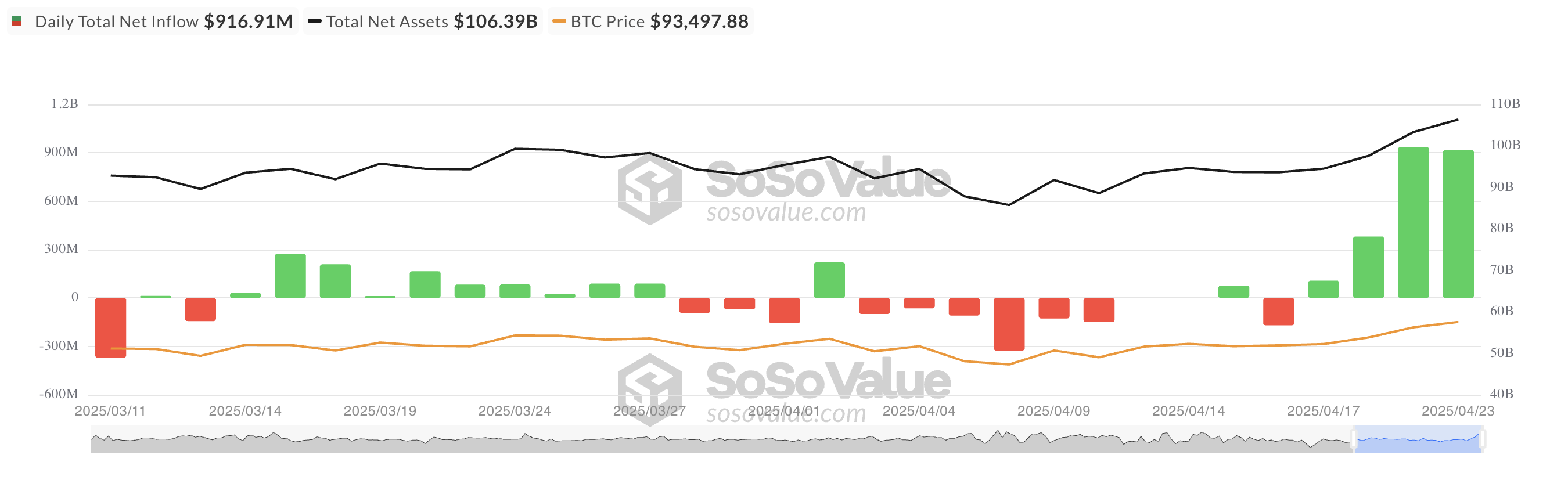

The US Bitcoin spot ETF continued its inflow march on the 23rd (local time), raising over $900 million in new capital.

However, despite strong ETF demand, Bitcoin's open interest decreased, and the funding rate turned negative, indicating a shift in short-term market sentiment.

High Interest in Bitcoin ETF

The BTC spot ETF recorded a net inflow of $91.691 million on Wednesday, continuing to attract investors.

This marks four consecutive days of inflow, particularly showing increased institutional interest in BTC exposure while attempting to maintain the coin's price at a stable $90,000 level.

On Wednesday, BlackRock's ETF IBIT recorded its highest daily net inflow of $643.16 million, reaching a total cumulative net inflow of $40.63 billion.

Ark Invest and 21Shares' ETF ARKB ranked second with a net inflow of $129.5 million. The total historical net inflow of this ETF reaches $3 billion.

Traders Adjusting Bitcoin Positions…Market Cautious

Trading activity across the cryptocurrency market decreased over the past 24 hours, with total market capitalization dropping by $18 billion.

