XRP has recorded a 3% price increase over the past week. This aligns with the overall rally in the cryptocurrency market where major coins have risen.

However, despite the upward momentum, key technical indicators are sending warning signals that could hinder XRP's recent rise.

XRP Rally Precarious

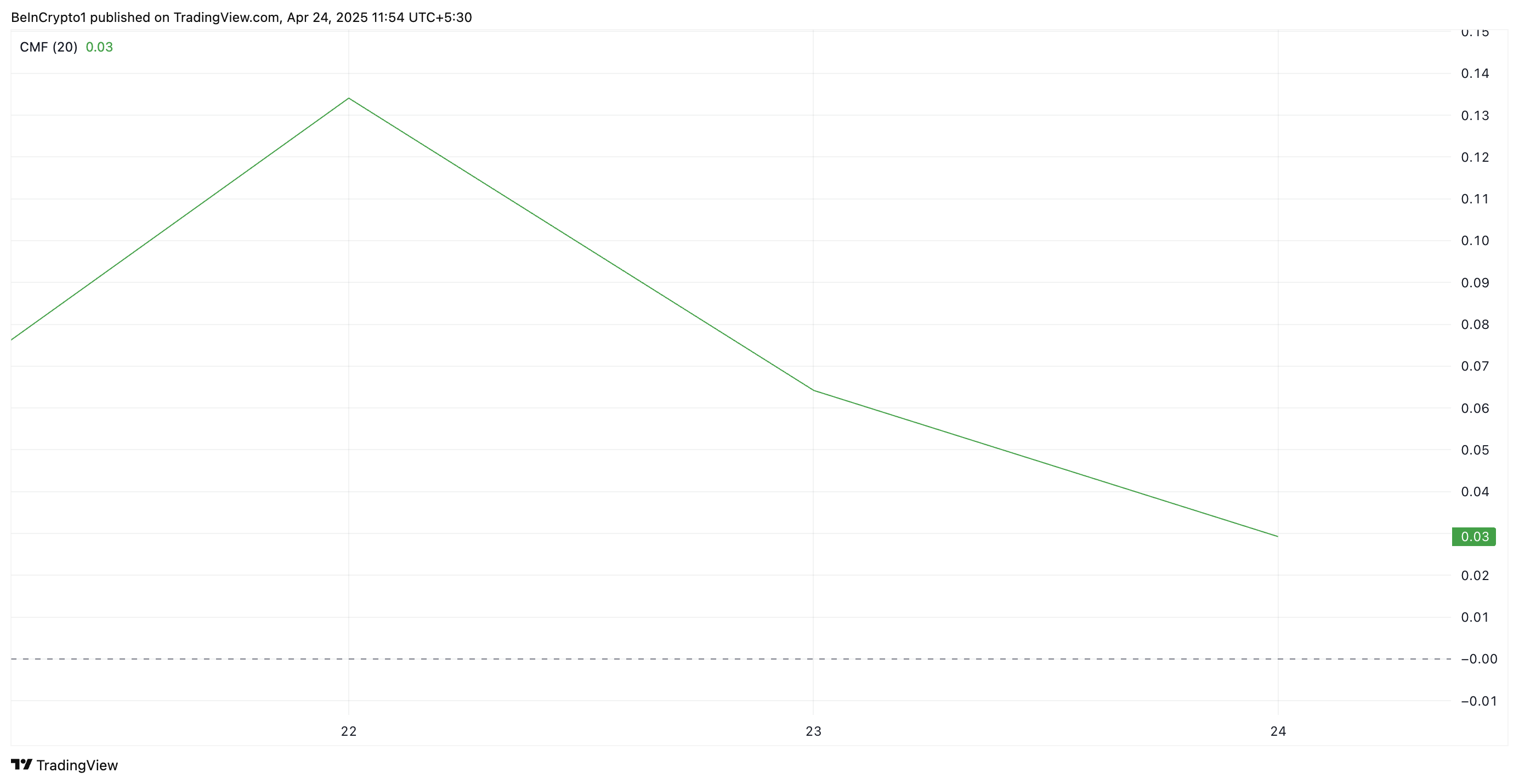

XRP's Chaikin Money Flow (CMF) is an indicator that measures capital inflows and outflows into an asset. This indicator is showing a downward trend while the token's price continues to rise. This momentum indicator is currently at 0.03 and moving towards the centerline.

This trend forms a bearish divergence between XRP's price movement and CMF. This warns that momentum is weakening. Generally, CMF tracks capital flows into an asset. Therefore, when the price is rising but CMF is falling, it suggests the rally is not receiving solid support from sustained demand.

