XRP's price has been struggling to recover in recent weeks, and the overall market conditions remain weak. Despite these challenges, XRP is maintaining levels above $2.

This stability is primarily maintained by long-term holders (LTH), who are working to prevent the price from falling below this critical level.

XRP Investors Buying at Lower Prices

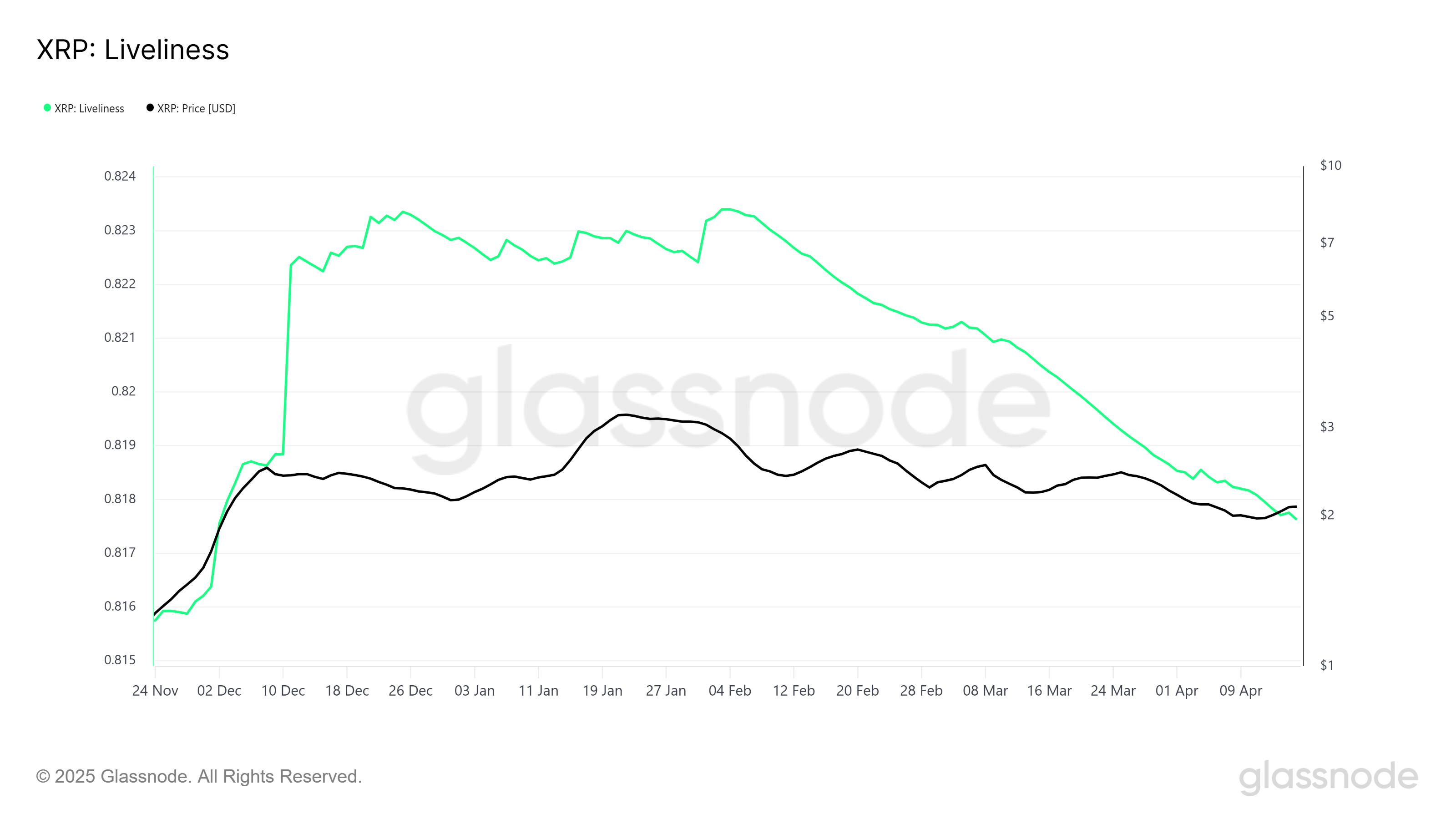

The liveliness indicator tracking transaction frequency has been steadily decreasing since February. This indicates fewer tokens are being traded and signals that long-term holders are accumulating XRP at lower prices.

