Solana is making intensive efforts to recover from the losses it experienced over the past three months. Recently, this altcoin has been drawing attention due to the participation of long-term holders (LTH).

This support will help pave the way for Solana's full recovery next month.

Solana Investors Have Expectations

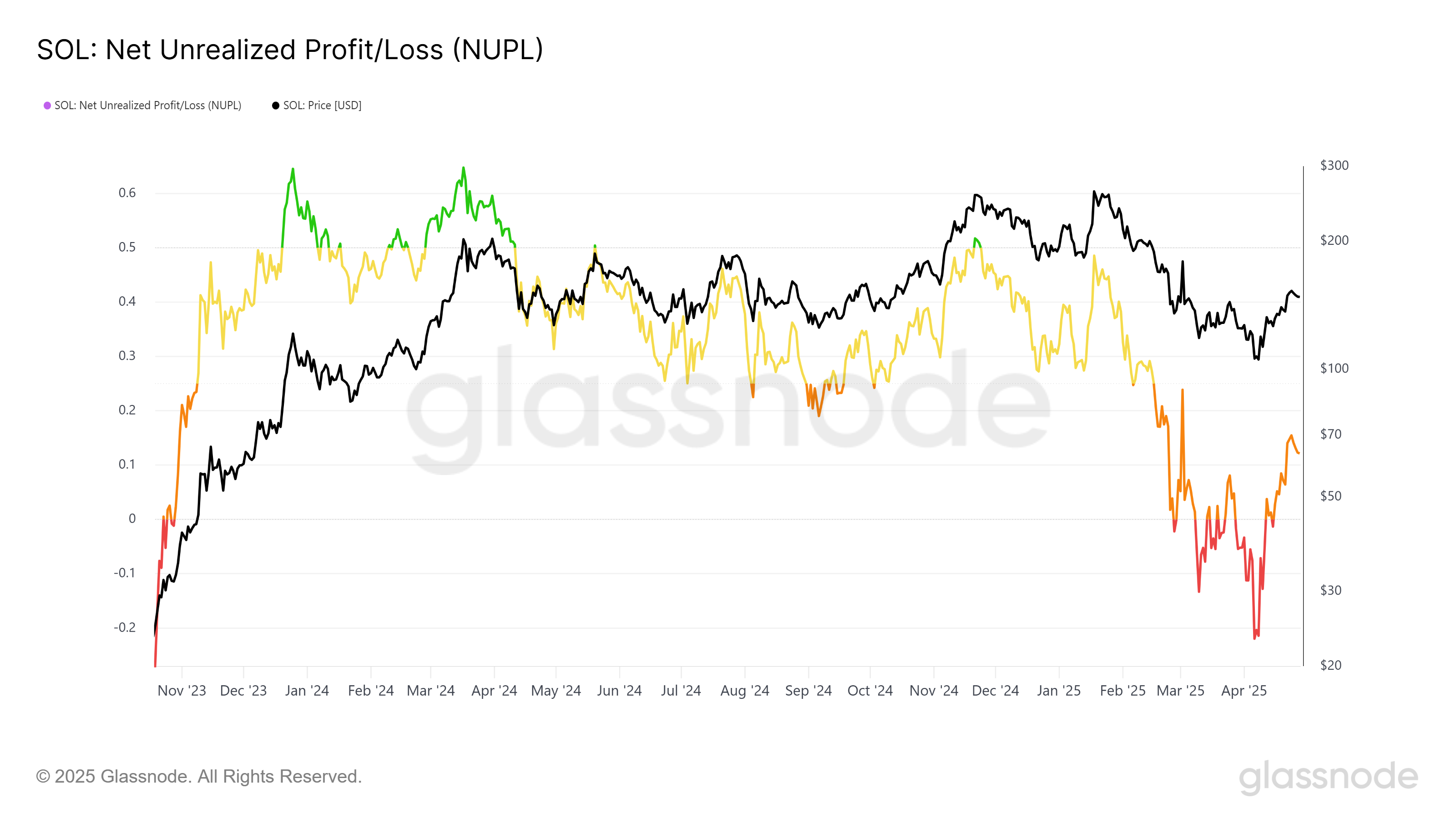

Currently, according to the Net Unrealized Profit/Loss (NUPL) indicator, Solana is in the "hope" zone. Historically, when Solana entered this zone, price increases often followed. The closer the indicator gets to 0.25 in the "optimism" zone, the more the price rose. While Solana is still far from this threshold, it can potentially rise with additional upward momentum.

Beyond the strong NUPL signal, Solana is receiving significant attention from institutional investors. This interest is further strengthening positive market sentiment as more institutional investors increase their exposure to Solana. This institutional confidence will contribute to Solana's continued positive price movement and support its recovery.

Recently, Canada approved the world's first spot SOL ETF. This is significant as it is something US investors have long demanded. However, Chris Chung, CEO and co-founder of Titan, mentioned in a discussion with BeInCrypto that its impact is limited.

"The approval of Canada's spot SOL ETF alone is not enough to support Solana's price, but it clearly signals that the institutional world is preparing for Solana. Especially considering that the Ontario Securities Commission (OSC) approved staking, which was a long-controversial issue. The SEC should now follow suit, which will have greater implications in terms of capital inflows," Chung said.

