Today, approximately $8.05 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are expiring, and cryptocurrency market participants are preparing for volatility.

Traders and investors should pay attention to today's option expiration, as it could potentially impact short-term trends due to high trading volume and nominal value. However, the put-call ratio and maximum pain point provide insights into the expected market direction.

Insights into Today's Expiring Bitcoin and Ethereum Options

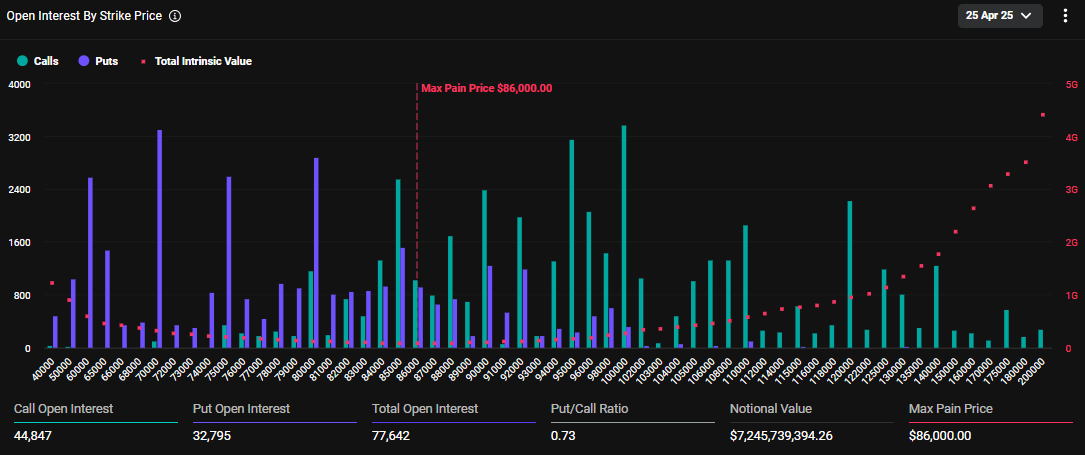

The nominal value of Bitcoin options expiring today is $7.24 billion. According to data from cryptocurrency derivatives exchange Deribit, the put-call ratio for these 77,642 expiring Bitcoin options is 0.73, indicating that call options are more prevalent than put options.

The data also shows that the maximum pain point for these expiring options is $86,000. In cryptocurrency options trading, the maximum pain point is the price that would cause the most financial loss to option holders.

In addition to Bitcoin options, 458,926 Ethereum option contracts are expiring today. The nominal value of these expiring options is $808.3 million, with a put-call ratio of 0.74 and a maximum pain point of $1,900.

The number of Ethereum options expiring today was significantly higher than last week. BeInCrypto previously reported that last week's expiring ETH options were 177,130 contracts, with a nominal value of $27.978 million.

At the time of writing, Bitcoin was trading at $93,471, well above the maximum pain level of $86,000. Meanwhile, Ethereum was trading at $1,764, below the strike price of $1,900.

"BTC is trading above the maximum pain level, while ETH is trading below. The positioning for expiration is not aligned," Deribit analysts noted.

The maximum pain level (also known as the strike price) can act like a magnet on price due to smart money behavior. Both Bitcoin and Ethereum could be pulled towards their respective levels.

The open interest positioning for BTC and ETH indicates high trader activity near the maximum pain level. Bitcoin has a concentrated histogram between $80,000 and $90,000, while Ethereum is between $1,800 and $2,000.

This positioning suggests the possibility of short-term price adjustment or volatility.

Polymarket: 16% Probability of Bitcoin Reaching $100,000 in April

According to Deribit, traders are selling cash-secured put options on Bitcoin and positioning themselves to potentially buy BTC at lower prices while collecting premiums using stablecoins. This reflects a long-term bullish outlook.

"Deribit's BTC traders are expressing a long-term bullish sentiment by selling cash-secured puts using stablecoins and potentially buying on dips to collect premiums," Deribit wrote.

Deribit analysts also note that the highest open interest for BTC options is around the $100,000 strike price, indicating a strong market expectation that Bitcoin will reach this level.

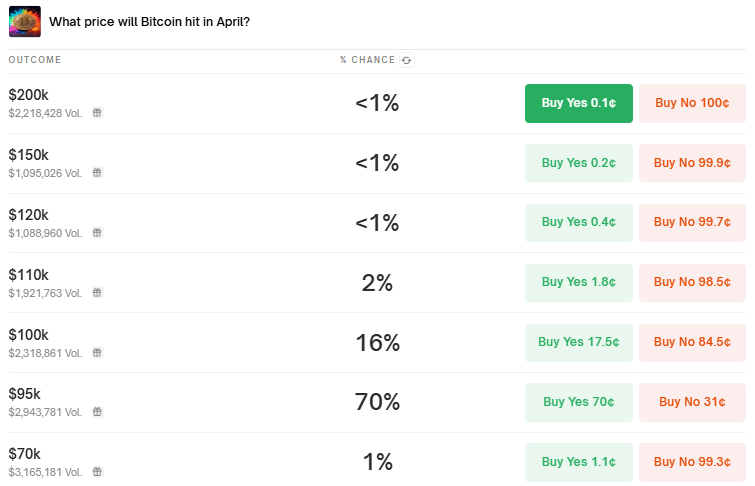

However, data from the Polymarket prediction platform shows that traders estimate a 16% probability of BTC reaching $100,000 in April.

Interestingly, the cumulative delta (CD) of Deribit's BTC and related ETF options has reached $9 billion, showing high sensitivity to Bitcoin price changes and suggesting potential volatility as market makers hedge their positions.

This aligns with cryptocurrency analyst Kyle Chase's statement that hedge funds are not betting on Bitcoin's long-term price appreciation. Instead, they are farming risk-free yields and using arbitrage. Once trading concludes, they withdraw liquidity, potentially intensifying Bitcoin's selling pressure.

Nevertheless, Deribit analysts revealed a surge in call option purchases for Bitcoin options expiring from April to June 2025. Investors are targeting strike prices between $90,000 and $110,000, inspired by Bitcoin's breakthrough above $89,000.

This suggests that bullish market sentiment was triggered by FOMO as BTC price exceeded $90,000. Analysts also emphasize that Trump's tariff policy withdrawal on April 9th had a market stabilizing effect. This action reduced global market volatility and promoted investment shifts from gold to cryptocurrency, contributing to Bitcoin's price recovery.

However, not all activities leading to Bitcoin's recovery were new funds or fresh capital inflows. According to Tony Stewart's analysis from Deribit, half of it included strategic adjustments to existing positions.