This trend could be a positive indicator, showing that investors believe in XRP's future potential and are positioning themselves for long-term gains. Despite LTH accumulation, market sentiment remains mixed due to the overall weak environment.

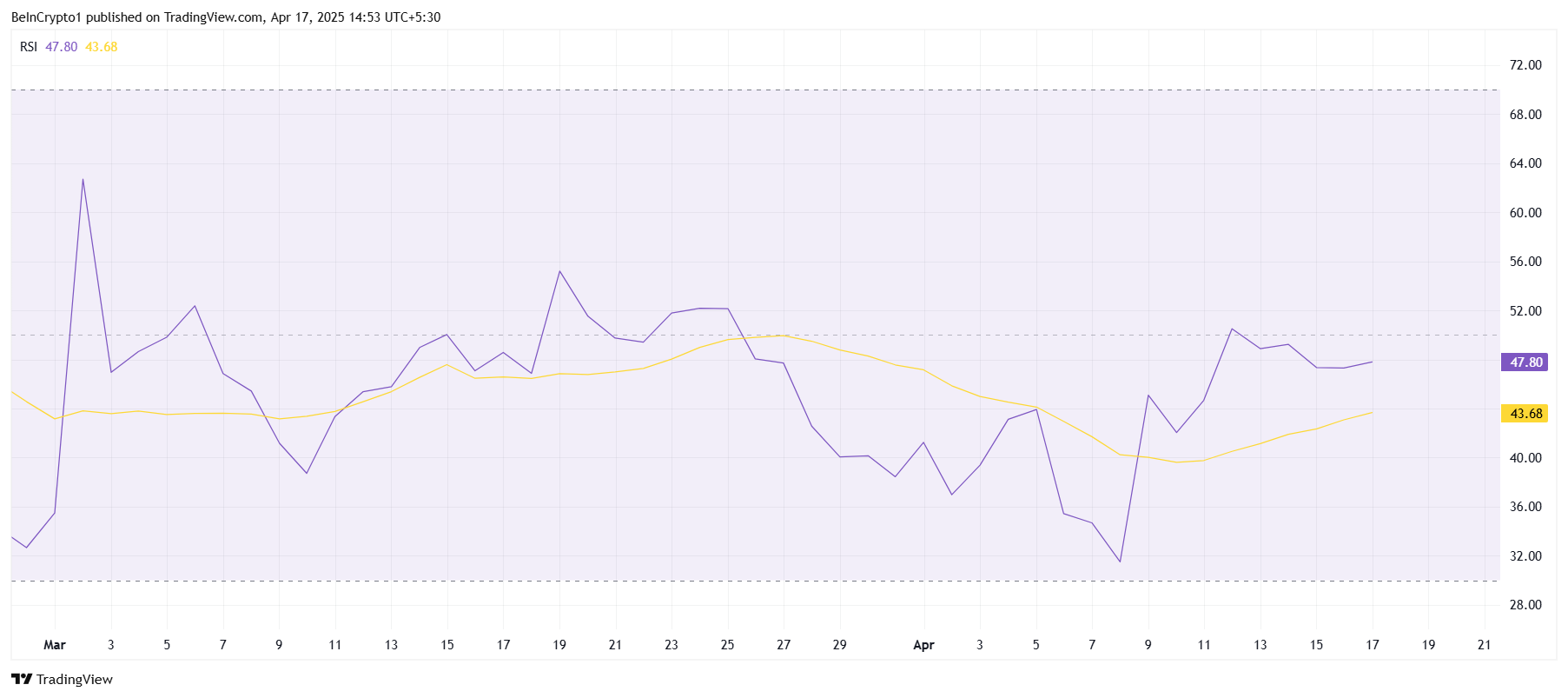

From a technical perspective, XRP's Relative Strength Index (RSI) has remained in a weak zone over the past two months. Occasionally crossing the neutral line of 50, but mostly staying below, indicating a lack of bullish momentum. This persistent weak trend is offsetting long-term holders' efforts to raise the price.