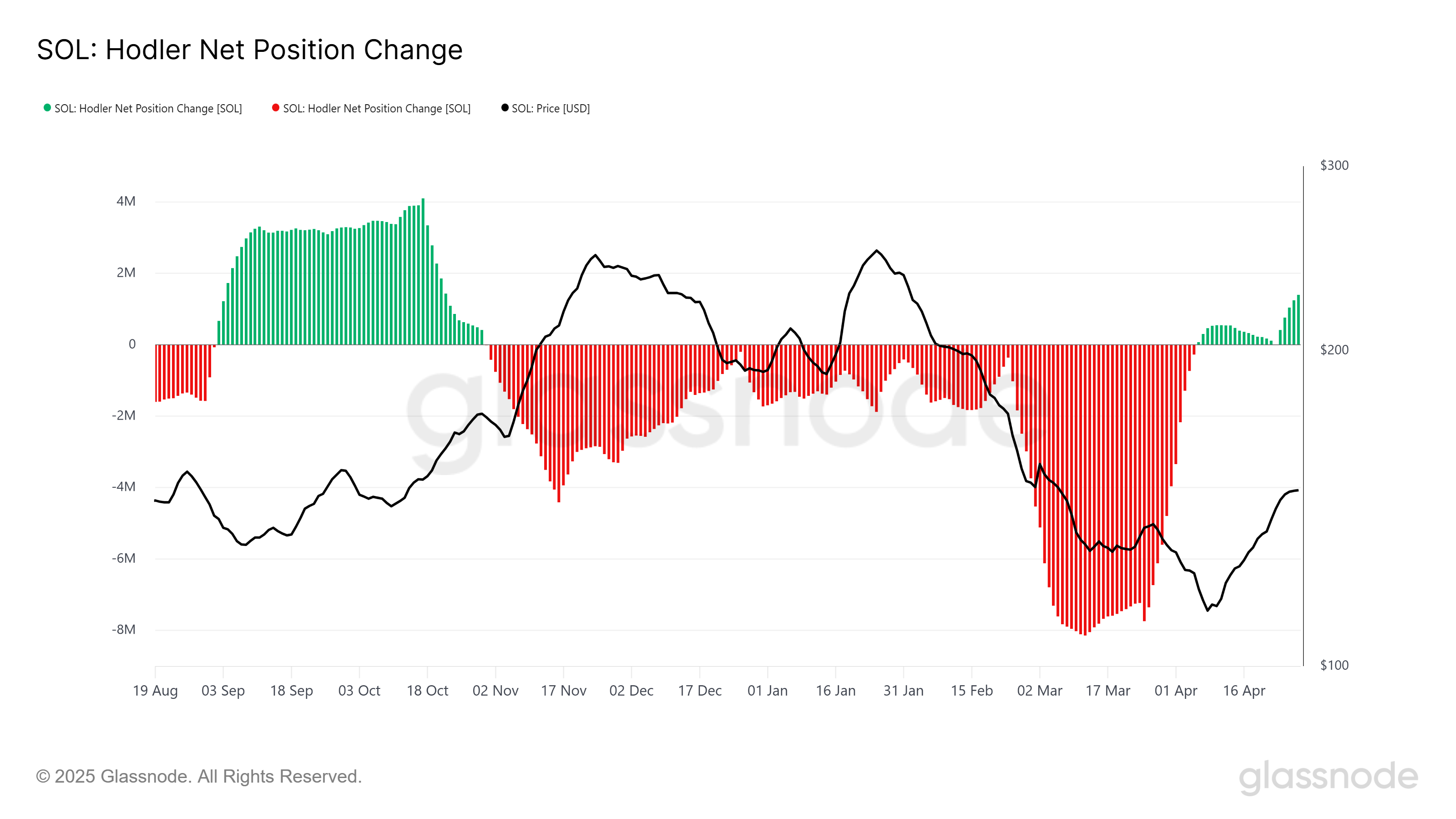

Therefore, Solana's macro momentum is also showing signs of improvement. HODLer net position change has recently surged. This surge indicates increasing accumulation by long-term holders (LTH), suggesting growing confidence in the asset. LTH accumulation represents confidence in Solana's long-term price appreciation, and the altcoin is likely to benefit from this continuous accumulation.

The fact that LTHs are increasingly maintaining their positions is a strong indicator of confidence in Solana's future. This trend can stabilize the price and support additional growth. LTHs typically have a strong influence on market direction. As more investors hold SOL tokens, the foundation for a continuous upward movement is being laid.

SOL Price, Expected Upward Trend

Solana's price has risen 41% this month, reaching $149 at the time of writing. The next major resistance is $180, and breaking this level would signify substantial recovery from March's losses. To reach $180, SOL needs to rise 21.8%, which seems achievable considering the current momentum.

If Solana successfully breaks through $180, it will be in a good position to maintain upward momentum. Continuous rise could help SOL recover February's losses and potentially push the price to $221. However, this price increase is likely to limit immediate additional gains with market saturation.

However, if investors decide to sell their holdings prematurely, Solana's price could take a significant hit. If it fails to break the $180 resistance level, the price could drop back to $123. This scenario could invalidate the current upward logic and halt recovery.