Welcome to the US Morning Cryptocurrency News Briefing. We will comprehensively summarize today's important cryptocurrency developments.

Check out expert opinions on Bitcoin's (BTC) future while enjoying your coffee. Meanwhile, gold is no longer the only investment destination during uncertain times.

Standard Chartered: Bitcoin to Reach $120,000 in the Next Bull Market?

According to recent US cryptocurrency news, Bitcoin's price is moving towards its descending wedge pattern target.

After overcoming resistance at 94,000, BTC is facing immediate resistance at 95,765. Breaking through this obstacle decisively could complete Bitcoin's predicted 20% rise, reaching 102,239.

This optimism emerges as Bitcoin rises as a potential beneficiary amid global trade tensions. US tariffs are triggering capital outflows and market volatility.

In this context, analysts are already predicting a major Bitcoin revaluation. They cite increased liquidity and global conditions, suggesting a move away from dollar-dependent assets.

BeInCrypto contacted Standard Chartered to gain insights into the current Bitcoin market outlook. Interestingly, the bank predicts a Bitcoin rally reflecting a surge after the US election, setting a Q2 price target of $120,000.

According to Jeff Kendrick, Head of Digital Assets Research at Standard Chartered, Bitcoin's price is preparing for a rally similar to the dramatic rise following the November 2024 US election.

The pioneering cryptocurrency recorded an all-time high of $103,713 last month.

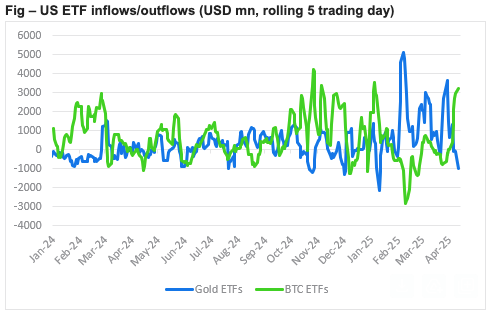

Kendrick specifically noted that in contrast to decreasing gold ETP inflows, US spot Bitcoin ETF inflows are accelerating.

"The gap between Bitcoin and gold ETF inflows was this wide last during the US election week," Kendrick told BeInCrypto.

According to Kendrick, Bitcoin is already catching up to gold as the cryptocurrency king, playing a better hedge role amid strategic asset reallocation in the US.

This aligns with recent US cryptocurrency news that emphasized Bitcoin as a hedge against traditional finance (TradFi) and US Treasury risks.

Accordingly, Standard Chartered executives maintain their Q2 bullish target for the largest digital asset by market capitalization.

"We expect a new all-time high of $120,000 in Q2, maintaining our year-end prediction of $200,000," Kendrick added.

In fact, Standard Chartered recently predicted Bitcoin will reach new all-time highs, forecasting $200,000 by 2025 and $500,000 by 2028.

Today's Chart

This chart compares investment flows for two financial products, Bitcoin ETF and gold ETP, showing higher investor interest and volatility in the former compared to the latter.

Today's Major News

- Over 85% of Bitcoin's circulating supply is currently profitable, indicating strong investor confidence and an upward trend.

- Billionaire Ray Dalio warns that the global monetary order is approaching collapse, triggered by tariffs and de-globalization trends.

- Tether's Q1 2025 report reveals that their tokenized gold product, XAUT is backed by over 7.7 tons of physical gold. As global economic uncertainty increases, XAUT's market capitalization has surged to $853.7 million, becoming the largest tokenized gold product.

- Bitcoin ETF records positive capital inflow for 7 consecutive days, with over $500 million in new capital added. Despite strong ETF demand, the Bitcoin futures market remains cautious, with an increasing preference for downside options.

- BNB Chain optimizes speed, reducing BSC's block time to 1.5 seconds and OpBNB to 0.5 seconds. Meanwhile, Ethereum's Fusaka is experiencing conflicts among developers.

- Experts warn that stablecoin transaction volume may be inflated by bots, wash trading, and flash loans, distorting actual usage.

- Virtual Protocol's native token, VIRTUAL surged 161% in a week, reaching a two-month high as AI agent activity increases.

Cryptocurrency Stock Pre-Market Overview

| Company | Closing on April 28 | Pre-Market Overview |

| Strategy (MSTR) | $369.25 | $370.47 (+0.33%) |

| Coinbase Global (COIN) | $205.27 | $206.79 (+0.74%) |

| Galaxy Digital Holdings (GLXY.TO) | $21.21 | $21.81 (+2.81%) |

| MARA Holdings (MARA) | $14.01 | $14.04 (+0.21%) |

| Riot Platform (RIOT) | $7.63 | $7.66 (+0.39%) |

| Core Scientific (CORZ) | $8.24 | $8.34 (+1.21%) |