In the past 24 hours, approximately $67.89 million worth of leveraged positions were liquidated in the cryptocurrency market.

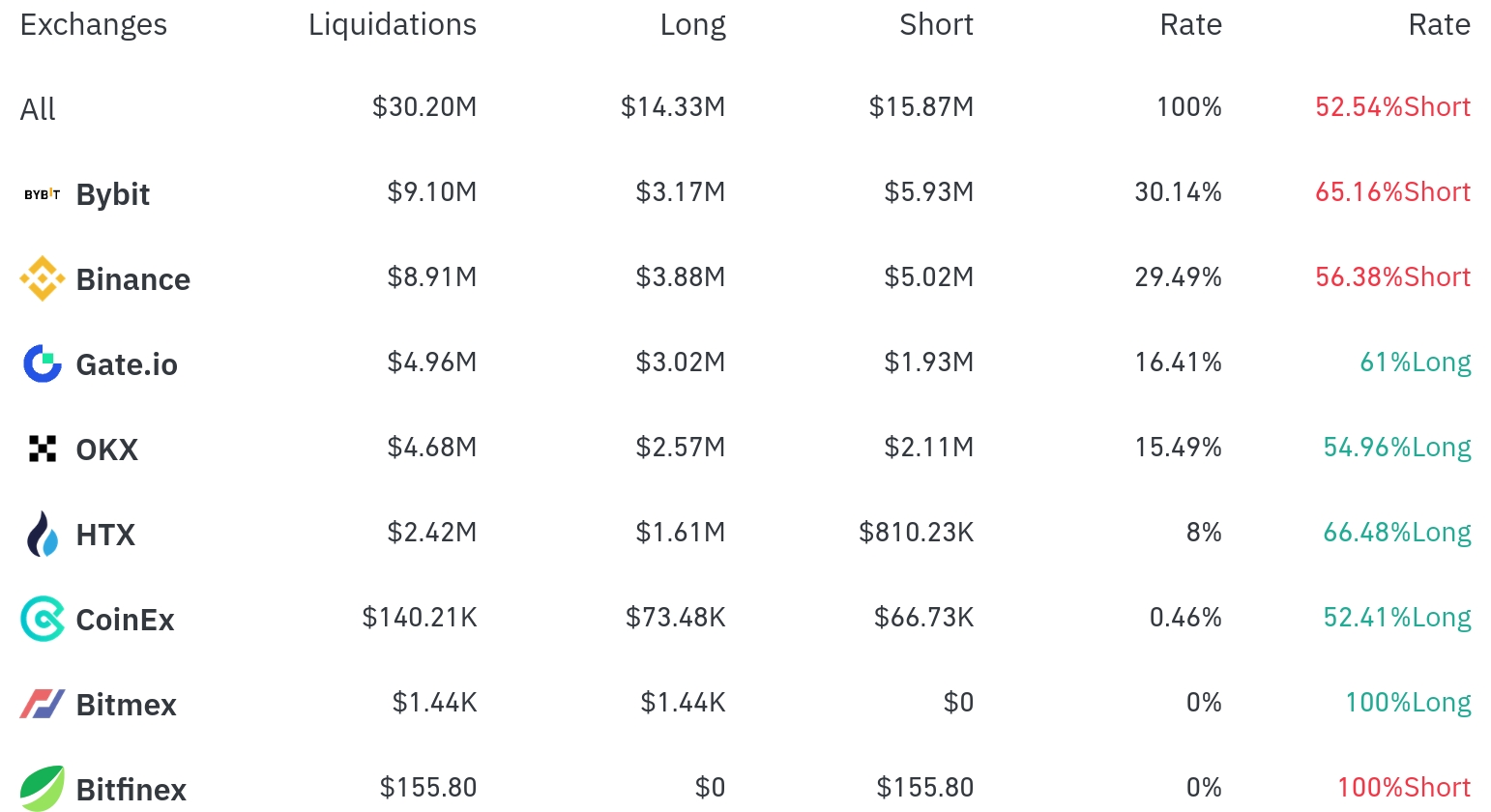

According to the current aggregated data, within a 4-hour period, short positions accounted for $15.87 million, representing 52.54% of total liquidations, while long positions were $14.33 million, accounting for 47.46%.

Over the past 4 hours, Bybit had the most position liquidations, with a total of $9.1 million (30.14%) liquidated. Notably, short positions comprised $5.93 million, or 65.16% of this amount.

Binance was the second-highest exchange for liquidations, with $8.91 million (29.49%) of positions liquidated, of which short positions accounted for $5.02 million (56.38%).

Gate.io saw $4.96 million (16.41%) in liquidations, with long positions dominating at 61%. OKX experienced approximately $4.68 million (15.49%) in liquidations, with long positions at 54.96%.

Overall, major exchanges showed mixed liquidation ratios between short and long positions.

By coin, Bitcoin (BTC) had the most liquidated positions. Over 24 hours, approximately $30.35 million in Bitcoin positions were liquidated, with $6.01 million in long positions and $12.21 million in short positions within a 4-hour period.

Ethereum (ETH) saw about $24.28 million in liquidations over 24 hours, with $1.76 million in long positions and $13.14 million in short positions within a 4-hour period.

Solana (SOL) had approximately $12.53 million liquidated over 24 hours, with $2.43 million in long positions and $6.10 million in short positions within a 4-hour period.

Notably, the 'FARTCO' Token drew significant attention, with a 7.63% price drop and $3.4 million in positions liquidated over 24 hours. Within a 4-hour period, approximately $3.30 million in long positions and $2.43 million in short positions were liquidated.

The 'TRUMP' Token also experienced a 3.10% price drop, with about $1.02 million in liquidations over 24 hours. Particularly notable was the short position liquidation, with $6.58 million liquidated within just 4 hours.

This liquidation data demonstrates increasing bidirectional market volatility, with mixed long and short position liquidations across major exchanges, requiring traders to exercise caution.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>