The RSI's inability to maintain upward momentum suggests that XRP continues to face challenges. This is exacerbated by the overall weak market conditions, suppressing investor sentiment.

XRP Price Maintenance

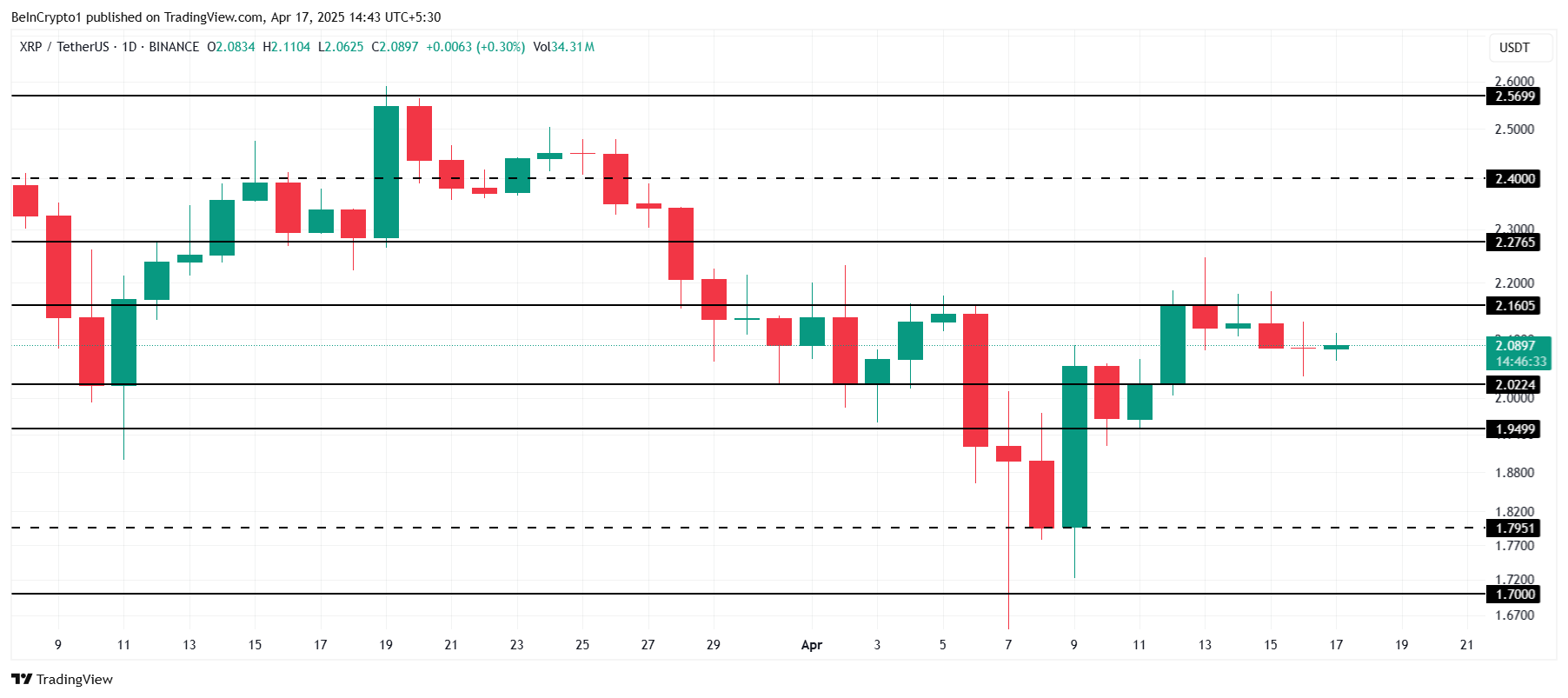

At the time of writing, XRP is trading at $2.08, maintaining support at $2.02. This indicates that the altcoin is stabilizing despite recent declines. Long-term holders' support is propping up the price and preventing further drops.

However, mixed signals from technical indicators and market sentiment suggest XRP may remain below the $2.16 resistance. Price movement within this range could continue until a strong bullish signal emerges, leaving investors uncertain about the next major move.

If XRP fails to maintain the $2.02 support, the altcoin could drop to $1.94 or even $1.79. Falling below these levels could invalidate the current bullish outlook and suggest potential expanded losses for investors.