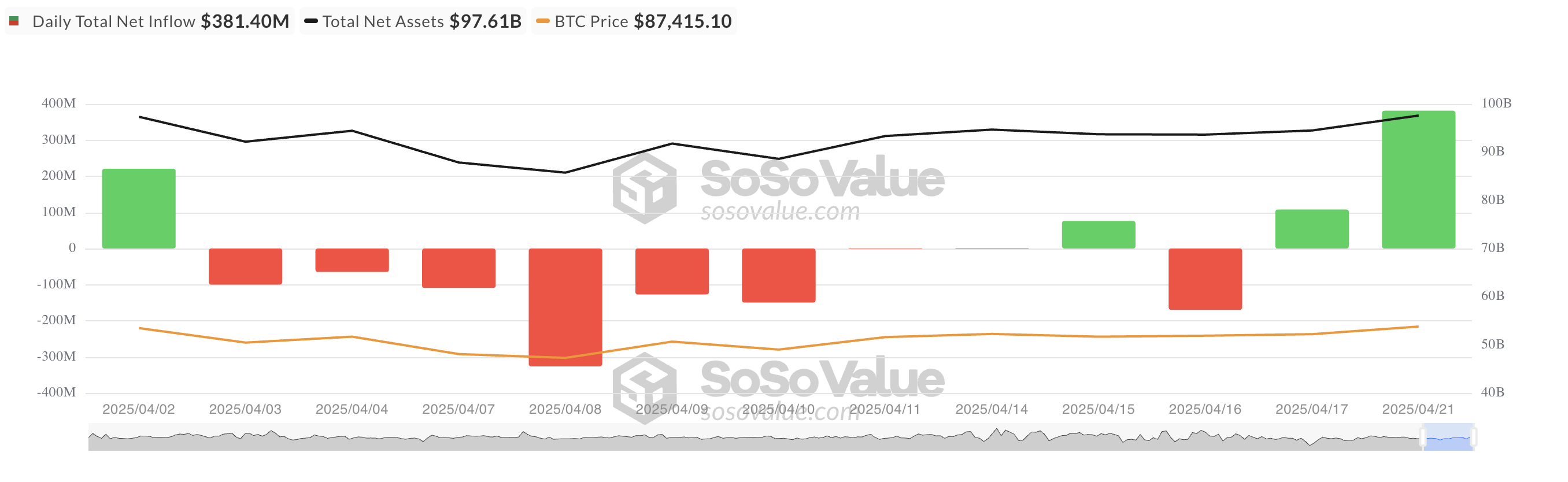

This week, the Bit ETF has had a positive start. Institutional investors are strongly returning. On Monday, the Bit ETF recorded over $380 million in net inflows. This is the largest single-day inflow since January 30th.

The surge in capital inflows indicates that institutional confidence in major coins has newly increased after a period of low activity in the ETF market.

Bit ETF, $381 Million Inflow

On Monday, the BTC ETF's net inflow was $381.4 million. It has been almost 13 weeks since the Bit ETF has seen such a large fund inflow in a single day. This surge is noteworthy.

The capital inflow reflects a renewed bullish bias among institutional investors. This occurred at a time when overall market sentiment was relatively cautious.

Yesterday, Ark Invest and 21Shares' ETF ARKB recorded the largest single-day net inflow of $116.13 million. The total cumulative net inflow reaches $2.6 billion.

Fidelity's ETF FBTC ranked second with a net inflow of $87.61 million. The total historical net inflow of ETFs is now $11.37 billion.

Rising Investor Confidence

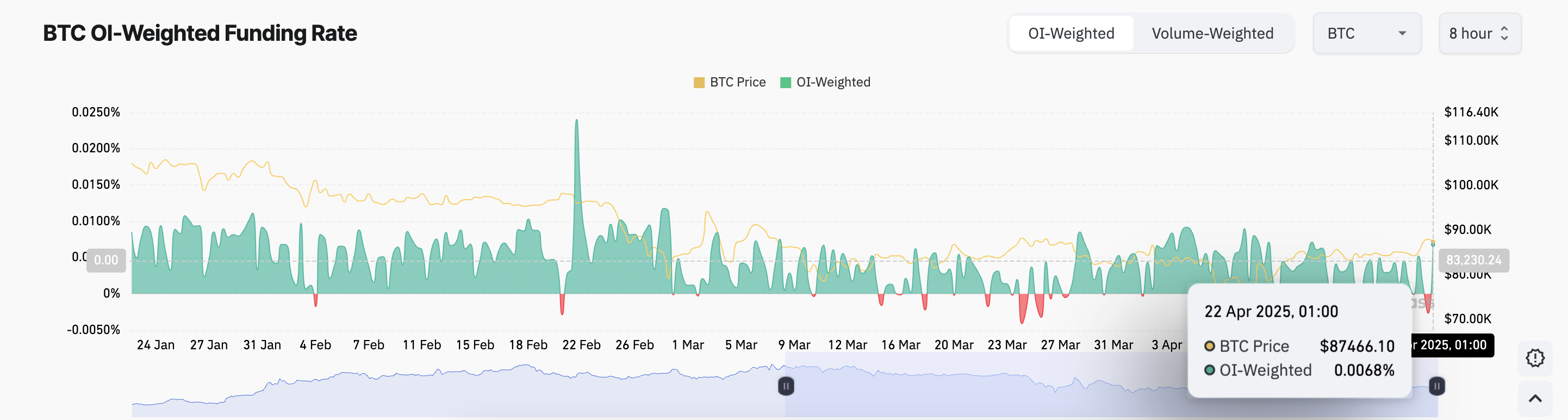

BTC recorded a slight increase of 1% in the past 24 hours. This price increase triggered an increase in new open contracts in the coin's futures market. This is reflected in the increase in futures open interest. At the time of reporting, this was $58.46 billion, a 5% increase over the past day.

