Bitcoin (BTC) has slightly rebounded and recovered to the $94,000 range. The Arizona State House of Representatives passing the first BTC strategic reserve plan in the U.S. state positively influenced market sentiment. However, concerns about global economic slowdown continue to weigh on the market, making it difficult to break through the $95,000 resistance line.

According to the global virtual asset market site CoinMarketCap on the 29th, BTC was traded at $94,857.95 as of 8 a.m. This is a 0.93% increase from the previous day. At the same time, Ethereum (ETH), the leading altcoin, recorded $1,801.94, up 0.36%. XRP rose 1.71% and was traded at $2.301 per coin. Solana (SOL) dropped 0.47% to $148.05.

Related Articles

- Bitcoin 'Catching Its Breath' in the $93,000 Range... Ripple Rises Alone [Decenter Market Conditions]

- Bitcoin, Catching Its Breath... Exchange Holdings at 6-Year Low [Decenter Market Conditions]

- Bitcoin Gaining Momentum from Institutional Buying... Investor Sentiment Turns 'Greedy' in 3 Months [Decenter Market Conditions]

- Bitcoin Reclaims $90,000... Similar Flow to Gold [Decenter Market Conditions]

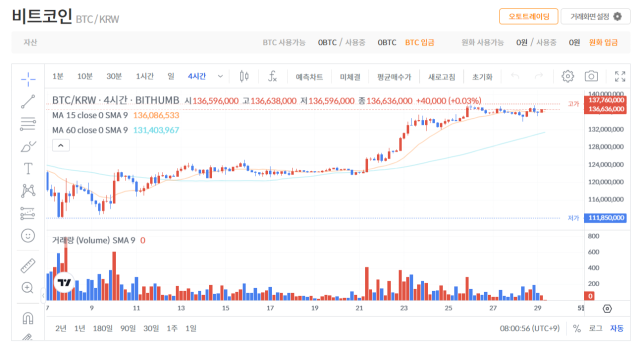

Major virtual asset prices also slightly increased on domestic exchanges. On Bithumb, BTC recorded 136,638,000 won, up 0.95% from the previous day. ETH rose 0.46% to 2,598,000 won, and XRP was trading at 3,316 won, up 1.78%.

The Arizona State House of Representatives passing the first U.S. BTC strategic reserve plan (SB1373, SB1025) drove the price increase. SB1373 involves creating a digital asset strategic reserve managed by the state treasurer. SB1025 allows public funds, such as pension funds, to invest in virtual assets.

However, BTC price is struggling to break through the $95,000 resistance line. BTC dropped by about $2,000 early in the day, falling to $93,500. This is due to the spread of risk-averse sentiment along with the decline in U.S. Treasury yields. Typically, when financial markets are unstable, bond buying increases, causing yields to fall.

A significant portion of BTC's upward momentum is also a burden, relying on Strategy's purchase of $428 million (about 6.15 trillion won). With Strategy reportedly having already used 97% of its approved common stock issuance, questions are being raised about the possibility of continued additional purchases.

Virtual asset investment sentiment has also calmed down. The Crypto Fear and Greed Index from alternative asset data analysis company Alternative.me dropped 7 points from the previous day to 54 points, transitioning to a 'neutral' state. This index indicates that the closer it is to 0, the more investment sentiment is suppressed, and the closer to 100, the more the market is overheated.

- Reporter Kim Jung-woo

- woo@sedaily.com

< Copyright ⓒ Decenter, Unauthorized Reproduction and Redistribution Prohibited >