From First Principles: Restaking

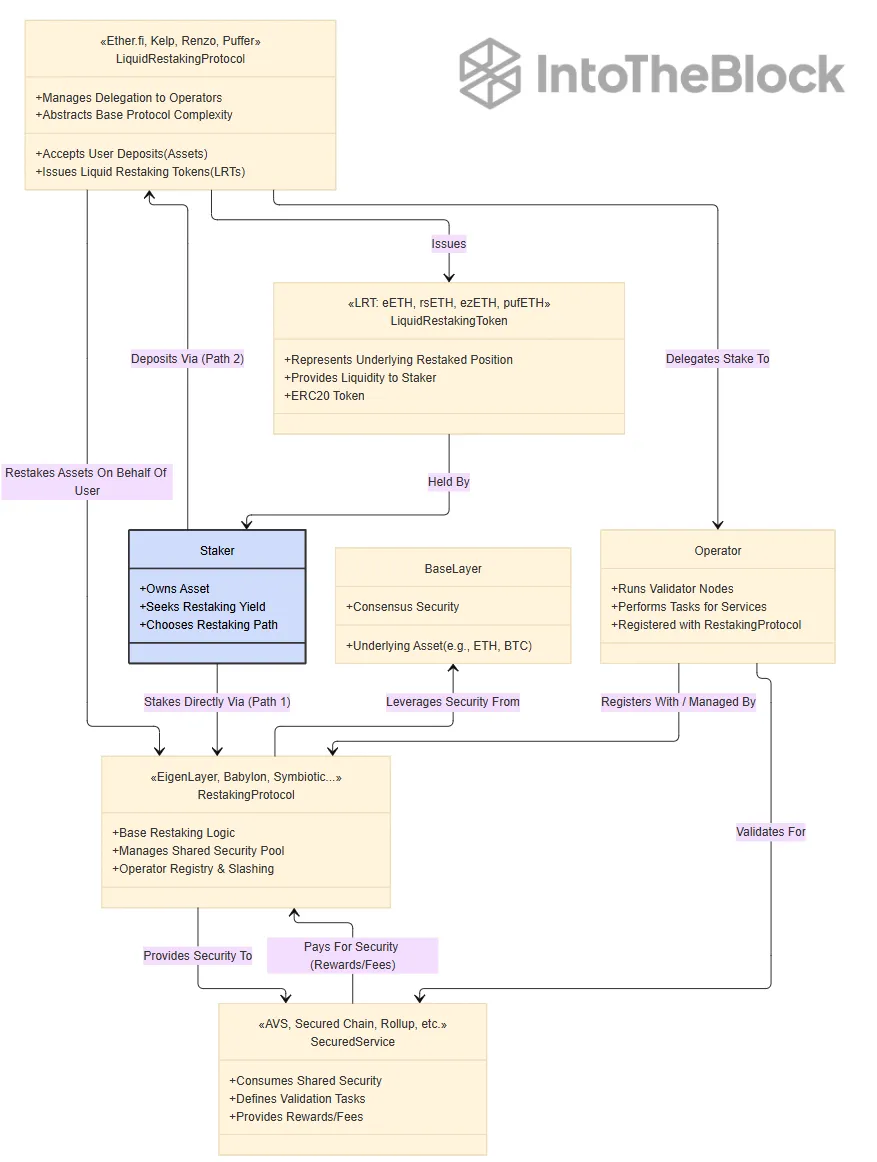

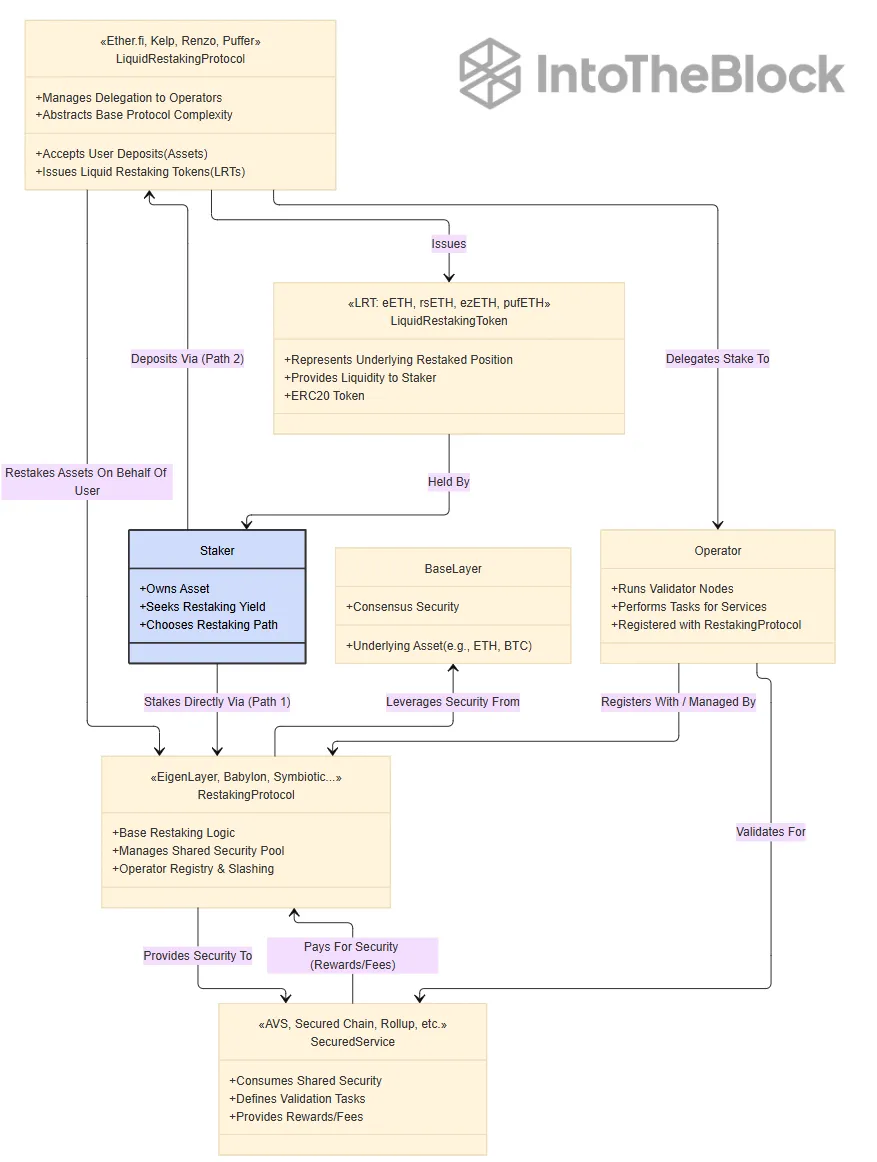

Traditional finance continuously innovates to optimize capital utilization, and DeFi is equally committed to strengthening its foundational layer—network security. In traditional Proof of (( (PoS), users maintain the security of blockchains like Ethereum by locking assets ("staking"), which constitutes a critical foundation. The concept of restconsolidatesally how we utilize economic security in interconnected blockchain ecosystems.

Restaking breaks through traditional staking limitations—previously staked assets could only secure their native blockchain. By allowing these assets to simultaneously provide security for other protocols or services, restaking redefines their functionality. This is not just capital reuse, but more like transforming static single-purpose assets into dynamic mediums that provide security for broader DeFi ecosystems.

