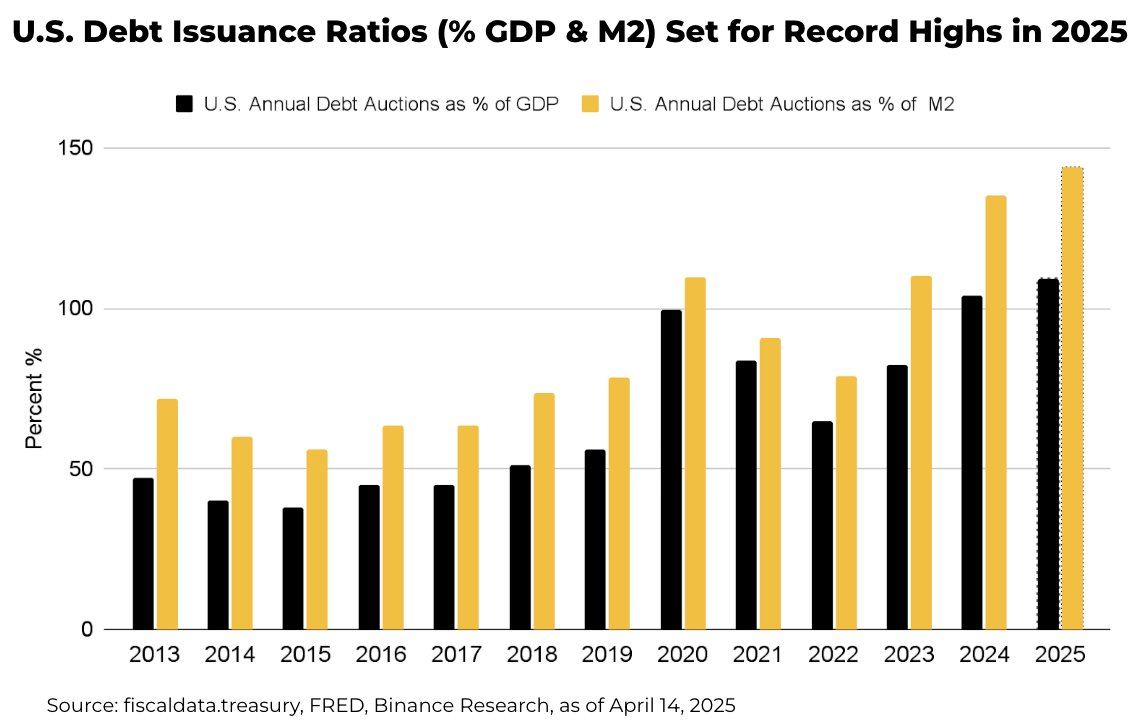

The U.S. Treasury plans to issue over $31 trillion in bonds this year. This represents approximately 109% of GDP and 144% of M2. This will be the highest level of bond issuance in history. How will this impact the crypto market?

Massive supply can increase yields because the Treasury's funding needs exceed demand. High yields can increase the opportunity cost of holding non-yielding assets like Bitcoin and Ethereum, potentially drawing capital away from cryptocurrencies.

U.S. Bonds, Adding Volatility to the Crypto Market?

The overall story may come down to foreign demand for U.S. bonds. Foreign investors hold about one-third of U.S. debt.

If demand decreases due to tariffs or portfolio rebalancing, the Treasury may need to offer higher yields. Rising yields can tighten global liquidity, making risky assets like cryptocurrencies less attractive.

As yields rise, stocks and cryptocurrencies may face selling pressure. For example, Bitcoin dropped over 50% during the 2022 bond sell-off, along with a sharp yield increase. A similar situation could test cryptocurrencies' appeal.

Meanwhile, U.S. dollar strength could exacerbate headwinds. Yields typically strengthen the dollar. A strong dollar makes Bitcoin's dollar-denominated price more expensive for foreign buyers, reducing demand.

However, cryptocurrencies offer unique attributes. During extreme monetary expansion periods like post-pandemic, investors chose Bitcoin as an inflation hedge.

Even if high yields suppress speculative flows, cryptocurrencies' limited supply and decentralized nature can maintain a baseline of buyer interest.

Technically, Bitcoin's correlation could weaken if Treasury issuance triggers broader macroeconomic volatility. When bond markets are shocked by trade or fiscal policy, traders might diversify into digital assets due to their non-correlation.

However, this logic depends on continued institutional adoption and favorable regulation.

5/ What This Means for Crypto

— Binance Research (@BinanceResearch) April 18, 2025

Persistent upward pressure on rates from Treasury supply could weigh on risk assets—crypto included. However, if the government eventually turns to debt monetization—essentially printing money to fund deficits—it could strengthen the case for…

Cryptocurrency's liquidity profile is also important. Large bond sales often deplete bank reserves, tightening funding markets.

Theoretically, tighter liquidity could increase demand for DeFi protocols offering higher yields than traditional financial markets.

Overall, record U.S. debt supply points to high yields and a strong dollar. This could introduce volatility to cryptocurrencies as a risk asset.

However, cryptocurrencies' inflation hedge narrative and technical role in diversified portfolios could mitigate volatility. Market participants should watch foreign demand trends and liquidity conditions as key indicators of cryptocurrencies' next moves.