Bitcoin (BTC) is gaining new momentum in May 2025, rising over 14% in the past 30 days and trading at a level 6.3% below the critical $100,000 mark. Behind the price movement is Bitcoin's apparent demand, which has turned positive for the first time since late February, indicating a change in on-chain behavior.

However, new inflows from US-based ETFs remain minimal compared to 2024 levels, suggesting that institutional confidence has not fully returned. According to Tracy Jin, COO of MEXC, if current conditions persist, a rally to $150,000 is possible during the summer, and market sentiment is becoming increasingly positive.

Increasing Bitcoin Demand... Lack of New Inflows

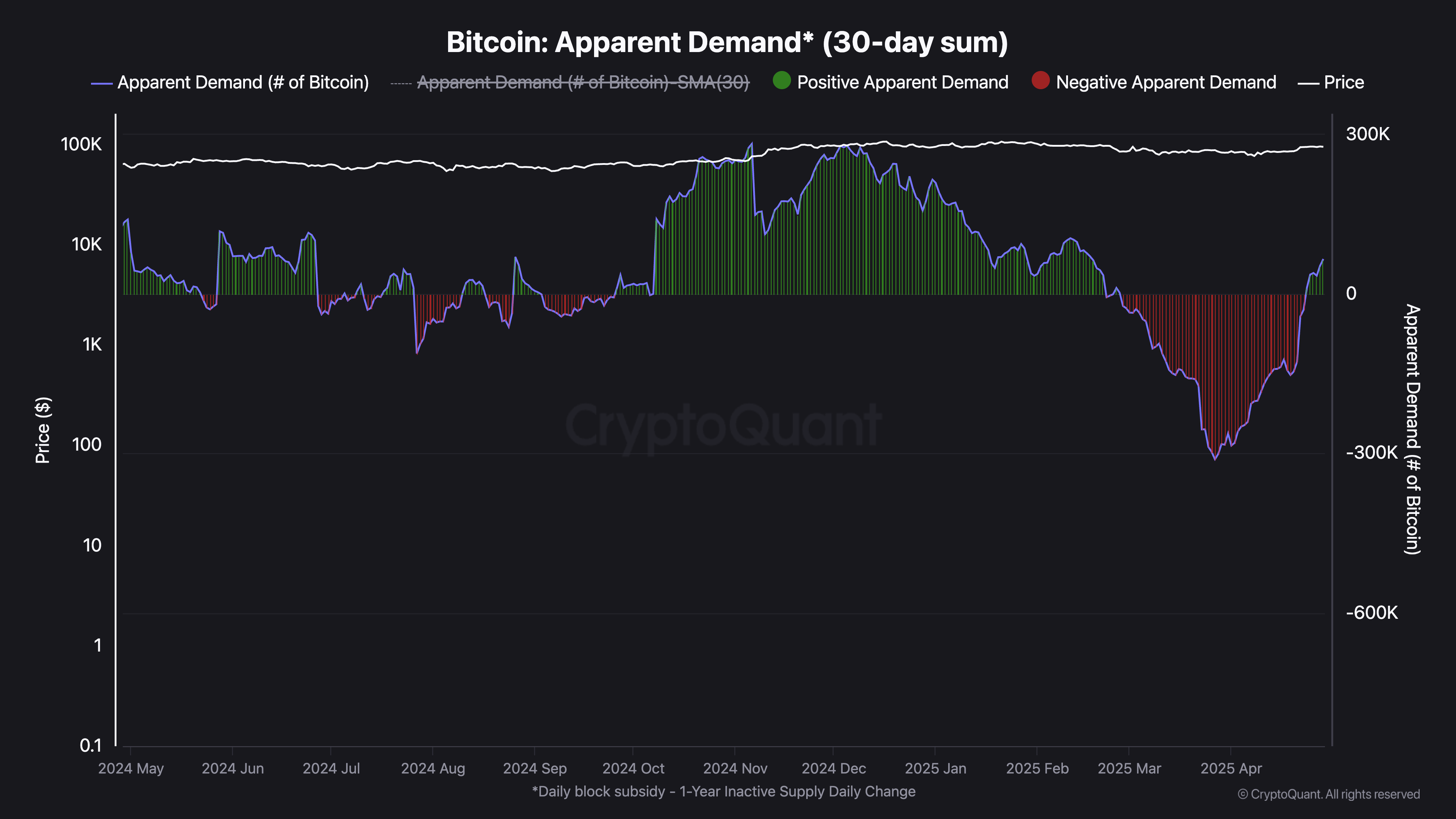

Bitcoin's apparent demand has shown a clear recovery signal, rising to 65,000 BTC over the past 30 days. This represents a sharp rebound from the March 27 low, when apparent demand, defined as the net 30-day change in holdings across all investor groups, reached a deeply negative level of -311,000 BTC.

Apparent demand reflects the aggregated balance changes between wallets, providing insights into whether capital is entering or leaving the Bitcoin network.

While current demand levels are still far below the early peaks of 2024, a crucial turning point occurred on April 24. Bitcoin's apparent demand turned positive and has maintained a positive state for six consecutive days after nearly two months of continuous outflows.

Despite these improvements, the overall demand momentum remains weak.

It suggests that recent accumulation is being driven by existing holders rather than new capital entering the market.

For Bitcoin to achieve a sustainable rally, apparent demand and demand momentum must show consistent and synchronized growth. Until that alignment occurs, the current stabilization may not support a strong or long-term price breakthrough.

