SUI and Solana are attracting attention due to recent changes in institutional interest. Over the past few weeks, SUI has emerged as one of the top assets for institutional inflows, surpassing Solana.

Now the question arises: Is this a temporary trend, or are institutions viewing SUI as a promising next-generation blockchain platform?

Sui Overtakes Solana

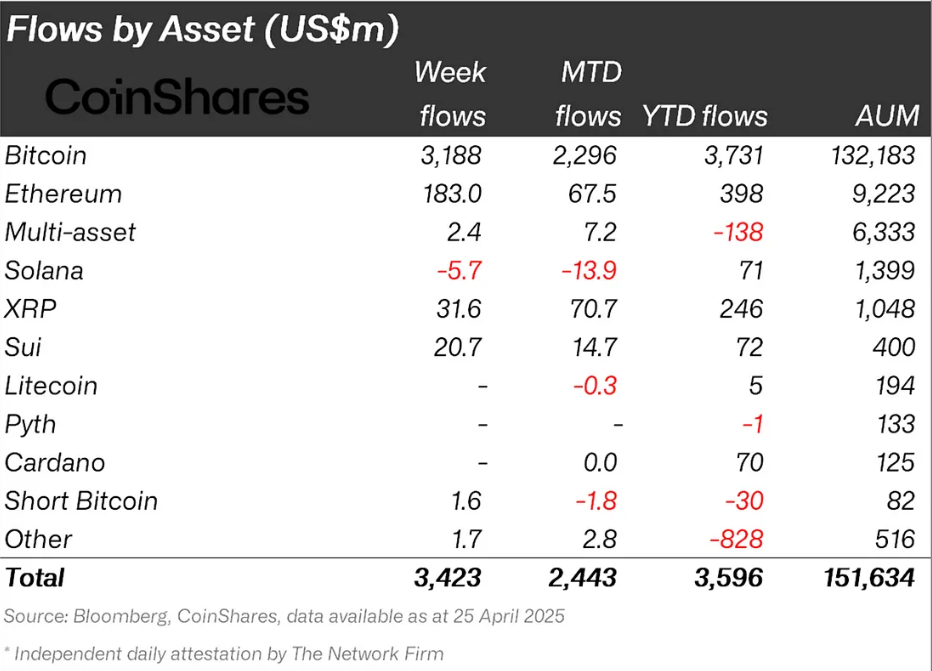

April was a crucial turning point for SUI. SUI overtook Solana in terms of institutional inflows. SUI recorded $14.7 million in inflows. In contrast, Solana experienced $13.9 million in outflows during the same period.

From the beginning of the year until now, SUI has been in fierce competition with Solana, with $72 million in inflows. This change in investor sentiment could indicate a broader market shift, suggesting that institutions are showing a preference for SUI over the well-known Solana.

This trend is particularly interesting when considering the performance of both assets. Solana has long been considered a strong player in the blockchain field. However, SUI's recent rise suggests that investors are diversifying across major platforms.

Juan Felisert, Chief Research Analyst at Into the Block, shared a similar perspective in an interview with BeInCrypto.

"Institutions are diversifying rather than replacing Solana with SUI. 60% of Solana's outflows moved to SUI, driven by growth potential and new technology. However, Solana's $73 billion market cap, established ecosystem, and strong ETF momentum continue to maintain its major position, complementing SUI's role," Felisert told BeInCrypto.

