Bitcoin (BTC) remains below $94,000 and continues to be sensitive to US economic indicators. Therefore, this week's US economic data could cause volatility in the cryptocurrency market.

From consumer confidence to labor market strength, economic indicators can influence investment sentiment and shake cryptocurrency prices.

US Economic Data to Watch This Week

The following US economic indicators could impact the portfolios of cryptocurrency traders and investors.

"I will help you understand all the context: tariff confusion, declining consumer confidence, increased recession risk, market instability, and all the impacts the economy will have on your life," economist Justin Wolfers mentioned.

Consumer Confidence

The list of US economic indicators affecting cryptocurrencies this week begins with the consumer confidence report. On Tuesday, the April Conference Board Consumer Confidence Index will show whether households are optimistic about their financial situation.

The index of 92.9 in March indicated that US consumers have a relatively pessimistic outlook on the economy and their financial situation.

According to Marketwatch's data, the median forecast is 87.4. Strong confidence is often associated with risk-preference sentiment, which can promote investment in Bitcoin and altcoins.

Therefore, a lower-than-expected figure could trigger profit-taking and reduce confidence in the overall economic strength.

Amid global trade tensions, an unexpected decline could increase demand for Bitcoin as a safe asset, but volatility remains a risk factor.

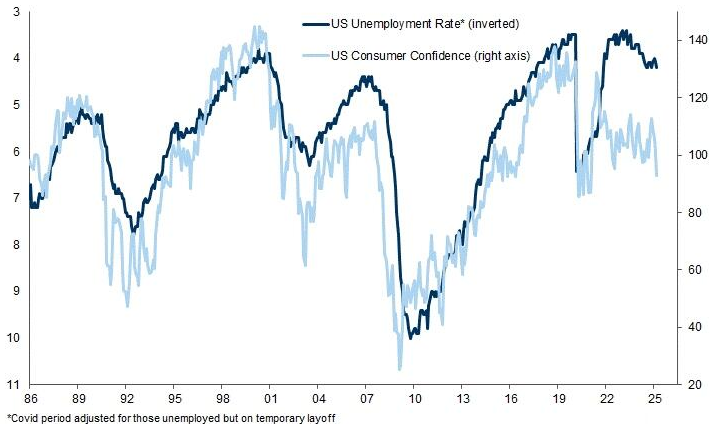

"Soft data suggests hard data is ready to decline. Consumer confidence can lead unemployment (inversion). If that's the case this time, we're looking at over 6%," Markets & Mayhem wrote.

JOLTS Job Openings

The Job Openings and Labor Turnover Survey (JOLTS) tracking demand is added to the list of US economic indicators this week.

The last JOLTS report, released on April 1st, covered February 2025 data. It reported 7.6 million job openings, 5.4 million hires, and 5.3 million total separations. The next JOLTS report for March 2025 will be released on Tuesday, with a median forecast of 7.4 million.

A rebound of over 7.6 million for cryptocurrencies would indicate economic resilience and could support risk assets like Bitcoin. Strong openings suggest hiring confidence and could increase disposable income for cryptocurrency investment.

However, a weaker-than-expected figure below the median forecast of 7.4 million could stimulate recession concerns. Such results would drive investors to use Bitcoin as a hedge.

The cryptocurrency market responds to labor market signals, which influence Federal Reserve (Fed) policy expectations. With interest rates at 4.25%–4.5%, a tight labor market could delay rate cuts and pressure speculative assets.

ADP Employment

The ADP National Employment Report tracking private sector job growth will be released on Wednesday. 155,000 jobs in March 2025 exceeded expectations, indicating labor market strength despite tariff concerns.

A strong figure over 160,000 for cryptocurrencies could generate bullish sentiment as job growth promotes consumer spending and risk preference. If employment data suggests economic expansion, Bitcoin could gain more upside potential.

