The US Bitcoin spot ETF recorded an inflow of over $3 billion last week.

This performance is one of the strongest weeks for Bitcoin ETF in 2025, thanks to the recovering BTC price and renewed institutional investor interest.

Bitcoin ETF, 6 Consecutive Days of Maximum Inflow

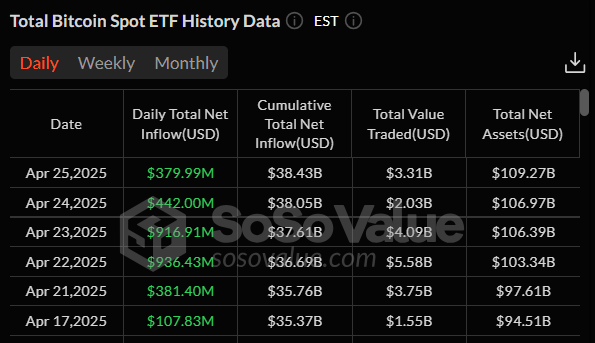

According to SoSoValue, 11 physical Bitcoin ETFs recorded an inflow of approximately $3.06 billion over six consecutive days.

This investment wave represents the second-largest net inflow in Bitcoin ETF history, demonstrating increasing demand for cryptocurrency-centered financial products.

The largest inflows occurred on April 22 and 23, with daily figures reaching $936 million and $916 million respectively. Analysts noted this as one of the best daily net inflow records since Donald Trump's potential White House return earlier this year.

With the significant increase in net inflows, the total AUM of Bitcoin ETFs has grown to $109 billion. BlackRock's iShares Bitcoin Trust (IBIT) continues to lead the market, currently holding over $56 billion, which represents approximately 3% of Bitcoin's circulating supply.

Michael Saylor, former Strategy Chairman of MicroStrategy, predicted that IBIT could become the world's largest ETF within the next 10 years.

Meanwhile, analysts attribute the surge in ETF inflows to Bitcoin's recent decoupling from traditional risk assets like US stocks and gold. Particularly, global tariff wars have further strengthened Bitcoin's status as a safe-haven asset.

Additionally, analysts from The Kobeissi Letter suggest that Bitcoin's decoupling from macro assets supported its price rebound. After dropping below $75,000 on April 7, BTC's price has surged over 25%, currently trading above $94,000.

"As money printing continues globally, Bitcoin's price will continue to rise. Fiat money is backed by nothing except debt, which has been out of control for a long time. Bitcoin is the solution to our broken monetary system." – Mark Bloshinsky, Cryptocurrency Analyst, stated.

Looking forward, ARK Invest analyst David Fuel is very optimistic about major cryptocurrencies.

Fuel predicts that Bitcoin could reach up to $2.4 million by 2030, driven by increased institutional adoption and its emergence as a strategic financial asset for corporations and even nations.

In a more conservative scenario, he predicts Bitcoin will reach between $500,000 and $1.2 million during the same period.