In the past 24 hours, approximately $147.13 million (about 215 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, long positions accounted for about 54.94% of the liquidated positions, while short positions recorded about 45.06%. This indicates a relatively balanced liquidation as the market recently turned bullish, with a notably high short position liquidation rate.

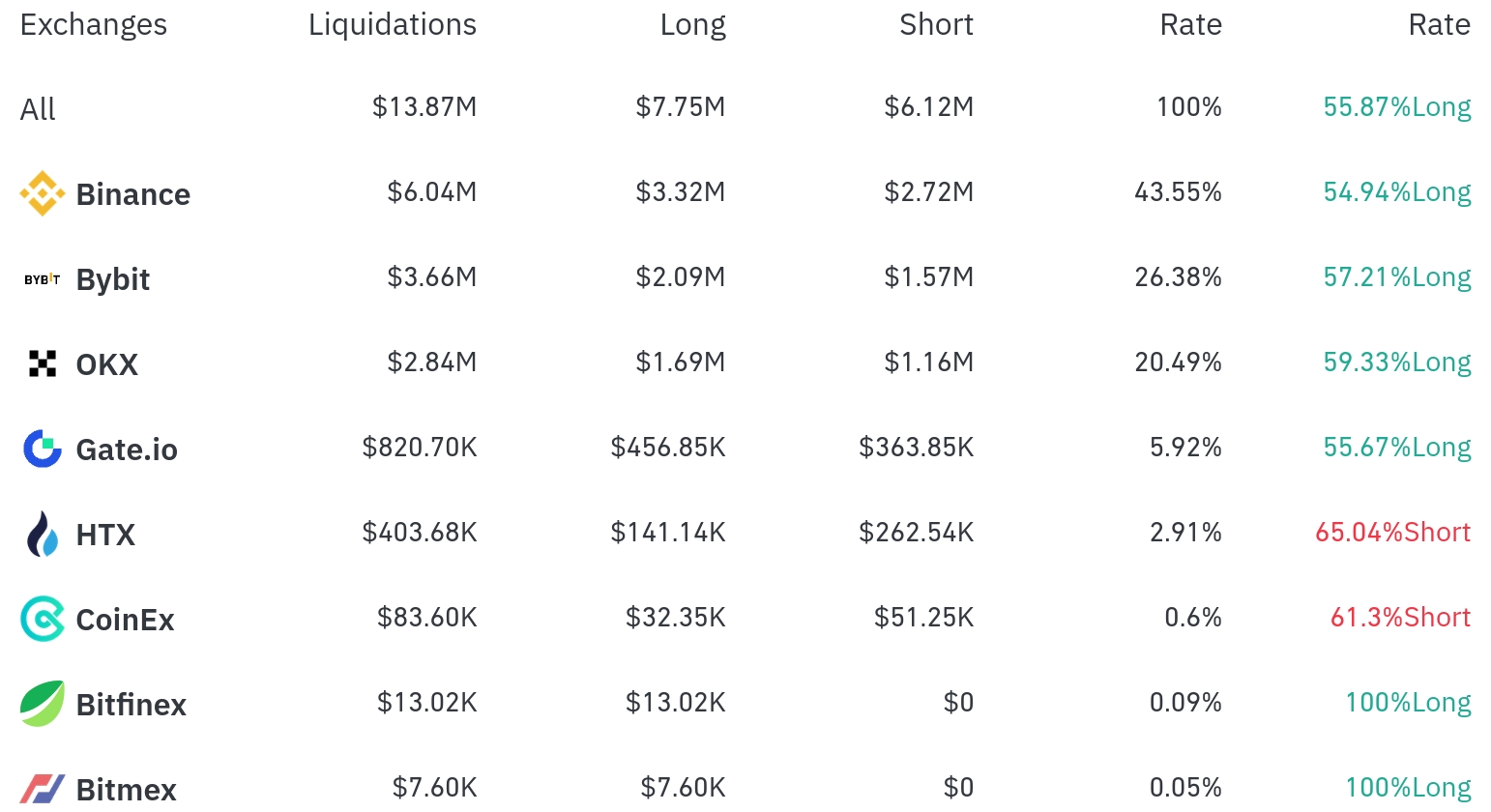

Binance experienced the most position liquidations in the past 4 hours, with a total of $6.04 million (43.55% of the total) liquidated. Among these, long positions accounted for $3.32 million, representing 54.94%.

ByBit was the second-highest exchange with $3.66 million (26.38%) of positions liquidated, with long positions making up $2.09 million (57.21%).

OKX saw approximately $2.84 million (20.49%) in liquidations, with long positions at 59.33%.

Notably, HTX and CoinEx showed higher short position liquidation rates of 65.04% and 61.3%, respectively, compared to long positions. This is analyzed as being influenced by the rebound in some altcoin markets.

By coin, Bitcoin (BTC) had the most liquidated positions. Approximately $89.05 million in Bitcoin positions were liquidated in 24 hours, with $2.1 million in long positions and $8.28 million in short positions liquidated in the past 4 hours. This appears to be due to short position investors being impacted as Bitcoin price rose by +2.12%.

Ethereum (ETH) saw about $39.6 million in positions liquidated in 24 hours, with $8.72 million in short positions liquidated in 4 hours. Ethereum also showed prominent short position liquidations with a +1.75% price increase.

Solana (SOL) had approximately $7.54 million liquidated in 24 hours, and Litecoin (LTC) experienced significant short position liquidations with a strong +5.52% price increase.

Dogecoin (DOGE) saw $2.18 million in short positions liquidated in 4 hours with a +3.87% price increase, and $2.86 million in liquidations over 24 hours.

Notably, the TRUMP Token experienced $51.8 million in long position liquidations in 4 hours with a -4.64% price drop, while FARTCO (-4.87%) and ENA (-4.58%) tokens also saw substantial long position liquidations alongside significant price declines.

The SUI Token had $6.06 million in positions liquidated over 24 hours, with $6.84 million in long positions liquidated in just 4 hours, requiring investor caution.

In the cryptocurrency market, Bitcoin has surpassed $96,000 and Ethereum has recovered to $1,840, showing an overall market uptrend, but some altcoins and meme coins are experiencing high volatility. Investors should exercise caution with leverage investments given the current market conditions.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>