However, a figure below March's 155,000 or the median forecast of 110,000 could raise recession concerns. This might drive investors towards safe assets like stablecoins or Bitcoin.

Unlike the Bureau of Labor Statistics' Non-Farm Payrolls (NFP), ADP's payroll-based methodology excludes government jobs. This methodology provides a more detailed perspective.

As the market watches Fed policy, ADP's results will set the tone for Friday's NFP.

Q1 GDP

The preliminary estimate for Q1 2025 GDP will be released on the 30th (Wednesday). This data measures economic growth.

Q3 2024 was 2.8% annualized, and Q4 was 2.4%. However, this year's GDP figures are expected to be somewhat lower due to surging import volumes caused by US tariff uncertainty.

A strong GDP growth over 3% in cryptocurrencies would indicate economic health, often causing Bitcoin to rise as investors take risks. However, this scenario is unlikely now. According to the Atlanta Fed's latest GDPnow data, Q1 GDP is expected to contract at an annualized rate of -2.4%. Excluding gold imports, it would be a -0.4% contraction.

With ongoing inflation concerns, if Q1 GDP growth falls lower than -0.4%, the Fed may have to prepare for a recession. This is why there are suggestions that weak growth could promote expectations of monetary easing.

PCE

The Fed's preferred inflation indicator is the Core Personal Consumption Expenditures (PCE) Price Index. This US economic indicator will cover March and is expected to be released on the 30th at night. It will be released after the March 28th data covering February.

In February 2025, the PCE index rose 2.5% year-on-year. Wall Street anticipates that the March PCE index will have increased by 2.2% year-on-year. If the PCE index for Bitcoin comes in below 2.5%, it could create a positive atmosphere for Bitcoin as inflation eases and expectations for interest rate cuts rise.

A figure above 2.5%, higher than expected, could strengthen Federal Reserve policy expectations. PCE provides a stable inflation perspective by excluding volatile food and energy prices, playing a crucial role in cryptocurrency sentiment.

As the market is sensitive to monetary policy changes, traders should monitor service expenditure reflecting consumer resilience. However, volatility is expected as PCE influences Federal Reserve rhetoric.

"The March PCE inflation (to be announced on Wednesday, April 30) should come in at 2.1% (rounded). The April PCE (to be announced at the end of May) should come in at 2.0% (rounded). Tariffs are an important factor, but this is the Federal Reserve's target measure. Honestly, it might be time to cut rates excluding political elements." Written by hedge fund manager Ophir Gottlieb.

New Unemployment Claims

The weekly unemployment claims reported every Thursday are added to the list of US economic indicators. This data measures weekly unemployment applications. The claims are a high-frequency indicator providing real-time labor market insights, and the cryptocurrency market often reacts quickly to surprising results.

Claims of 222,000 for the week ending April 18 indicated a stable labor market despite tariff confusion. Therefore, claims below 222,000 could suggest employment growth, creating risk-appetite sentiment and potentially driving Bitcoin up.

However, high claims above 222,000 could raise concerns about economic slowdown, potentially causing investors to move to stablecoins or Bitcoin for safety. As the Federal Reserve closely monitors labor data, an unexpected surge could spark speculation about rate cuts.

Non-Farm Payrolls

The Non-Farm Payrolls (NFP) report will be released on Friday. In March 2025, 228,000 job increases exceeded expectations, with the unemployment rate at 4.2%.

A strong NFP can drive upward momentum as job growth indicates consumer spending power. A weak report below the median prediction of 130,000 could trigger recession concerns, pushing Bitcoin as a hedge and stablecoins for stability.

NFP significantly impacts the market as it covers 80% of workers contributing to GDP. Wage growth will also be of interest. A monthly 0.3% increase could suggest inflation pressure, potentially limiting cryptocurrency rises.

As the market prices in Federal Reserve policy, surprising results could trigger sharp volatility.

According to BeInCrypto data, Bitcoin is currently trading at $94,154, up 0.29% in the past 24 hours.