Cryptocurrency inflows set another record last week, with trade disruptions and the impact on the dollar continuing to shake the market.

This signifies a reversal of the negative trend that continued for three consecutive weeks, with Bitcoin moving opposite to altcoins.

Cryptocurrency Product Inflows Reach $3.4 Billion Last Week

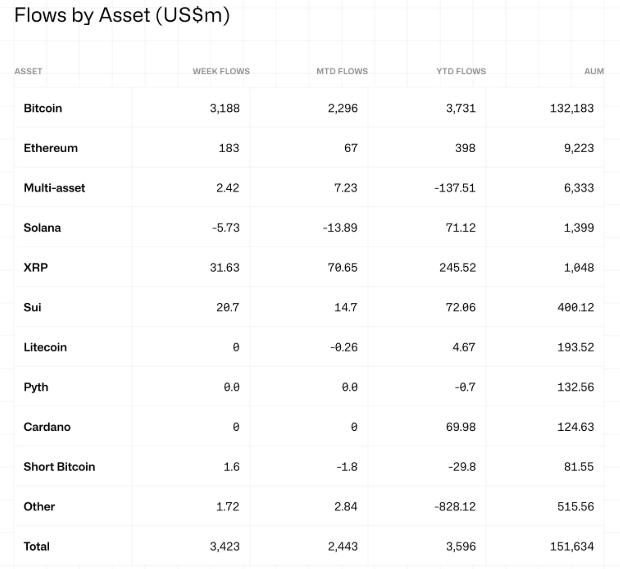

According to the latest CoinShares report, cryptocurrency inflows reached $3.4 billion last week, reversing the negative trend of three weeks.

Cryptocurrency outflows had reached $146 million the previous week. In the two weeks prior, outflows of $795 million and $240 million were recorded respectively.

James Butterfill, research head at CoinShares, praises the positive flow last week as the largest cryptocurrency inflow on record. He explains this dramatic reversal due to concerns about tariff impacts on corporate earnings and the cascading effect on the dollar.

"We believe the tariff impact on corporate earnings and the dramatic weakness of the dollar are the reasons investors are turning their eyes to digital assets." – James Butterfill, Research Head at CoinShares.

According to Butterfill, investors are increasingly considering cryptocurrencies other than Bitcoin as new safe-haven assets. However, Bitcoin investment products, the largest by market capitalization, were the main beneficiary, recording inflows of $3.188 billion.

According to the data, XRP outperformed other altcoins by reversing its trend last week. This aligns with the optimistic atmosphere surrounding the approval of ProShares' XRP futures ETF.

BeInCrypto reports that a spot XRP ETF could follow, potentially attracting $100 billion to Ripple's payment token.

"A spot XRP ETF could come next, potentially creating real demand and causing a price surge. Over $100 billion could soon flow into XRP." – Analyst Armando Pantoya.

Tariff Impact, Effects on Corporate Earnings and the Dollar

In a recent report, CoinShares explored the economic role of the US government and the Federal Reserve's position amidst the chaos.

Meanwhile, Donald Trump is pressuring the Federal Reserve to lower rates. However, the Federal Open Market Committee (FOMC) has refused additional rate cuts. The Fed has also significantly downgraded its 2025 economic outlook.

The Fed's actions suggest slowing growth and persistent inflation, while Trump's moves indicate a potential political battle over monetary policy.

"Is the US government controlling the economy? Is the Fed losing control?" – CoinShares.

The US dollar is taking a hit from this chaos. For example, BeInCrypto recently reported a declining DXY (Dollar Index) amid Trump's push to dismiss Fed Chair Jerome Powell.

Analysts also emphasize Bitcoin's transition from a risk asset to a hedge against monetary management failures. The chaos in the US economy, Q1 2025 GDP, and new tariffs have led to this result, with Bitcoin outperforming the Nasdaq-100 by 4.5% after tariff announcements.