In the past 24 hours, approximately $164.47 million (about 24 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, long positions accounted for $99.57 million, representing 60.5% of the total liquidated positions, while short positions were $64.90 million, accounting for 39.5%.

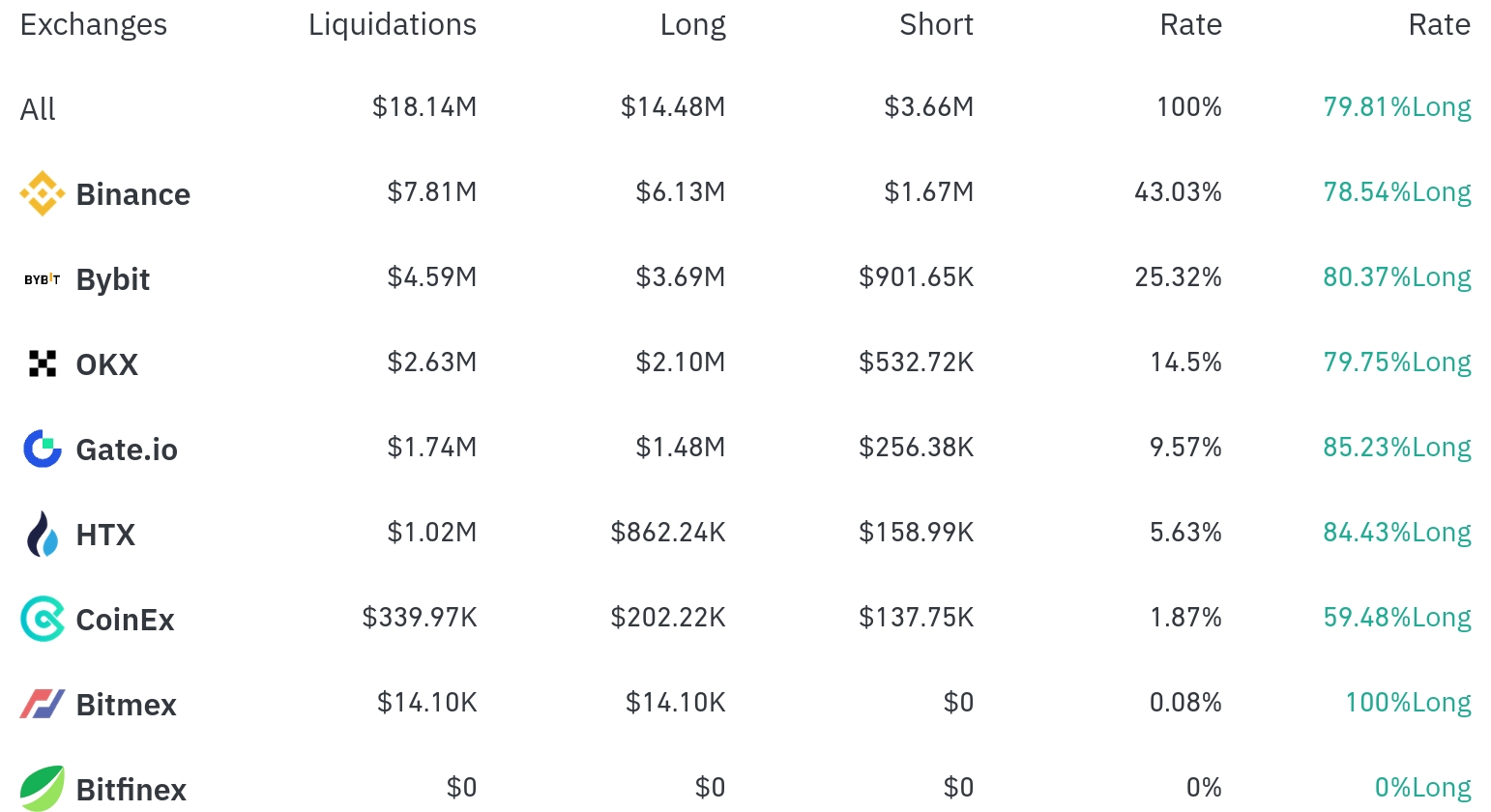

Binance experienced the most position liquidations in the past 4 hours, with a total of $7.81 million (43.03%) liquidated. Among this, long positions accounted for $6.13 million, or 78.54%.

Bybit was the second-highest exchange with liquidations, with $4.59 million (25.32%) of positions liquidated, of which long positions comprised $3.69 million (80.37%).

OKX saw approximately $2.63 million (14.5%) in liquidations, with long positions at 79.75%. Gate.io had $1.74 million (9.57%), and HTX had $1.02 million (5.63%) in liquidations.

Notably, BitMEX experienced $14,000 in liquidations, all of which were long positions.

