The arrival of the altcoin season is often linked to Bitcoin's performance. When funds move from BTC to altcoins, altcoin prices rise.

However, this cycle is being delayed due to factors beyond Bitcoin. One of these is the recent surge in Token Generation Events (TGE).

TGE Increase: Opportunity or Crisis?

Over the past four and a half months, 45 new tokens have been launched, most of which did not provide satisfactory returns. Many tokens launched in 2025 failed to sustain growth after listing, raising questions about whether this trend is due to weak macroeconomic conditions or a lack of fundamental value in these tokens. This is turning altcoins into speculative assets driven by momentum.

In an interview with BeInCrypto, Vincent Liu, CIO of Chronos Research, explained this issue.

"The constant token launches, especially meme coins, have diluted liquidity and distracted investors. Simultaneously, macroeconomic headwinds like rising interest rates and global risk aversion have suppressed speculative capital. Tokens lacking utility, clear roadmaps, and sustainable ecosystems have been quickly revalued as investor skepticism grows," Liu explained.

One of the few successful launches with a strong ROI is Solayer (LAYER). Since its launch in February, LAYER has risen 88% and is currently trading below $2.00.

Altcoin Season Delayed... Narrative Growth

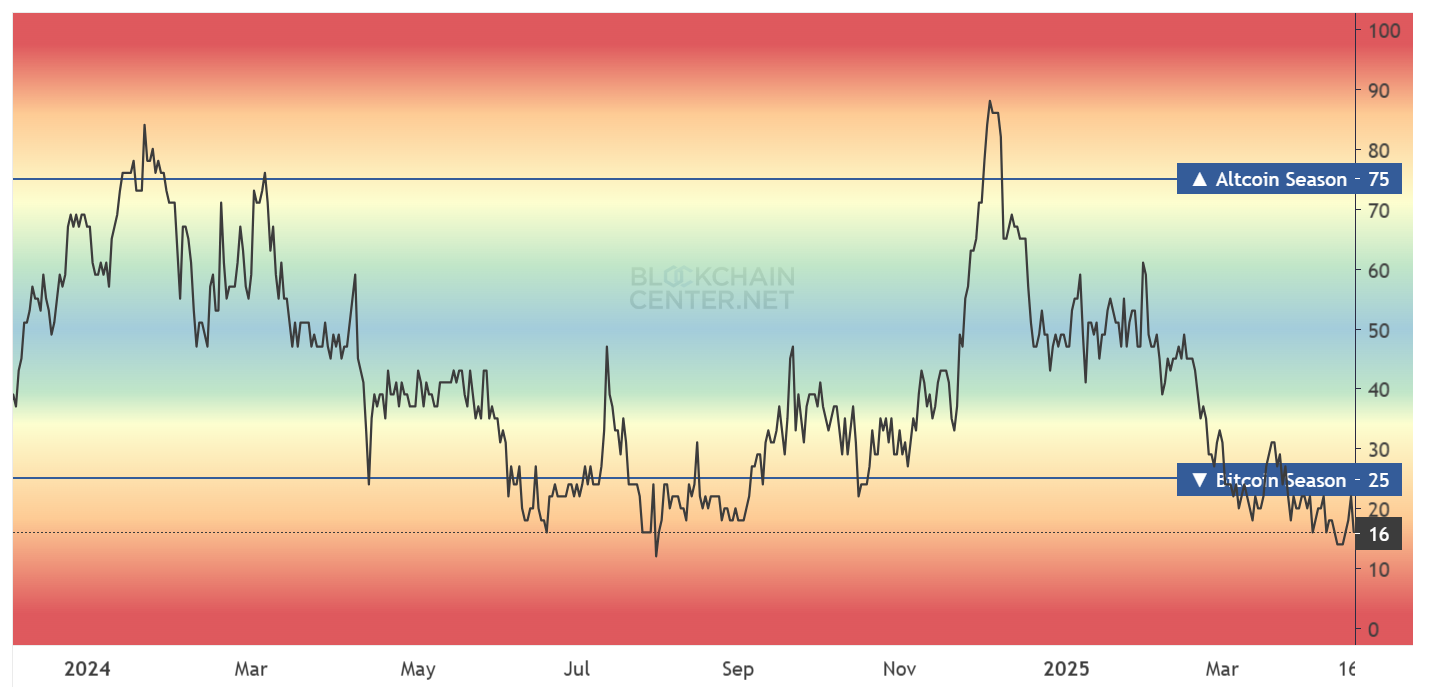

The altcoin season index is currently at 16, indicating Bitcoin's dominance. Rapid token launches and post-listing failures are contributing to the delay.

However, Liu noted that niche categories like AI-related tokens are still showing strong demand.

"The full altcoin season has not yet materialized, but niche categories like AI-integrated meme coins and new technology narratives have shown strong signals. Many token launches continue to dilute capital and hinder broader momentum due to overvaluation and weak fundamentals. However, AI-related narratives are gaining attention not just from crypto natives but also from traditional finance. The altcoin season is not disappearing, it's just evolving," Liu said.

Despite the delay, the possibility of an altcoin season remains. However, a true change can only be signaled when 75% of the top 50 altcoins outperform Bitcoin, which is not the case currently.

Market Makers Fueling High TGE Interest?

Arthur Cheng, founder and CEO of Defiance Capital, recently raised concerns about TGE. He emphasized the risk of projects and market makers artificially inflating token prices together. This can distort market behavior and undermine investor confidence.

"I can't tell if prices are the result of organic supply and demand or simply manipulated by projects and market makers for other objectives. It's really strange that CEXs are turning a blind eye and the altcoin market is becoming more and more like a lemon market. Trust is diminishing," Cheng tweeted.

In response, Vincent Liu suggested that reforms are needed in the token launch approach.

"...The issue of artificially inflated token prices before launch is raising increasing concerns. Such short-term spikes can attract initial interest but often undermine long-term investor trust. To mitigate this, the industry needs to increase transparency in partnership contracts, listing criteria, and pre-launch disclosures. Clear communication about a project's structure, roadmap, and market cap expectations is essential to building a sustainable and trustworthy ecosystem," Liu said.

Liu believes collaboration between market makers, centralized exchanges (CEX), and investors is necessary to address this issue.

"Through thorough research on the fundamentals of new projects, investors can protect themselves from significant losses and identify tokens of long-term value," Liu concluded.