US Spot Bitcoin ETF Inflows Far Below 2024 Levels

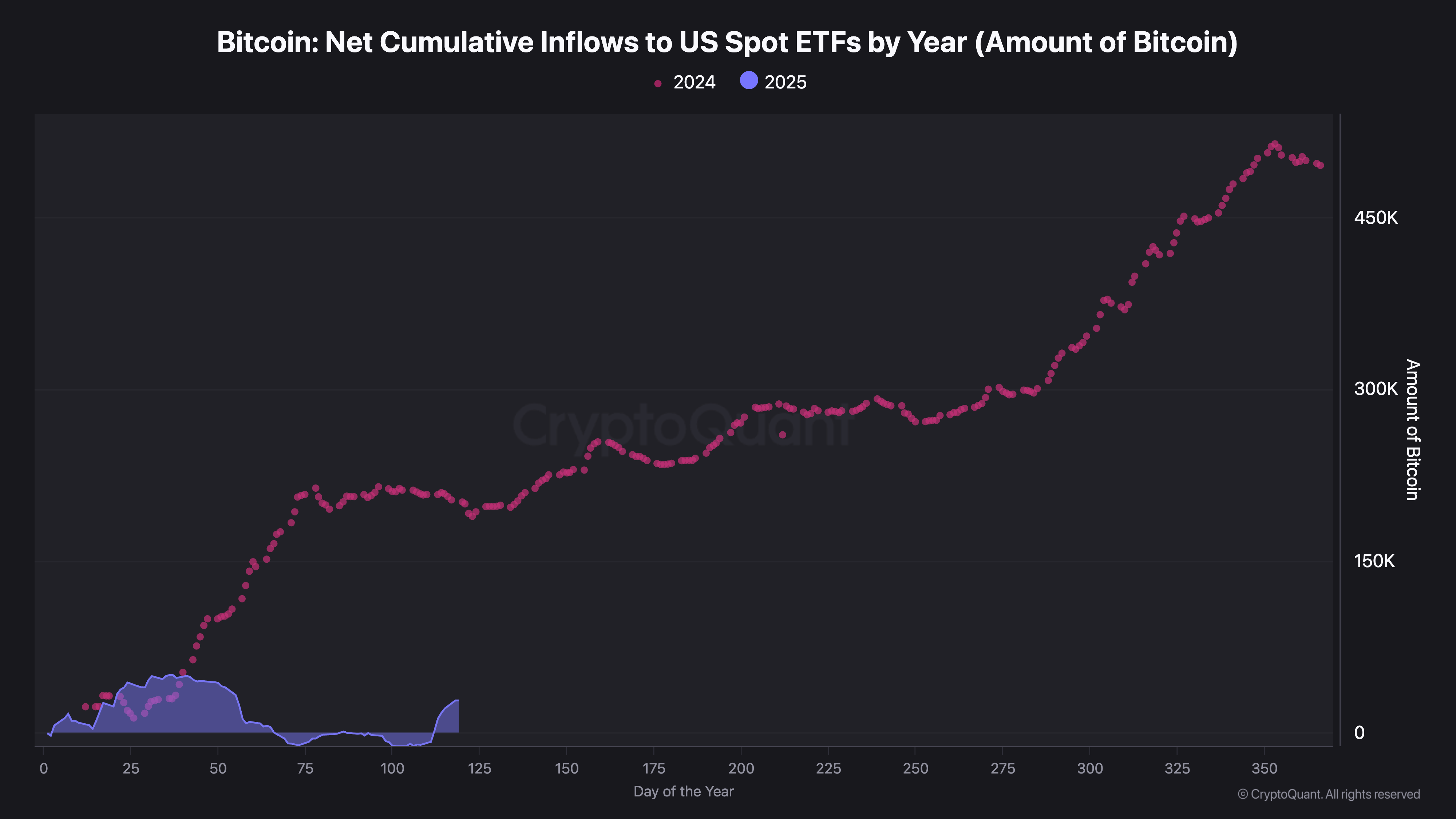

Bitcoin purchases by US-based ETFs have mostly remained flat since late March, with daily net flows fluctuating between -5,000 and +3,000 BTC.

This activity level stands in stark contrast to the strong inflows at the end of 2024, when daily purchases frequently exceeded 8,000 BTC, leading to Bitcoin's initial rally to $100,000.

So far in 2025, BTC ETFs have net purchased 28,000 BTC, which is significantly lower than the over 200,000 BTC purchased at this point last year.

This decline demonstrates a slowdown in institutional demand, which has historically driven major price movements.

There are initial signs of a slight rebound as ETF inflows have begun to increase recently. However, current levels are insufficient to drive a sustained upward trend.

ETF activity is often considered an indicator of institutional confidence, and a notable increase in purchases would again demonstrate trust in Bitcoin's medium-term trajectory.

Until such inflows strongly return, the broader market may struggle to generate momentum for a long-term rally.

Bitcoin Approaches $100,000 Despite Macroeconomic Pressure

Bitcoin price has risen over 14% in the past 30 days, strongly rebounding after falling below $75,000 in April.

This new momentum emerged as BTC showed relative resilience amid broader macroeconomic volatility and policy-driven pressures, including Trump's tariff measures weighing on risk assets.

While the entire cryptocurrency market was impacted, Bitcoin appeared less sensitive to external shocks compared to other digital assets, showing a somewhat isolated performance.

BTC is currently 6.3% below the $100,000 mark, with less than 17% difference from a potential move to $111,000. According to Tracy Jin, COO of MEXC, market sentiment is turning positive again:

"Beyond immediate price movements, increasing institutional demand and reduced supply mechanisms against the backdrop of macroeconomic uncertainties point to a structural change in Bitcoin's role in the global financial market. BTC is used as a hedge against inflation and fiat currency-based financial models. Its liquidity, scalability, programmability, and global accessibility provide many companies with a reliable modern alternative to traditional financial instruments," Jin said.

According to Jin, a summer rally to $150,000 is possible. She emphasized that the $95,000 range could be the starting point for a decisive breakthrough above $100,000 within a few days.

"If global trade tensions stabilize and institutional accumulation continues, a summer rally to $150,000 is possible, potentially extending to $200,000 by 2026. Overall, the external background is favorable for continued upward movement, especially with Friday's index growth potentially supporting Bitcoin over the weekend," – Jin