Over the past 24 hours, a large-scale Short position liquidation occurred in the cryptocurrency market. Major exchanges saw a total of $24.36 million (approximately 35.6 billion won) in leverage positions liquidated based on a 4-hour standard.

According to the currently compiled data, Short positions accounted for $18.45 million, representing 75.74% of the total liquidations, while Long positions were $5.91 million, accounting for 24.26%. This demonstrates that Short position holders were significantly impacted by the recent sharp price increase in the cryptocurrency market.

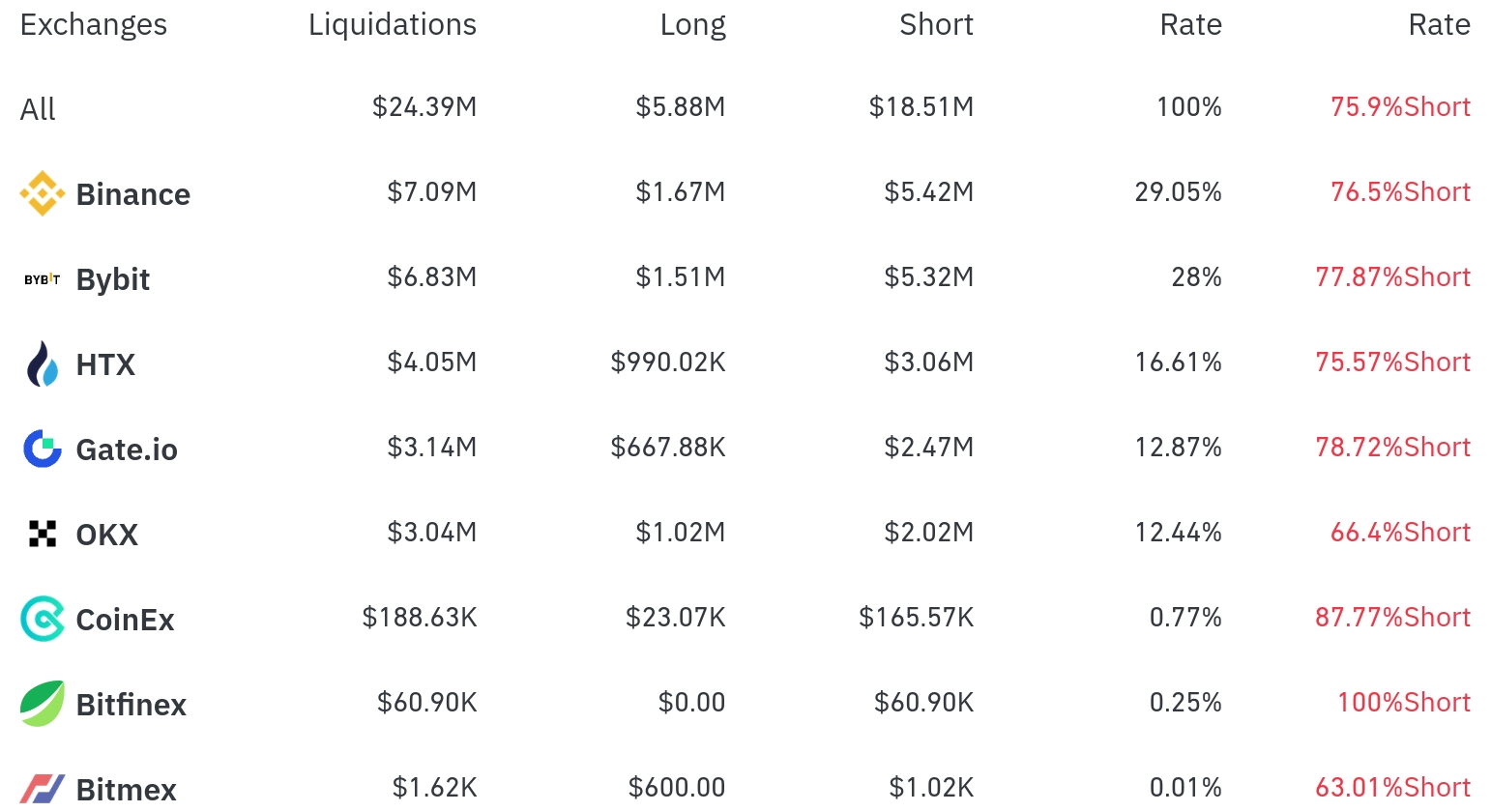

Binance saw the most position liquidations over the past 4 hours, with a total of $7.09 million (29.05% of the total) liquidated. Of this, Short positions comprised $5.42 million, or 76.5%.

ByBit was the second-highest exchange, with $6.83 million (28%) in positions liquidated, of which Short positions were $5.32 million (77.87%).

HTX experienced approximately $4.05 million (16.61%) in liquidations, with a Short position ratio of 75.57%. Gate.io and OKX also saw liquidations of $3.14 million (12.87%) and $3.04 million (12.44%), respectively.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $140.74 million in Bitcoin positions were liquidated over 24 hours, with Long positions at $13.62 million and Short positions at $127.11 million. Bitcoin's price rose 4.19% to $91,000 in 24 hours, with $9.73 million in Short positions liquidated over 4 hours.

Ethereum (ETH) saw about $91.69 million in positions liquidated over 24 hours, with Short positions of $55.90 million comprising the majority. Ethereum's price rose 7.40% to trade at $1,693.5.

Solana (SOL) had approximately $13.48 million liquidated over 24 hours, with its price rising 5.28% to $144.35.

Dogecoin (DOGE) saw $6.64 million in liquidations as its price rose 8.89% over 24 hours, with $5.77 million from Short positions.

A notable coin in this rally was FARTCO (FARTCOIN). The token showed a high price increase of 13.82% over 24 hours, with total position liquidations of $9.05 million. Of this, $7.77 million was from Short positions, resulting in significant losses for Short traders due to the sharp price increase.

The SUI Token also saw position liquidations of $4.09 million with a high increase of 11.06%, while the TRUMP Token rose 7.13% with $1.15 million in liquidations.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. This large-scale Short liquidation serves as an indicator of the cryptocurrency market's strong upward momentum, with the possibility that a Short Squeeze further accelerated market growth.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>