In the past 24 hours, approximately $120 million (about 170 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently aggregated data, the ratio of long and short positions among the total liquidated positions varied depending on the time and exchange.

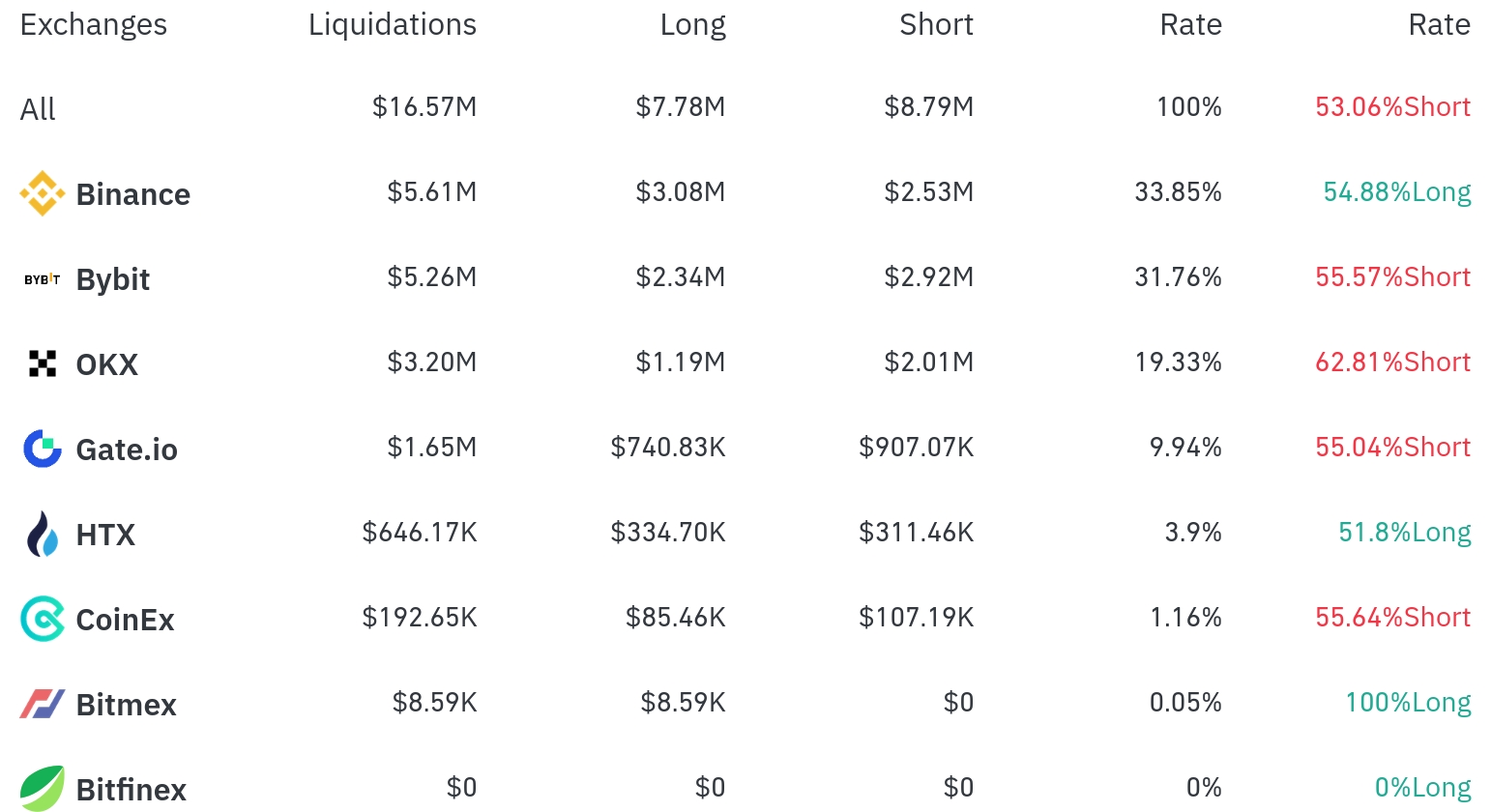

Binance had the most position liquidations in the past 4 hours, with a total of $5.61 million liquidated (33.85% of the total). Among these, long positions accounted for $3.08 million, or 54.88%.

Bybit was the second-highest exchange for liquidations, with $5.26 million (31.76%) of positions liquidated, of which short positions accounted for $2.92 million (55.57%), higher than long positions.

OKX saw approximately $3.20 million (19.33%) in liquidations, with the short position liquidation ratio at 62.81%, higher than long positions.

Notably, BitMEX had a small liquidation scale, but all liquidations ($8.59K) occurred in long positions.

By coin, Bitcoin (BTC) had the highest liquidations at a total of $74.19 million. Bitcoin is currently trading at $87,274 and rose 3.73% in the past 24 hours, but significant liquidations occurred due to sharp price fluctuations. Over 24 hours, short positions were liquidated at $69.45 million, much higher than long positions ($4.74 million).

Ethereum (ETH) saw $31.76 million in liquidations, currently trading at $1,635 and rising 3.89% in 24 hours. Over 4 hours, long positions were liquidated at $2.49 million, higher than short positions ($520,000).

Solana (SOL) had $8.96 million in liquidations and showed a 1.26% increase. Solana also had more short position liquidations ($5.20 million) than long positions ($3.76 million) over 24 hours.

Notably, the FARTCO Token showed a sharp 10.59% price increase, with approximately $2.91 million in liquidations over 24 hours. Of this, $2.19 million was short position liquidations, appearing to be a short squeeze phenomenon.

The SUI Token also showed a significant 8.47% increase, with about $1.12 million in liquidations over 24 hours, mostly short position liquidations.

The TRUMP Token rose 2.46%, with approximately $370,000 in liquidations. Over 4 hours, long position liquidations ($23,000) were higher than short position liquidations ($13,000).

Overall, this liquidation data reveals that while the cryptocurrency market shows an upward trend, diverse liquidation patterns emerged across exchanges and coins. Particularly notable was the prominent short position liquidations alongside strong price increases in many altcoins.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>