difficulties. The macro context also includes Jerome Powell's hawkish Federal Reserve stance, where he excluded short-term rate cuts.

Amid this uncertainty, investors may postpone allocating capital to high-volatility assets until macroeconomic prospects stabilize.

This could explain why Bitcoin's outlook is stagnating between the psychological levels of 80,000 and 90,000 dollars.

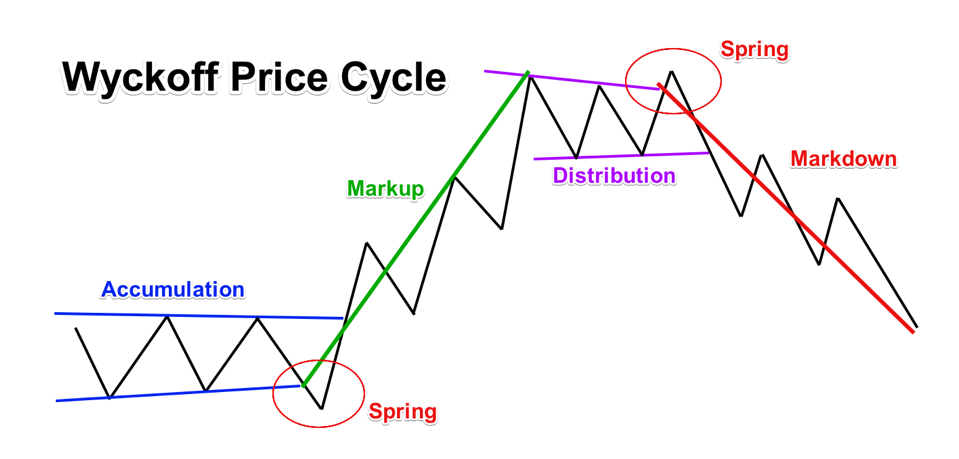

However, despite concerns, analysts remain optimistic and are mentioning major investment or trading strategies. BeInCrypto contacted Valentin Fournier from the Blockhead Research Network (BRN) to discuss the Wyckoff Price Cycle.

"Our basic assumption is that we are in the accumulation phase, and Bitcoin may occasionally drop before breaking the 89,000-90,000 dollar resistance," Fournier told BeInCrypto.

The Wyckoff Price Cycle, developed by Richard Wyckoff, is a technical analysis framework for identifying market trends and trading opportunities. It consists of four stages:

- Accumulation: The stage where smart money buys at low prices, often marked by a "spring" (false decline).

- Markup: The bullish stage where prices rise

- Distribution: The stage where smart money sells at high prices, also characterized by a "spring" (false rise)

- Markdown: The bearish stage where prices decline

Fournier added that altcoins might underperform in the short term because Bitcoin dominance continues to rise.

He also mentioned that trade tensions had a more significant impact on traditional markets, in contrast to Bitcoin's strength.

"This is highlighted by Nvidia's decline following new chip export restrictions to China," he said.

What Do Options Data Say?

If the accumulation phase hypothesis is true, it aligns with Deribit's Tony Stewart's recent analysis, emphasizing that trader sentiment favors an upward movement.

The bullish group is buying call options between 90,000 and 100,000 dollars, suggesting bets on Bitcoin price increases. However, others are bearish, buying put options at 80,000 dollars and selling call options above 100,000 dollars, anticipating or hedging against a decline.

Similarly, funding strategies show bullish traders raising positions with call options between 84,000 and 90,000 dollars and selling lower put options (75,000 dollars) to fund their bets, indicating confidence in a short-term rally.

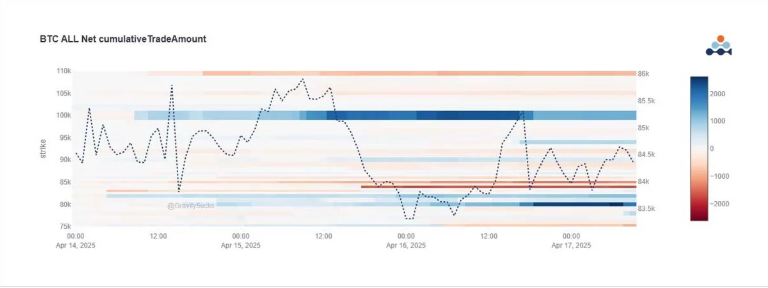

Today's Chart

Traders analyze recurring stages of price movements, volume, and market structure. Based on this, they can identify reversals, determine entry or exit points, and understand institutional behavior.

Today's Key News

- Bitcoin whales withdrew $280 million from exchanges in a single day. This indicates a strong movement towards cold storage amid market volatility.

- Gary Gensler warns that many altcoins lack solid fundamentals. Their value is more driven by sentiment and is unsustainable.

- CEO Richard Teng confirms that Binance advises governments on cryptocurrency policies and helps nations build cryptocurrency reserves.

- Coinbase predicts short-term cryptocurrency volatility until mid-May 2025. Citing economic pressure and trade policy uncertainty.

- Ethereum's dominance has dropped to 7.3%. This is the lowest in 5 years, with analysts viewing it as a rare long-term buying opportunity.

- a16z urges SEC to modernize cryptocurrency custody rules. Advocating for RIAs to self-custody digital assets under clear safeguards.

- Bitcoin is struggling below $85,000. Open interest is stagnant below $36 billion. This indicates indecisiveness among traders. Positive funding rates suggest new optimism.

- Base reveals an ambitious Q2 roadmap. This comes hours after a meme coin promoted by insiders triggered a trading frenzy and sudden collapse.

Cryptocurrency Stock Pre-Market Overview

| Company | April 16th Closing Price | Pre-Market Overview |

| MicroStrategy (MSTR) | $311.66 | $315.50 (+1.31%) |

| Coinbase Global (COIN) | $172.21 | $174.10 (+1.10%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.58 | $15.15 (-2.69%) |

| Marathon Holdings (MARA) | $12.32 | $12.40 (+0.65%) |

| Riot Platforms (RIOT) | $6.36 | $6.41 (+0.79%) |

| Core Scientific (CORZ) | $6.59 | $6.68 (+1.37) |