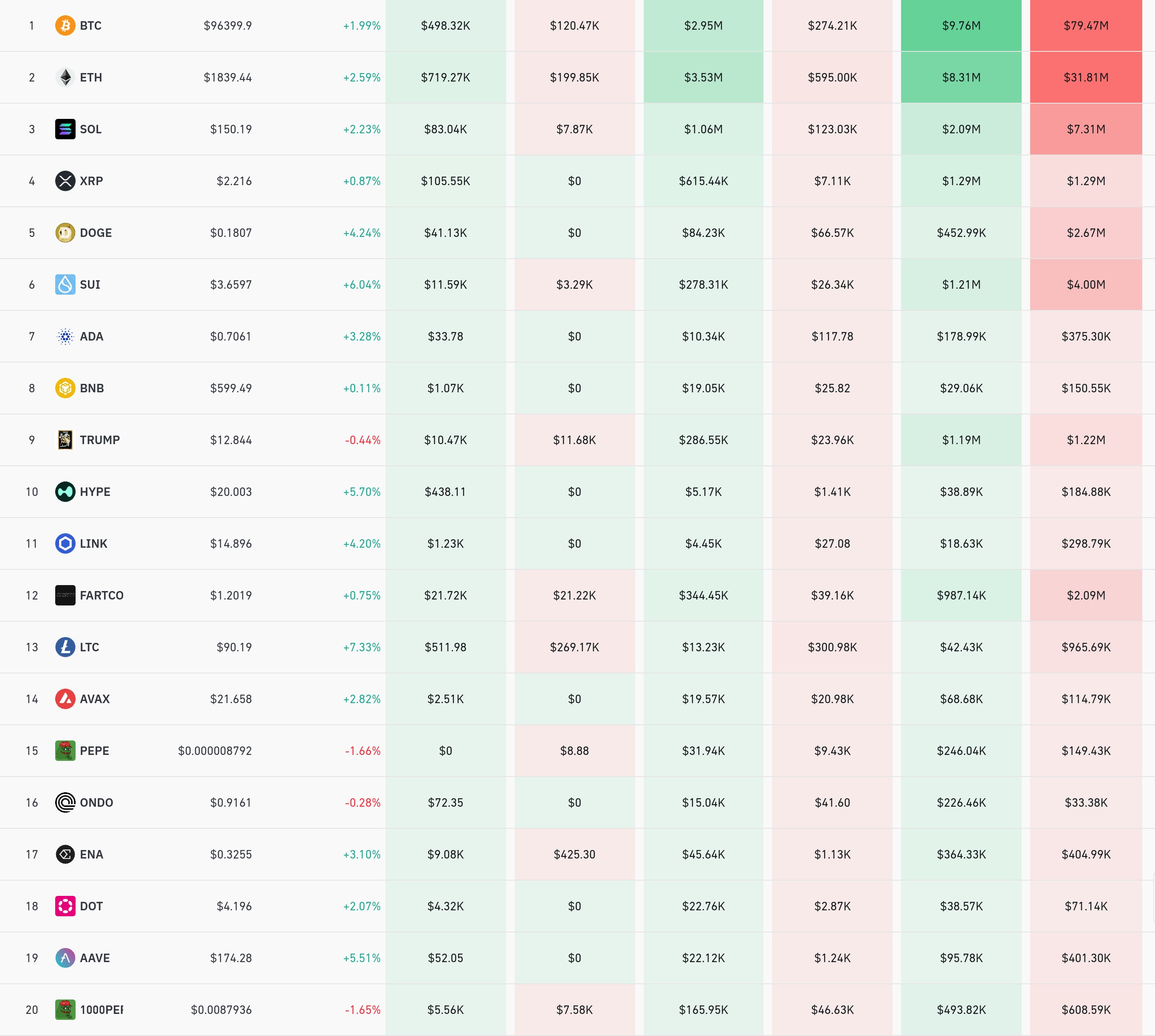

Bitcoin (BTC) had the most liquidated positions. Approximately $89.23 million in Bitcoin positions were liquidated in 24 hours, with $2.95 million in long positions and $274,000 in short positions liquidated in 4 hours.

Ethereum (ETH) saw about $40.12 million in positions liquidated in 24 hours, with $3.53 million in long positions and $595,000 in short positions liquidated in 4 hours.

Solana (SOL) had approximately $9.41 million liquidated in 24 hours, while Sui showed a recent 6.04% increase and experienced $5.21 million in liquidations over 24 hours.

Doge, showing a 4.24% price increase, had about $3.13 million in liquidations over 24 hours.

Notably, the TRUMP Token saw a slight decline (-0.44%) with approximately $2.41 million in liquidations over 24 hours, and FARTCO experienced substantial liquidations of $3.07 million despite a slight increase of 0.75%.

Additionally, the 1000PEI Token declined by 1.65% with over $1.10 million in liquidations over 24 hours, with long and short positions liquidated at similar rates.

In the cryptocurrency market, 'liquidation' refers to the forced closure of a leverage position when a trader fails to meet margin requirements. The current market is generally showing an upward trend, with Bitcoin rising 1.99%, Ethereum 2.59%, and Litecoin (LTC) recording a high increase of 7.33%.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>