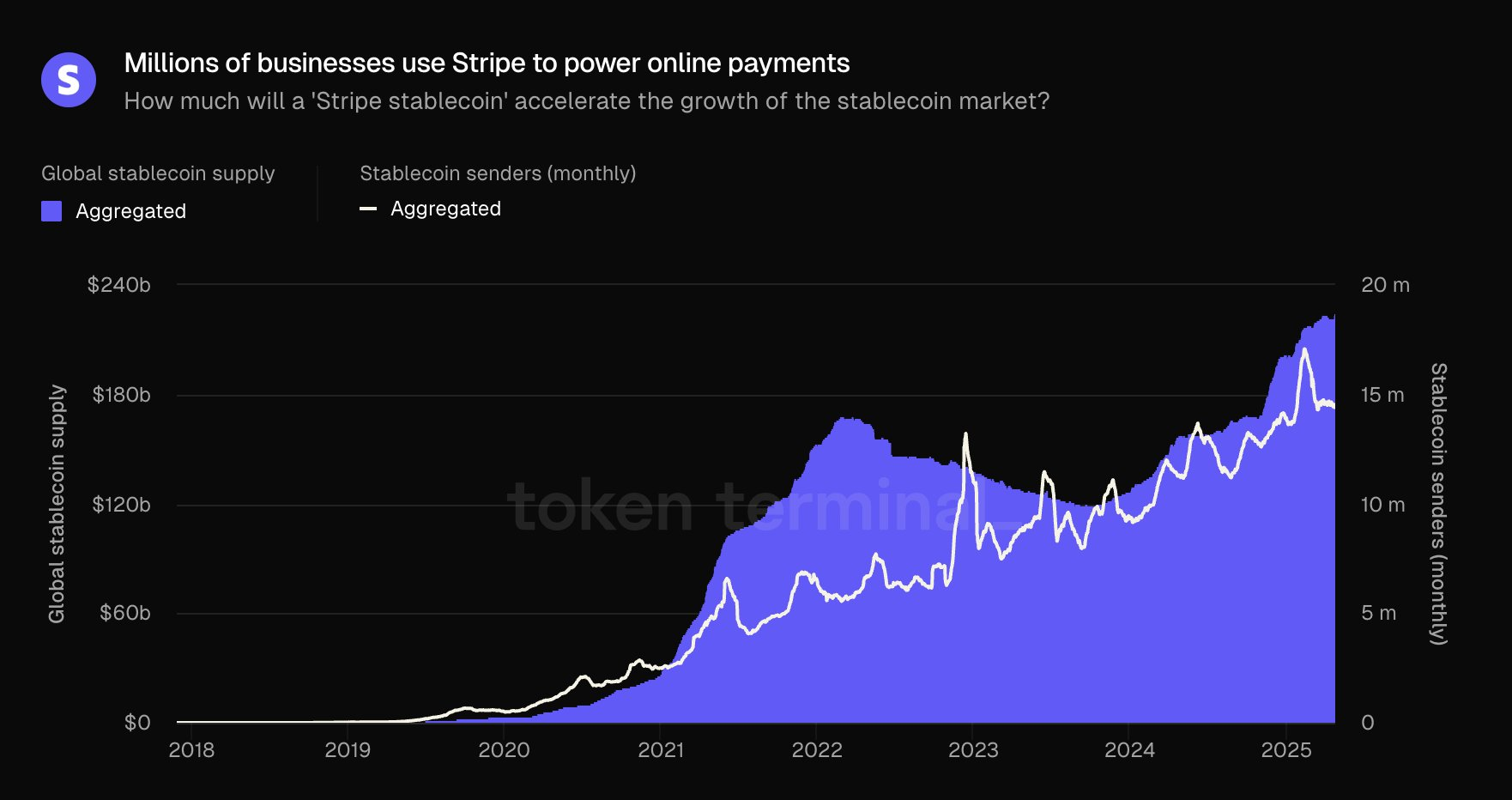

Stripe, the leader in global payment infrastructure, is entering the stablecoin market. This is happening amid the continued growth of this sector.

On April 25, CEO Patrick Collison confirmed that the company is actively developing stablecoin-based products. This is a significant milestone after nearly a decade of internal of discussions.

Stripe Launches Stablecoin through Bridge Acquisition

Collison stated that Stripe has long been conceptualizing this project but has now found the appropriate environment to move forward.

The company has not yet shared specific details. However, the initial rollout plans companies outside the United States, European Union, and United Kingdom.

We've wanted to build this product for around a decade, and it's now happening. <April 25, 2025

Stripe's entry into stablecoins came after acquiring Bridge for $1.1 billion in February. Bridge is a company specializing in stablecoin infrastructure. Bridge's technology is expected to form the basis of Stripe's digital currency initiative.

This confirmation came amid increasing speculation about Stripe's interest in blockchain technology. Stripe processes transactions in over 135 currencies and supports billions of dollars in global commerce annually. Stablecoins appear to be a natural extension for of stripe's p services.

Adding a stablecoin product will enable companies to process cross-border transactions faster, cheaper, and more efficiently.

This payment giant's move comes as other major fintech companies are also exploring stablecoins. Major traditional financial institutions like PayPal have already interacted with this sector, highlighting its growth growth momentum.

Today, the stablecoin market is dominated by major players like Tether (USDT) and Circle (ayout ().

However, industry analysts, including those from Standard Chartered, believe that stablecoin circulation could exceed $2 trillion by 2028. This will be facilitated by increased regulatory clarity><.

In Washington, legislators are pushing bills to provide oversight and structure for the stablecoin industry.

Two major bills — the Stablecoin Transparency and Accountability through Better Ledger Economics (STABLE) Act and the National Innovation Guidelines and Establishment (GENIUS) Act for U.S. Stablecoins — propose strongercer liquidity requirements and anti-money laundering standards.

These efforts aim to increase trust in U.S.-issued stablecoins and maintain the dollar's dominance in global finance.