In the past 24 hours, a significant number of leveraged positions were liquidated in the cryptocurrency market.

According to the currently aggregated data, long positions dominated the liquidated positions, with over 77% long position bias observed on major exchanges.

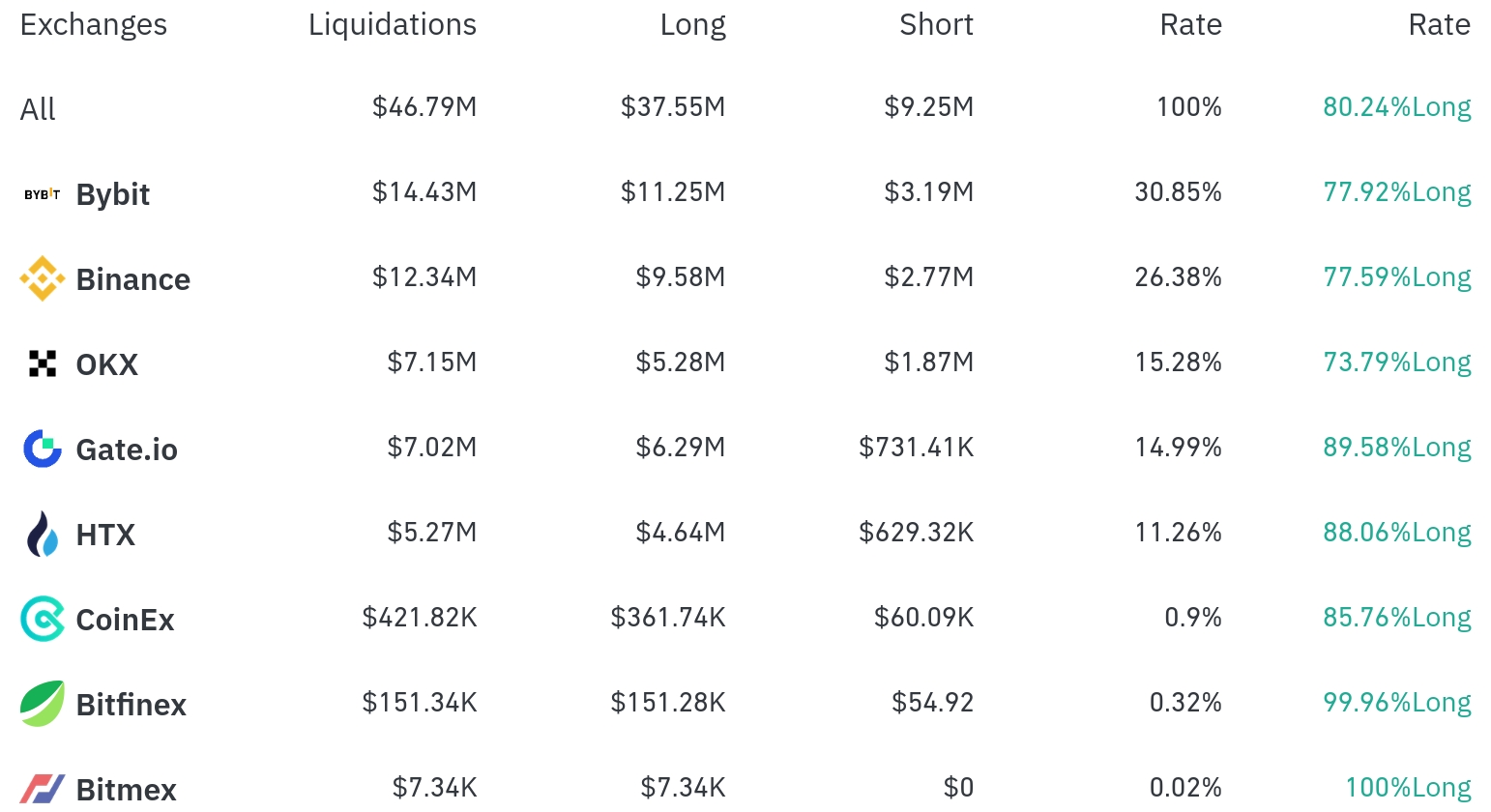

Bybit saw the most position liquidations over the past 4 hours, with a total of $14.43 million (30.85%) liquidated. Of this, long positions accounted for $11.25 million, or 77.92%.

Binance was the second-highest exchange for liquidations, with $12.34 million (26.38%) of positions liquidated, of which long positions were $9.58 million (77.59%).

OKX experienced around $7.15 million (15.28%) in liquidations, with a long position ratio of 73.79%. Gate.io saw approximately $7.02 million (14.99%) in liquidations, with an exceptionally high long position bias of 89.58%.

By coin, Bitcoin (BTC) and Ethereum (ETH) positions were liquidated the most. Over 24 hours, approximately $73.25 million in Bitcoin positions and $68.16 million in Ethereum positions were liquidated.

Bitcoin declined 1.26% in the past 24 hours, with $7.79 million in long positions and $1.74 million in short positions liquidated over 4 hours.

Ethereum declined more significantly at 3.00%, with $13.44 million in long positions and $1.39 million in short positions liquidated over 4 hours, recording the largest liquidation scale.

A notable coin was the TRUMP Token, which saw massive liquidations of around $24.06 million despite a 31.44% surge in 24 hours. Interestingly, short position liquidations ($13.07 million) were higher than long position liquidations ($10.99 million).

In the meme coin category, Doge (-4.83%) recorded $11.44 million in liquidations over 24 hours, while Pepe (-8.13%) saw $2.48 million. Newer meme coins like 1000PEI and FARTCO also experienced significant liquidations alongside price drops of 8.26% and 6.96% respectively.

This large-scale liquidation in the cryptocurrency market is analyzed as a correction of traders' excessive leveraged positions amid the recent market-wide downtrend. Notably, long position liquidations were prominent amid the price declines of major coins.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>