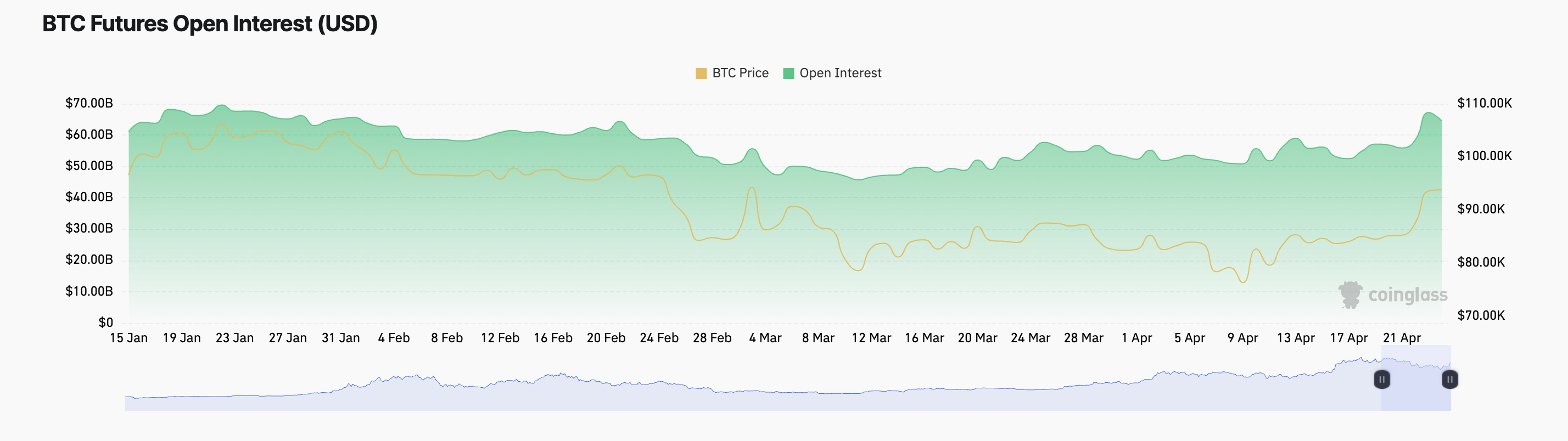

This retreat contributed to a 1% decline in BTC price. The momentum decrease is clearly evident in the reduction of the coin's futures open interest, indicating decreased trading participation. At the time of reporting, BTC's futures open interest was $64.54 billion, a 5% decrease over the past day.

When an asset's price and open interest drop sharply, it indicates that traders are closing existing positions rather than opening new ones. This combination reflects weak conviction and potential trend reversal or deeper correction in the BTC market.

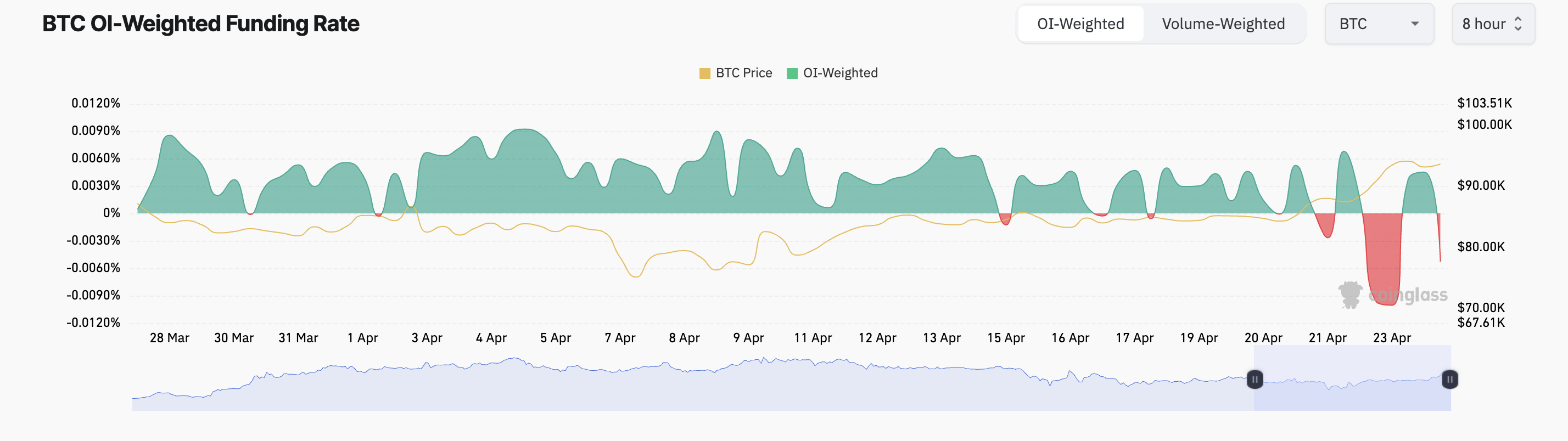

Additionally, BTC's funding rate has turned negative again, indicating that short traders are gaining the upper hand and paying costs to maintain their current positions. At the time of reporting, this is -0.0053%.