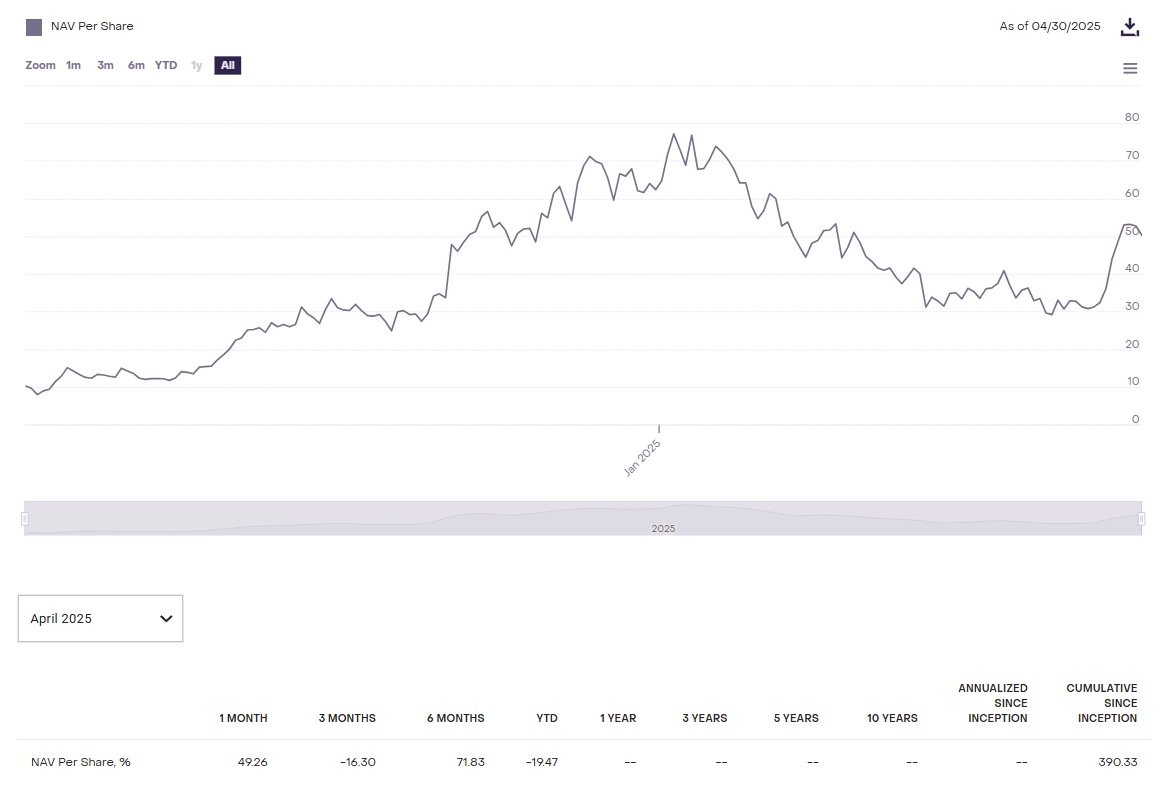

It's worth considering the macro momentum of both assets, especially when comparing the Grayscale Trusts of SUI (SUIFUND) and Solana (GSOL). Over the past six months, Grayscale's SUI Trust net asset value (NAV) showed a positive change of 71.8%, while Solana's NAV remained unchanged.

This notable performance difference highlights the difference in demand for these tokens and its impact on related investment vehicles.

Additionally, CBOE recently applied to the SEC for Canary Capital's SUI ETF. However, Felisert believes this is unlikely to happen soon.

"A SUI ETF is less likely to be approved before the Solana ETF. Solana's June 2024 application, $73 billion market cap, and support from major companies like Fidelity prioritize a mid-2025 decision. SUI's March 2025 application and smaller market presence may be delayed due to its new status and past allegations, but a crypto-friendly SEC could enable approval faster than expected."

SUI vs Solana Price Performance

SUI and Solana have both seen price declines year-to-date. SUI decreased by 14%, while Solana dropped by 19%. However, April was a crucial turning point for both tokens. SUI rose by 56.6%, trading at $3.54, while Solana increased by 21%, reaching $151.

Despite April's growth, the difference in market capitalization between the two assets should be noted. Solana's $11 billion market cap growth was equal to SUI's entire market cap. This difference in market cap growth indicates that while SUI's rise is impressive, Solana's larger market cap provides a more established position in the market.

However, SUI's strong performance in April highlights a shift in interest driven by more scalable chains and growing partnerships. This trend could drive further growth for SUI in the second and third quarters. Nevertheless, SUI is still far from overtaking Solana as the preferred institutional asset.