XRP has been experiencing a recent downward trend, with altcoins falling below major support lines. However, it appears to be forming a bullish pattern for a potential breakout.

However, the overvaluation of XRP has reduced the likelihood of this breakout. As the altcoin's price surges, concerns about its sustainability are growing.

XRP Overvalued

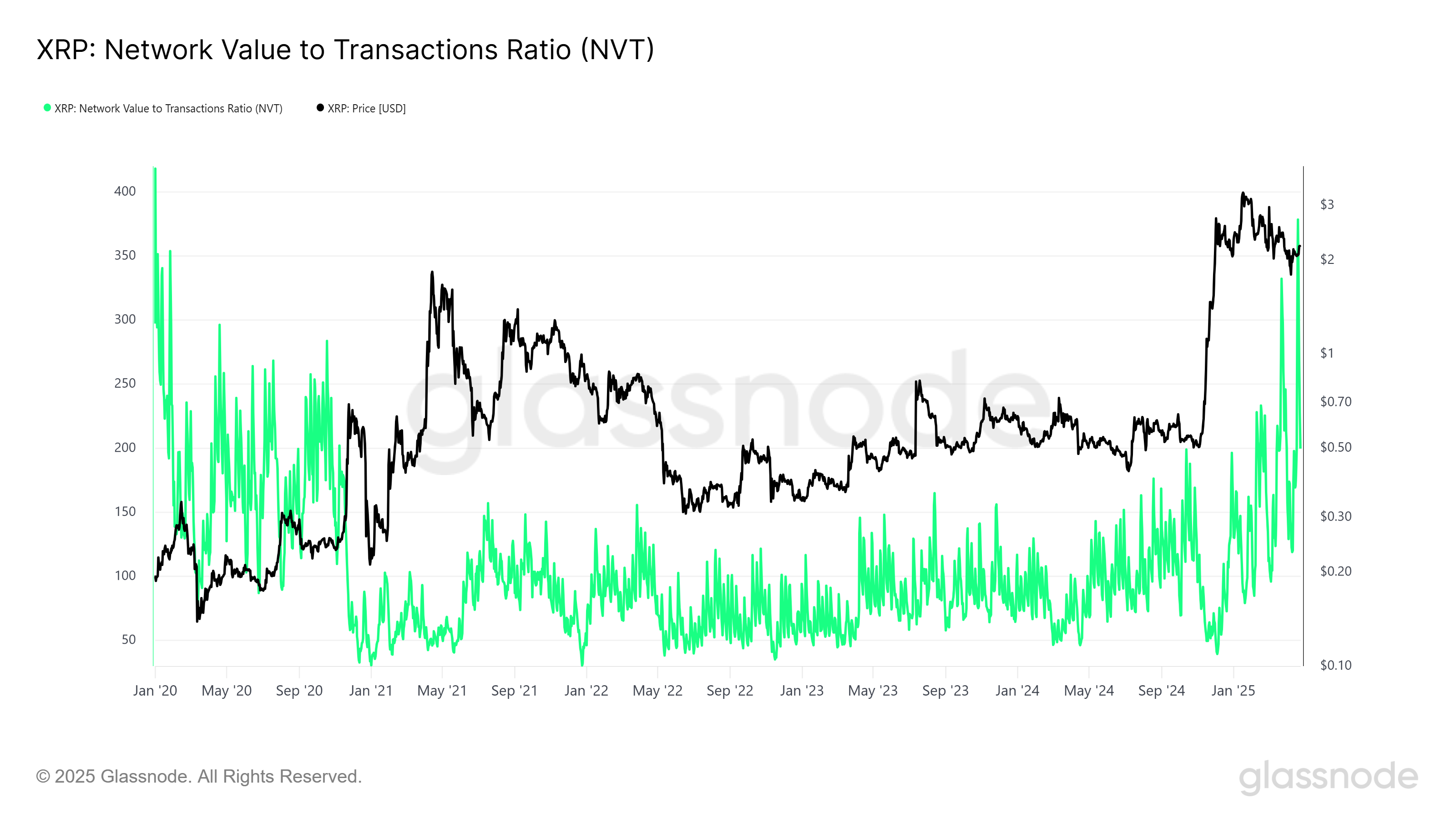

This week, XRP's Network Value to Transactions (NVT) ratio reached a 5-year high, indicating overvaluation. The NVT ratio is an important metric that compares a cryptocurrency's market capitalization to its trading volume. A sharp increase in the NVT ratio suggests that the network value is exceeding actual trading activity.

Historically, this situation has been associated with price corrections. The last time the NVT ratio reached a similar level was in January 2020, after which XRP experienced a significant price decline. The NVT surge indicates that the market is overheating and is expected to cool down.

Despite XRP rising by 22% over the past two weeks, technical indicators are painting a more concerning picture. The Chaikin Money Flow (CMF) indicator showed a significant surge indicating money flowing into the market. However, a closer look reveals a lack of substantial buying activity supporting the price increase.

Instead, high interest and speculation are driving the price surge, with these factors having a greater impact than genuine investor interest.

Considering these points, XRP's upward momentum is more likely to be a short-term anomaly rather than a sustainable uptrend. As the market cools and high interest fades, altcoins will struggle to maintain recent price levels. The overvaluation status remains a significant risk factor and could lead to a price correction.

XRP Price Faces Decline Signals

Currently, XRP is trading at $2.19, having risen 22% over the past two weeks. The altcoin appears to be preparing to break out of a three-month-old downtrend channel. However, the overvaluation status and broader market indicators suggest this uptrend may not be sustainable.

Considering potential downside factors, even if XRP successfully breaks out, the upward movement could be short-lived. If the breakout is not maintained, the price could retreat to $2.02 or potentially drop to $1.94. The combination of overvaluation and weak buying momentum could quickly reverse gains.

Conversely, if XRP can maintain the breakout, securing support levels at $2.40 and $2.56 could provide a crucial foundation for further price increases. Such a movement would invalidate the bearish outlook and allow XRP to rise higher.