In other words, XRP traders might be buying based on short-term high interest rather than long-term conviction. This means the recent rise could easily disappear if market sentiment changes or profit-taking begins.

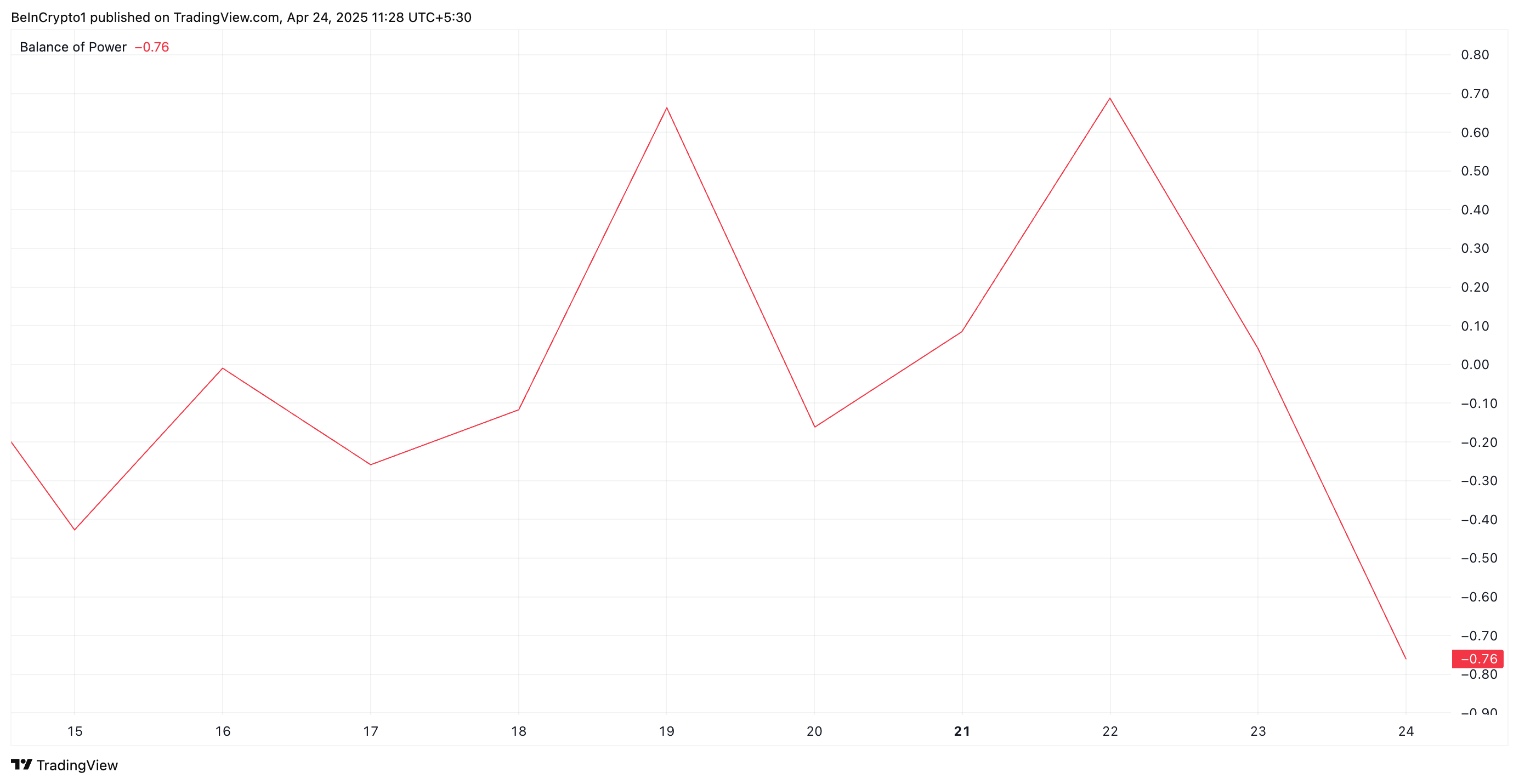

Additionally, the negative Balance of Power (BoP) for the altcoin supports this bearish outlook. At the time of writing, this indicator is at -0.76, emphasizing that demand for XRP is weakening.

When an asset's BoP is this negative, sellers have more influence on price movements than buyers. This is a bearish signal indicating additional downward pressure on XRP.

XRP Faces Critical Test of $2 Support Line

XRP is currently trading at $2.18, above a support line formed at $2.03. If demand weakens further, XRP buyers might fail to defend this support line, and the altcoin could drop below $2, trading at $1.61.

However, this bearish outlook will be invalidated if new demand for XRP increases. In that case, the price could rise to $2.29 and move towards $2.50.