The asset's open interest measures the total number of unsettled derivative contracts. This means contracts such as futures or options have not yet been settled or closed.

When BTC's open interest rises with the price, it indicates that more traders are entering the market. This means they are opening new long or short positions. This is a bullish signal confirming increased investor interest in the king coin.

Additionally, at the time of reporting, BTC's funding rate is positive. This indicates market confidence in future price performance. It is currently 0.0068%.

When the asset's funding rate is this positive, long traders pay short traders. This means more traders are expecting BTC to rise. This reflects a bullish market sentiment.

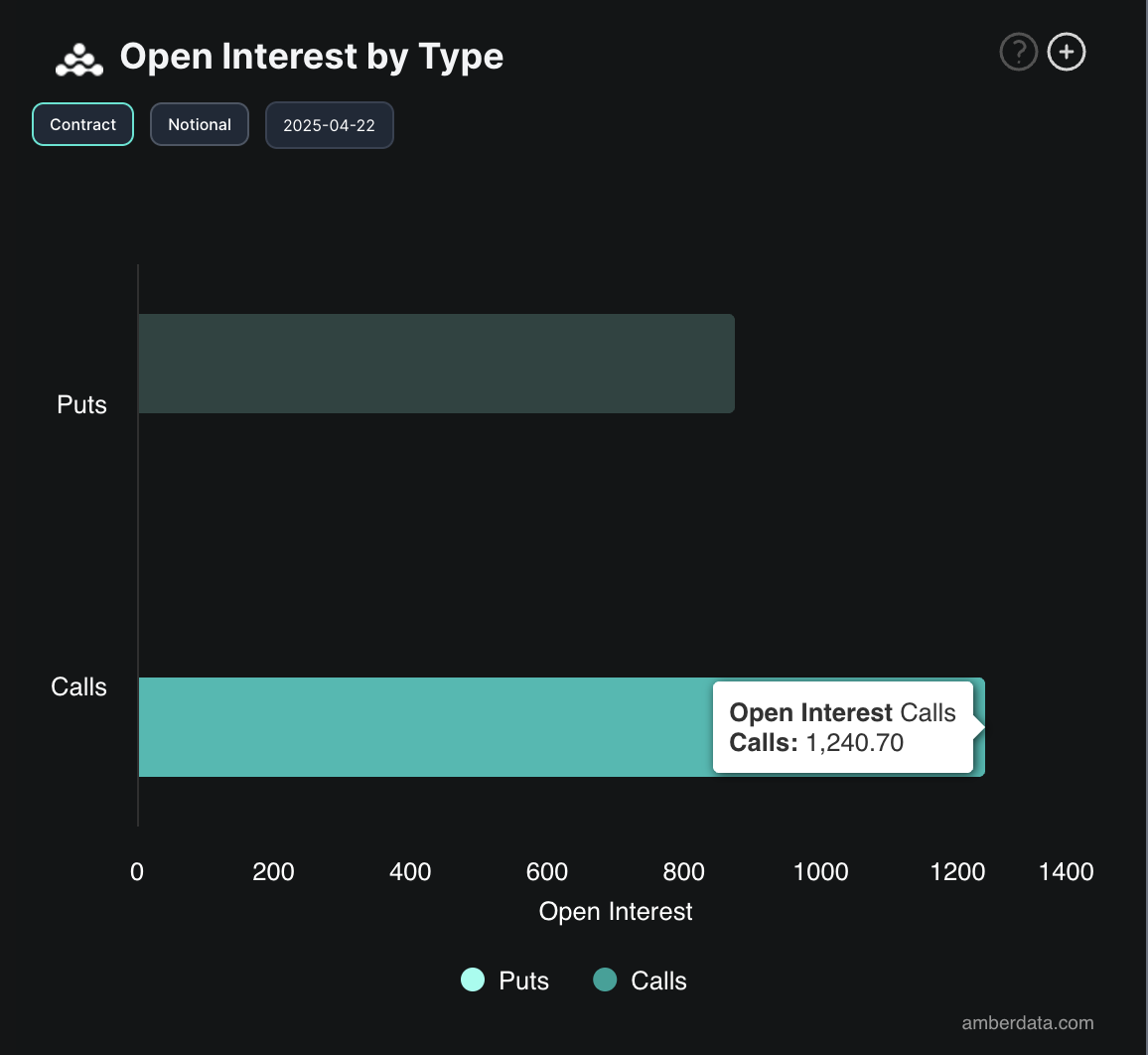

Moreover, call demand is high in today's BTC options market. This supports a bullish outlook. According to cryptocurrency derivatives exchange Deribit, BTC's put-call ratio is currently 0.71.

This indicates that call options are being traded more than puts. This suggests a bullish bias among option traders. This low ratio reflects increasing investor confidence and price rise expectations.