The current price of Bitcoin is $88,178, and considering its historical resilience and expert predictions, the overall outlook is cautiously optimistic.

In the short term, investors should carefully observe the support level at $83,000 and the resistance level at $90,000. These levels are likely to shape market sentiment.

To overcome the bear market, it needs to surpass $91,000-$92,000

On Easter Sunday in 2025, Bitcoin reached $84,600, marking its highest level on this holiday in 17 years. According to the report by DocumentingBTC, Bitcoin has shown unparalleled resilience and adoption, rising from $0 in 2009-2010 to $84,600 in 2025.

Bitcoin dominance (BTC.D) has also reached its highest point in 4 years. However, experts are divided on whether an altcoin season is approaching.

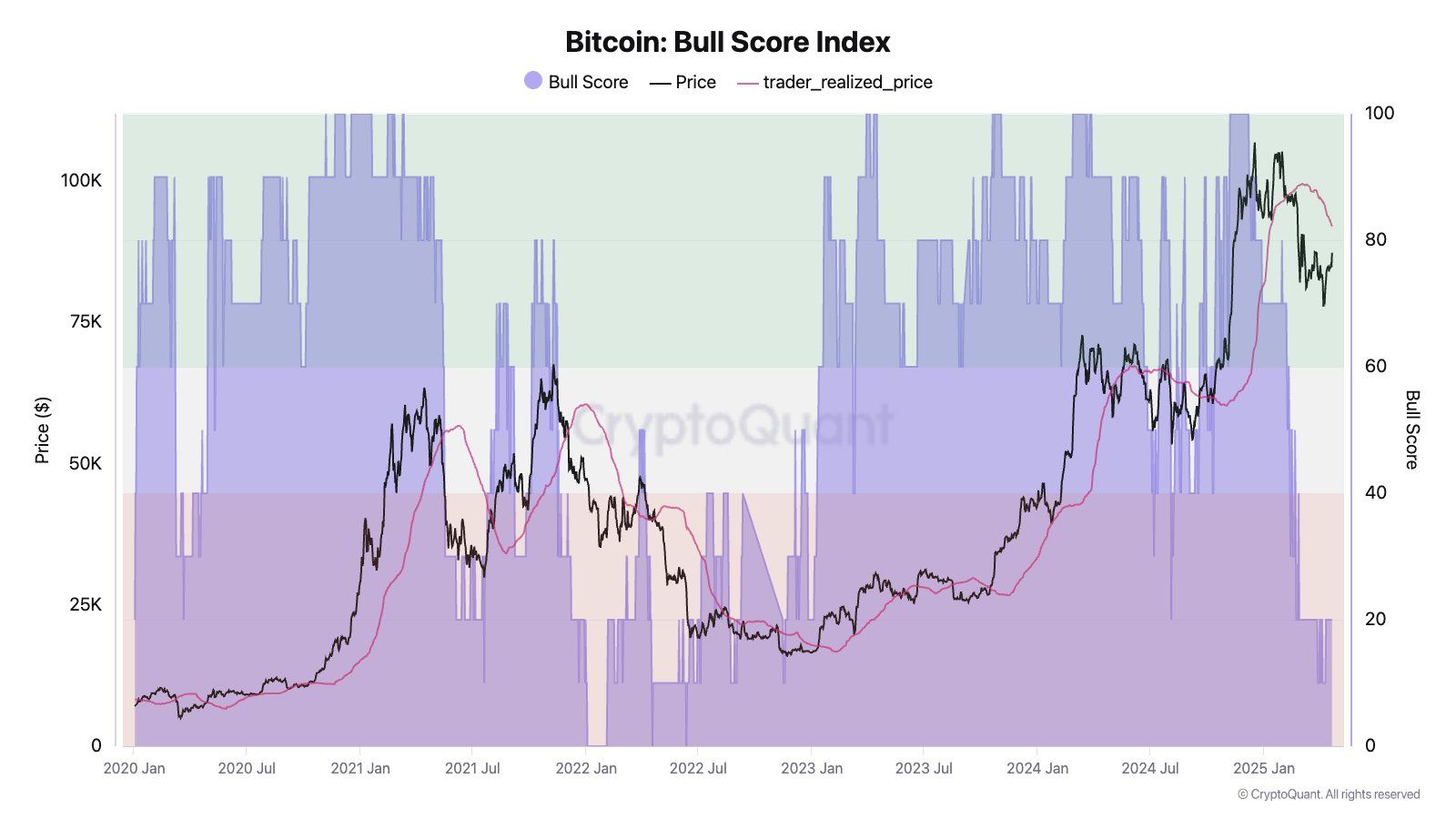

Julio Moreno, Research Director at the on-chain crypto platform CryptoQuant, shared on X that Bitcoin's price resistance could be between $91,000 and $92,000. According to the analysis, in bull markets (bull score ≥ 60), this realized price often acts as support, while in bear markets (bull score ≤ 40), it acts as resistance. The current market is still considered to be in the latter scenario.

In another analysis, CryptoQuant suggests that the market is more likely experiencing a typical correction rather than entering a full bear market cycle. This view aligns with Bitcoin's current price of $88,178, which is slightly below the recent high but still above major support levels.

Analyst Mark Cullen is particularly skeptical about the $83,000 level. If Bitcoin falls below this level, the market may show a stronger bearish reaction.

"Bitcoin's $90,000 liquidity is still valid. However, I don't think the $83,000 level is safe. It's more likely that the lows from last Sunday and Wednesday will be broken first," Mark Cullen said.

According to a recent BeInCrypto report, Bitcoin is aiming to break through $90,000, driven by increasing momentum in the derivatives market. Breaking this level could signal a new bullish wave, potentially driven by bottom buyers and derivatives traders.

Long-term Potential... Bull Market Future?

Looking at the long-term outlook, experts are optimistic about Bitcoin's trajectory.

"Seriously, guys, this might be the last chance to buy Bitcoin below $100,000," shared Arthur Hayes, co-founder of BitMEX on X.

Robert Kiyosaki, author of Rich Dad Poor Dad, posted that he is confident Bitcoin's price will reach $180,000 to $200,000 by the end of 2025.

Bitcoin's historical resilience supports this bullish outlook even after corrections. For example, after falling to $27,931 on Easter Sunday in 2023, BTC significantly rebounded to $84,600 by 2025. This recovery pattern aligns with analysts' views that corrections are healthy for long-term growth.

The Fear and Greed Index can also influence investor behavior. High index values (indicating greed) often signal bullish sentiment and could push Bitcoin above $90,000.