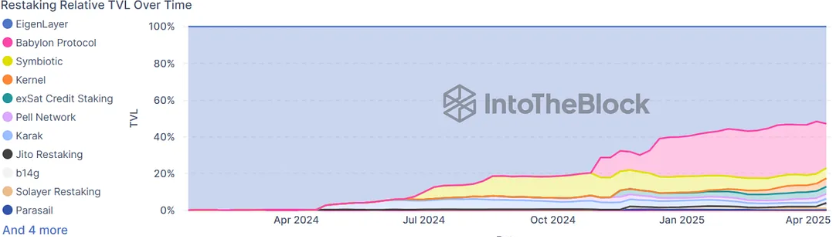

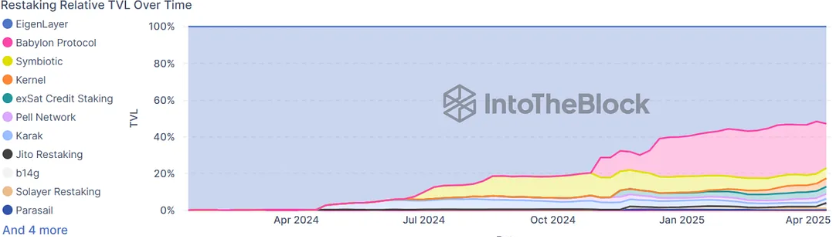

Pioneering field are protocols like EigenLayer (focusing on utilizing already staked ETH in Ethereum ecosystem), Babylon (aiming to mobilize Bitcoin's economic weight to protect other PoS chains). Meanwhile, emerging protocols like Symbiotic are emerging, offering modular shared security solutions. Although these protocols all target expanded security, their implementation implementation paths differ significantly due to different foundational layers and core design philosophies.

Source:

Delegation Mechanism

Most re-stakers delegate their assets to professional operators to run infrastructure. This introduces a trust factor: delegators' staked assets face potential slashing based on the operator's performance and integrity. Choosing reliable operators is crucial.

