In the past 24 hours, approximately $166.53M (about 243.1 billion won) worth of leveraged positions were liquidated in the cryptocurrency market.

According to the currently compiled data, short positions accounted for $107.2M, representing 64.37% of the total liquidations, while long positions were $59.33M, accounting for 35.63%.

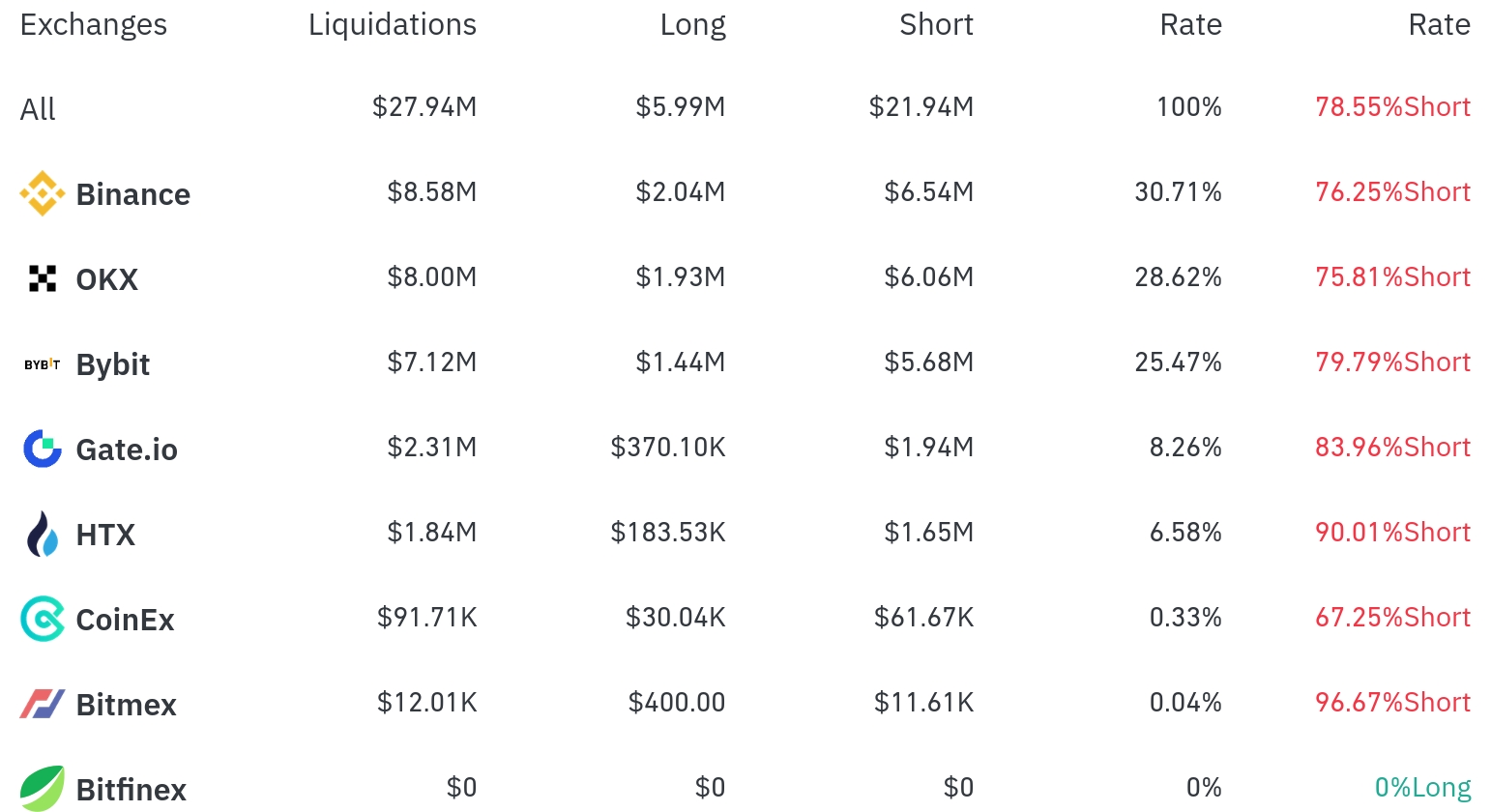

Binance had the highest position liquidations over the past 4 hours, with a total of $8.58M (30.71% of the total). Among these, short positions were $6.54M, accounting for 76.25%.

OKX was the second-highest exchange with liquidations, with $8.00M (28.62%) of positions liquidated, of which short positions were $6.06M (75.81%).

Bybit saw approximately $7.12M (25.47%) in liquidations, with a very high short position ratio of 79.79%.

Notably, short position liquidations were much higher than long positions across all exchanges, with HTX having the highest short position liquidation rate at 90.01%. BitMEX, despite small-scale liquidations, had short position liquidations reaching 96.67%.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $65.04M in Bitcoin positions were liquidated in 24 hours, with $6.45M liquidated in 4 hours. Particularly, BTC short position liquidations were $6.10M in 4 hours, overwhelmingly higher than long position liquidations of $350.88K.

Ethereum (ETH) had about $60.70M in positions liquidated in 24 hours, with $5.85M liquidated in 4 hours. ETH also showed higher short position liquidations ($4.44M) compared to long positions ($1.41M).

Solana (SOL) had approximately $13.49M liquidated in 24 hours, followed by SUI ($12.00M) and XRP ($10.51M) among other major altcoins.

Dogecoin (DOGE) experienced $7.78M in liquidations over 24 hours with a -1.87% price drop, and in 4 hours, 85.4% of the $502.45K liquidations were short positions.

Notably, the TRUMP Token saw more short position liquidations despite a -3.72% price drop, with a total of $4.95M in liquidations over 24 hours. Additionally, FARTCO Token had $4.31M in liquidations with a +2.65% price increase, and both PEPE and 1000PEPE saw significant liquidations with price increases of +1.03% and +1.05% respectively.

A notable point in this liquidation data is that most exchanges had overwhelmingly high short position liquidation rates, regardless of price movements. This suggests that market participants had many short position bets in the recent rising market, but contrary to expectations, prices did not fall or even rose, causing large-scale short squeezes.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>