Bitcoin net outflow has been observed on Coinbase.. The premium indicator has also been rising for three consecutive days, showing the possibility of continued buying pressure from the United States.

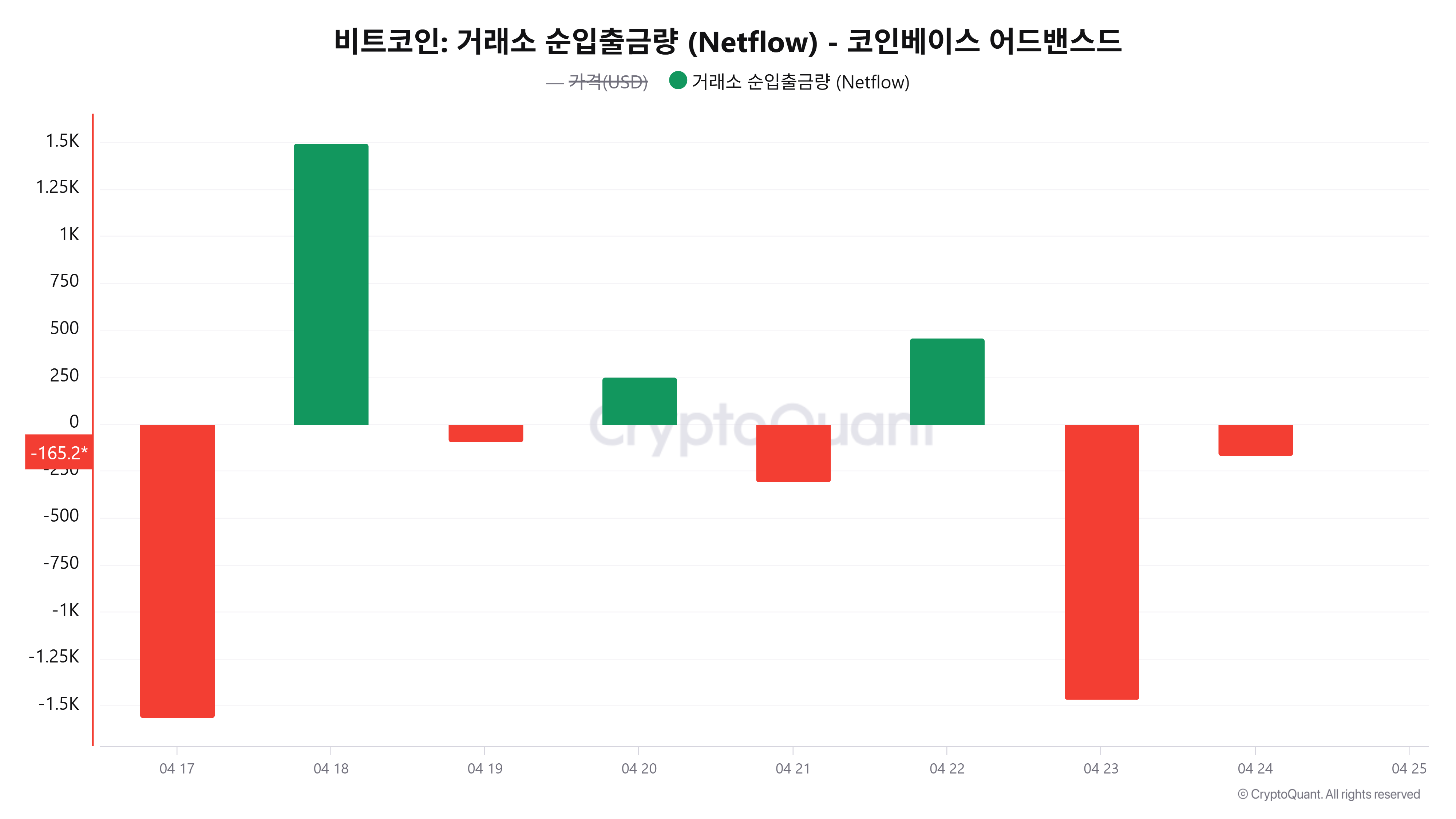

According to Cryptoquant's 'Coinbase Exchange Netflow' data, 165.20 BTC was net outflowed from Coinbase on the 24th (based on incomplete data).

On the 23rd, a strong outflow trend was seen with with 1,462.54 BTC net outflowed, and 22nd,458.21 , BTC net inflow was recorded. p p>< >a temporary net inflow trend was recently appeared, it has now returned to a clear outflow trend, is interpreted as continued movement for storage outside exchanges or long-term holding purposes.

The 'Coinbase Premium Indicator, which', gauges US buying pressure through the price difference between Coinbase and Binance, rose from 0.00667305% on 0the 21st to 0.0493456% on the 22nd, and 0.0531961% on the 23rd.

The consecutive rise and maintenance of a positive trend suggest that buying pressure from the US continues, and the increasing figures particularly indicate a strong possibility of buying pressure in the US spot market.

The Bitcoin-based trading volume decreased from 19, BTC to 12,538 BTC, reflecting a temporary in slowdown in-. However, the still high trading volume suggests level suggests that from US institutional investors.

As of :40, Bitcoin was trading at $82,578, down 1.31% from the day before.

For real-time news...Go to Token Post Telegram

div div lt;©, unauthorized reproduction and redistribution prohibited>Advertising InquiryArticle SubmissionPress Release