When BTC's funding rate is negative, short sellers pay costs to long holders to maintain their positions. This indicates bearish sentiment dominates the market and suggests traders expect the coin's price to fall soon.

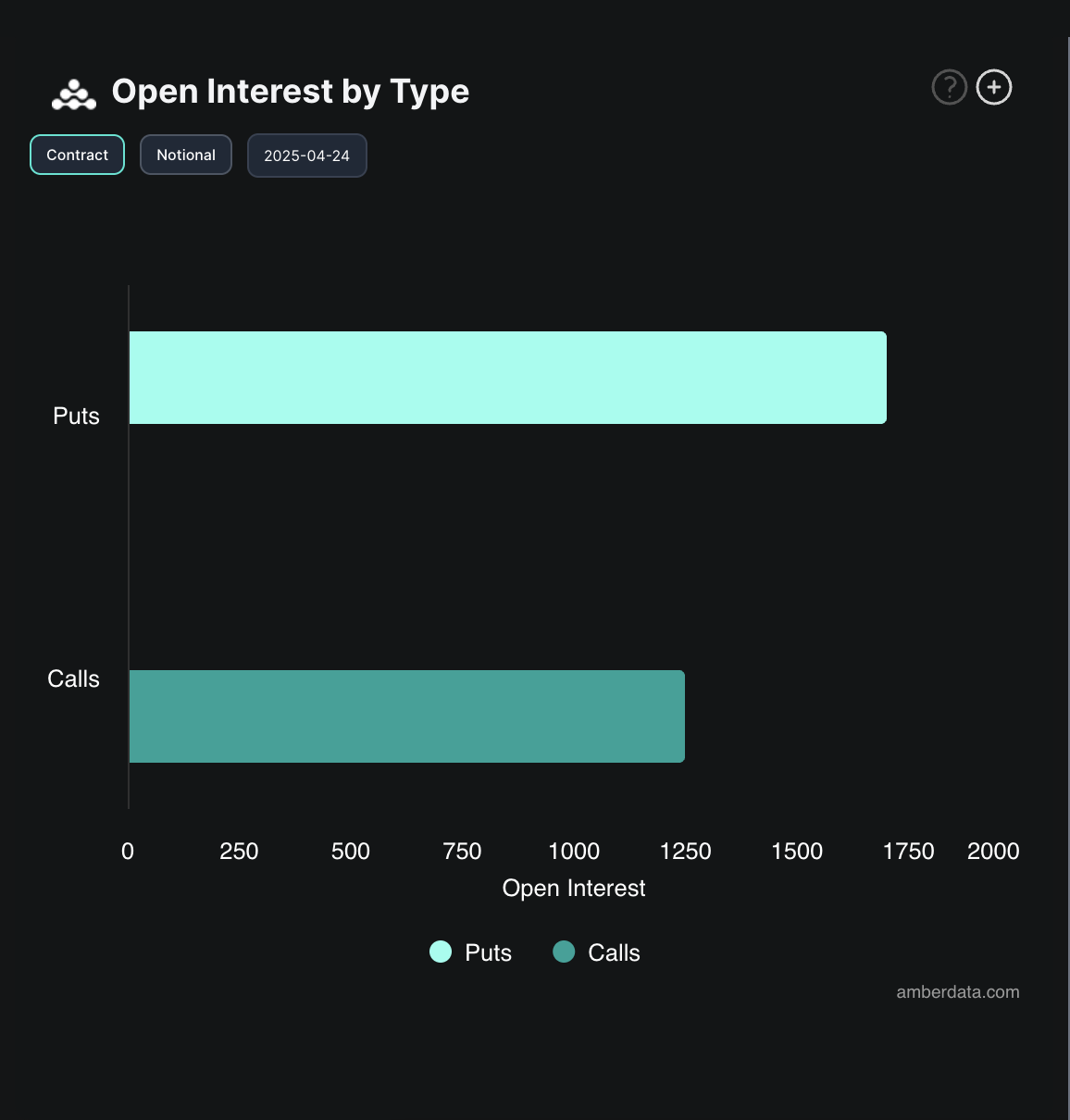

Moreover, put demand increased in today's BTC options market, supporting this bearish outlook. According to cryptocurrency derivatives exchange Deribit, BTC's put-call ratio is currently 1.36.

This indicates more put options are being traded than call options, suggesting a bearish bias among options traders. This ratio reflects growing expectations of price decline.