Welcome to the US Morning Cryptocurrency News Briefing. We will comprehensively summarize today's important cryptocurrency developments.

While drinking coffee, check out the potential rise of Bitcoin (BTC) as predicted by experts, as it increasingly secures an important position in mainstream finance. This rising reputation is also attracting attention from corporate holders, and if their interest is realized, it could open the path for further ascent.

Could Bitcoin Sell for $2.2 Million or $50 Million per Coin?

Despite a slight adjustment to test the level of $,$91, 575, continues to maintain its upward trend.

According to a recent BeInCrypto analysis, if this support level is maintained, the cryptocurrency king can target the psychological level of $100,000 after overcoming resistance at $94,000.

.

.This would mean a market capitalization of $1,050 trillion for Bitcoin. This represents a valuation equivalent to 10 times the 2023 global GDP of $100 trillion >trillion p>In particular, Strategic, formerly MicroStrategy, is the world's largest Bitcoin corporate holder. To the Bitcoin purchases.

Accordingly, BeInCrypto contacted Bitcoin pioneer Max Keiser. He played a crucial role in El Salvador's Bitcoin adoption. As a BTC advocate, he has revised his long-term price forecast for to $ 2.2 million per coin.

Keiser mentioned the ongoing competition between Jack Mallers' newly established 21 Capital and and S's company. According to Keiser, institutional FOMO for Bitcoin has reached its peak.

<>"The inevitable and undeniable path of Bitcoin is to take the top spot on the global asset leaderboard, displacing gold, and continue continue moving forward. Eventually, Bitcoin will account for more than 10% of all capital on Earth." told Be.In particular, 21 Capital is a Bitcoin investment company established with $3 billion in capital from Cantor Fitzgerald, SoftBank, Tether, and Bitfinex.

Mallers--Saylor Competition Accelerates Bitcoin Supply Shortage

Jack Mallers participates as co-founder and CEO. He has experience promoting Bitcoin adoption at the institutional, corporate, and government levels.. The Lightning payment app Strike.

Steven Lubka, head of Swan Private Wealth, says 21 Capital can challenge Saylor's MicroStrategy. mallers is challenging the strategic model by introducing BTC-specific indicators like Bitcoin per share (BPS), where investors are indirectly exposed to Bitcoin through MSTR stock.

Nevertheless, Lubka says unintended competition could bring positive results to Strategic.

"Ironically, someone throwing down the gauntlet and saying, 'We want want to be the most successful company in Bitcoin' makes MicroStrategy more valuable." Lubka mentioned.

TD Coitwan analysts view 21 Capital as the "meaningful most validation" oficroStrategy's Bitcoin-Bitcoin-centric financial strategy.

<."is point sentiment towards MSTR stock. This makes us increasingly optimistic." Cited by Matthew Sigel, head research of research Digital Assets Research.

these institutional giants stack Bitcoin and launch their own BTC investment vehicles to competeate with each other, liquidity is decreasing. Mallers-Aylor competition could could exponentially drive up prices by accelerating supply shortage.This is the reason for reconfirming the Bitcoin price target emphasized by Jeff Kendrick, head of of Digital Asset Research at Chartered in a recent US Crypto News> publication.<>

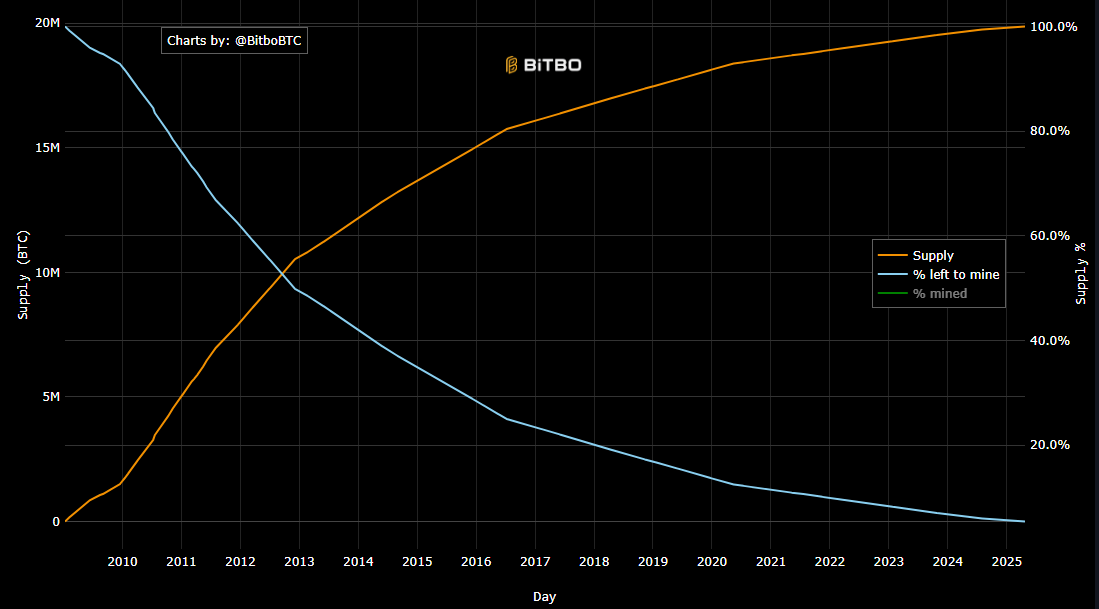

The number of Bitcoins in circulation continues to steadily increase, while the market price fluctuates, with demand and volatility rising sharply towards the end of the period.

This graph shows the total Bitcoin supply (orange line), the ratio of remaining Bitcoin mining volume (blue line), and the percentage of m(green line).

As Bitcoin approaches its total supply limit of of, the percentage of mincreases, the decretime.

This is emphasthat rate of newBitcissureleaseance decreases as as as Bitcoin is, a clear trend of near-complete supply around 2025.

Today's Key News

- According to on-chain analysts, dormant Bitcoin movement increased by 121% qin quarter 2025 compared to the first quarter of 2024.

- Canary Capital registered a legal trust in Delaware for a staked Sei (SEI) ETF, indicating the launch is one step closer.

- Kiloex plans to compensate victims with $7 resume operations.

- Charles Hoskinson claims that Cardano's original roadmap was completed in 2020, despite despite expansion issues with Li hydra and Leios.

- Bitcoin's divergdivergence from the dollar and Nasdaqano indicates a new role as as a safe asset amid global market changes.

- The ZKsync hacker agreed to the ZKsync Security Council's 10% bounty offer (about $5.7 million) returned 90% of the stolen funds.

- Over $ million flowed into Bitcoin ETFs on Wednesday, marking the fourth consecutive day of strong investor interest.

- Kraken's BNB listing indicates a a strategic changes US crypto exchanges, potentially suggesting broader broader token adoption.

| Company | Closing on April 23 | Pre-Market Overview |

| Strategy (MSTR) | $345.73 | $343.23 (-0.72%) |

| Coinbase Global (> | $194.80 | $193.06 (-0.89%) |

| Galaxyactic Digital Holdings (GLXY.TO) | $18.73 | $19.25 (+2.86%) |

| Marathon Holdings (MARA) | $14.13 | $13.94 (-1.34%) |

| Riot Platforms (RIOT) | $7.50 | $7.43 (-1.07%) |

| Core Scientific (CORZ) | $7.12 | $7.19 (+0.98%) |