Shared Rewards and Overlapping Risks

Rewards: Re-stakers/delegators can receive additional rewards/fees from secured services (typically supplementing base layer rewards), paid by service providers. Operators usually take a commission.

Slashing (Risk Overlay): This is a key trade-off. The same re-staked funds will be subject to slashing rules from all secured services and the base layer. Misconduct in any service can trigger slashing of corresponding funds through the related operator. Each additional service increases risk. For example, EigenLayer just activated its mainnet slashing mechanism in April this year, causing its participants to actually bear this risk.

Re-staking Rewards and Risks

Re-staking brings significant advantages for stakers, capital allocators, and developers:

Capital Efficiency Maximization: Stakers can earn additional rewards from secured services using the same capital, solving the opportunity cost of traditional staking. For assets without base rewards like BTC, or with broader asset support through protocols like Symbiotic, it can create inherent yields.

Security Cost Optimization for New Protocols: Dramatically reduces the enormous costs and complexity of securely launching new services, allowing them to "rent" established security and focus on creating core value.

Driving Innovation: Lowered security barriers enable developers to focus on building new applications (AVS/BSN/secured services) rather than building trust networks from scratch. EigenLayer is a prime example, supporting "permissionless innovation" that has cultivated a rapidly growing AVS ecosystem, including its self-developed EigenDA data availability layer and integration support for projects like Mantle and ZKsync. The flexibility of emerging protocols may further accelerate this process.

Enhancing Ecosystem Security: Pooling security resources makes attacking a single secured service far more costly than attacking isolated small networks. Babylon is particularly committed to mitigating PoS vulnerabilities like long-range attacks using Bitcoin timestamp mechanisms.

This could create a positive cycle: Re-staking demand enhances base asset utility (and potential value), thereby strengthening the scale effect of shared security pools.

Risks and Challenges

Re-staking introduces several new risks that must be fully understood and carefully assessed:

Overlapping Slashing (Core Risk): If a secured service experiences operational errors or is attacked, it could lead to collective slashing of funds secured by the same operator across multiple services. EigenLayer's recently activated mainnet slashing mechanism indicates that this risk has entered the practical stage across the entire ecosystem.

Smart Contract Risk: The multi-layered contract system (base layer, re-staking protocols, secured service contracts) expands the attack surface. Code vulnerabilities could cause incorrect slashing or fund losses. Complex interactions might trigger disputes beyond the community's consensus resolution capabilities (Vitalik Buterin has warned about this).

Operator Centralization: Economies of scale might advantage large operators, potentially introducing censorship risks, single points of failure, or collusion concerns, ultimately undermining decentralization goals.

Systemic Risk (LRT and Leverage): Liquid re-staking tokens (LRT) representing re-staking positions enhance liquidity but also increase complexity. Using LRTs as DeFi collateral might lead to over-leveraging, potentially causing cascading liquidations in case of significant slashing events. Liquidity management for such derivatives is critical. The proliferation of different re-staking protocols may further exacerbate system complexity.

Operational Complexity for Users and Operators: Users face challenges in cross-protocol, cross-service, and cross-operator risk assessment. Operators must manage diverse software stacks and simultaneously handle varied services and potentially different slashing rules across multiple re-staking platforms.

Evolution of Shared Security Landscape

Re-staking marks a significant advancement, transforming staked assets into dynamic security resources. EigenLayer and Babylon demonstrate two powerful and unique paths to improving capital efficiency and providing accessible security—the activation of EigenLayer's mainnet slashing mechanism and Babylon's recent mainnet launch signal the maturation of these pioneering protocols.

The core trade-off always exists: Higher potential rewards inevitably accompany overlapping risks. Especially now that cross-platform slashing is a reality, carefully choosing operators and thoroughly understanding service risks is an non-negotiable prerequisite. This field is rapidly evolving: While liquid re-staking tokens (LRT) enhance liquidity and expand applications through DeFi, they simultaneously introduce new systemic risks related to leverage and liquidity management.

A competitive landscape is forming, with protocols like Symbiotic entering the market. These new entrants often emphasize differentiated design choices, such as stronger modularity, permissionless core components, and more flexible collateral type admission. This competition will generate more innovations and potentially specialized solutions but might also lead to market fragmentation and increase user complexity when switching between different ecosystems and risk models.

For DeFi users, re-staking requires deep learning. This is far from a simple "advanced staking" but a entirely new paradigm involving complex multi-platform interactions and higher risks. Re-staking has enormous potential in lowering innovation barriers, optimizing capital efficiency, and building more interconnected decentralized networks, but its success depends on balancing innovation with rigorous risk management. As ecosystems like EigenLayer, Babylon, and Symbiotic mature and comprehensively implement their functionalities, re-staking will undoubtedly become a key force in shaping the blockchain future.