This week in the cryptocurrency sector, there were interesting developments across various ecosystems. The main highlights were focused on the BTC and XRP ecosystems.

If you missed it, here's a summary of the key cryptocurrency stories this week.

Bitcoin Tests $97,000 Level

Let's start the list of events in cryptocurrency this week. Bitcoin tested $97,000 for the first time since February 2025.

The pioneering cryptocurrency showed significant volatility over the past weeks and months. It withstood Trump's tariffs. From temporary interruptions and retaliation to rumors of tension easing, trade confusion exacerbated volatility.

However, amid this uncertainty, Bitcoin emerged as a hedge against traditional finance (TradFi) and U.S. Treasury risks. Institutional interest in BTC also increased. Bitcoin ETFs saw increased inflows, while gold ETPs lagged behind.

Sui Discusses Pokemon Collaboration

Another major highlight this week was speculation about potential collaboration between the Sui Blockchain and Pokemon. Amid these discussions, the SUI price surged over 60% during the week.

These rumors were triggered when Parasol Technologies, LLC appeared as a new developer in the Pokemon HOME privacy policy update. Parasol Technologies is a Web3 gaming infrastructure company acquired by Mysten Labs, Sui's developer, in March 2025.

However, a change in one of the distribution documents calmed the speculation and clarified the major driver of SUI price this week.

"The official Sui Foundation blog confirmed and removed Pokemon NFTs. They seem to be developing cloud infrastructure using blockchain technology to address bugs, hacking, duplications, and enable cross-game transfers. This is already possible in Pokemon HOME." Another user highlighted.

Nevertheless, speculation about Parasol's potential involvement in developing new Pokemon features remained unsubsided.

The SUI price dropped nearly 3% in the past 24 hours. At the time of writing, it was trading at $3.47.

ProShares XRP ETF Rumors

Adding to the week's speculation, rumors spread that the U.S. Securities and Exchange Commission (SEC) approved a ProShares XRP ETF.

However, BeInCrypto denied these claims, explaining that the approval was for ProShares' leveraged and Short XRP futures ETF. ETF analyst James Seyff also considered this claim false, providing additional clarity.

"Update: Many are posting/reporting that ProShares will launch an XRP ETF on April 30. We confirm this is not true. No confirmed launch date yet, but we believe it's likely to be launched in the short or medium term." Seyff explained.

ProShares launched three futures-based ETFs: Ultra XRP ETF, Short XRP ETF, and Ultra Short XRP ETF. This development came after the launch of Teucrium's 2x Long Daily XRP ETF in early April.

ProShares XRP Futures ETF Sparks Optimism

Meanwhile, the approval of ProShares XRP futures ETF sparked optimism. It raised expectations that a spot XRP ETF would be next.

According to industry expert Armando Pantoja, this move could lead to significant capital inflows into altcoins.

"A spot XRP ETF could be next, which will unlock real demand and cause a price surge. Over $100 billion could soon flow into XRP." – Armando Pantoja, Industry Expert

Pantoja perceived this approval as a crucial turning point for the industry and expanding XRP's investor base.

This optimism stems from the ProShares XRP futures ETF already attracting significant interest from Wall Street and institutional investors.

The approval cleared the runway for an XRP ETF, providing a regulated and accessible path for major financial players to participate in Ripple's token.

"Futures ETF = First domino. Spot ETF = Turning point. XRP's long-term setup is much stronger." – Armando Pantoja, Industry Expert

Other analysts took a more cautious stance amid high optimism, noting that the futures ETF is not the game-changer many expect.

"Not a silver bullet for mass adoption or massive price movement. The true catalyst will come when a spot XRP ETF is approved. Real token. Real demand. Real market impact." – John Squire, Analyst

SEC Delays XRP ETF Decision

To add to the list of developments in the XRP ecosystem this week, the U.S. SEC postponed its decision on a potential XRP ETF until June 17.

Before this news, cryptocurrency market participants were awaiting final decisions on XRP, Doge, and Ethereum Staking ETFs. However, all were postponed.

"These dates are all intermediate stages, and we are likely to see final decisions for many cryptocurrency ETPs in the fourth quarter. For the XRP spot ETF, the final decision deadline is seen around mid-October, around the 18th. The SEC may not take all that time to make a decision, but how actively they engage with the application will determine a lot." – James Seipart, Analyst

Currently, over 70 active ETF proposals are awaiting a decision from the securities regulatory agency. The June deadline for the XRP ETF is not final, and the committee can still implement additional delays until mid-October.

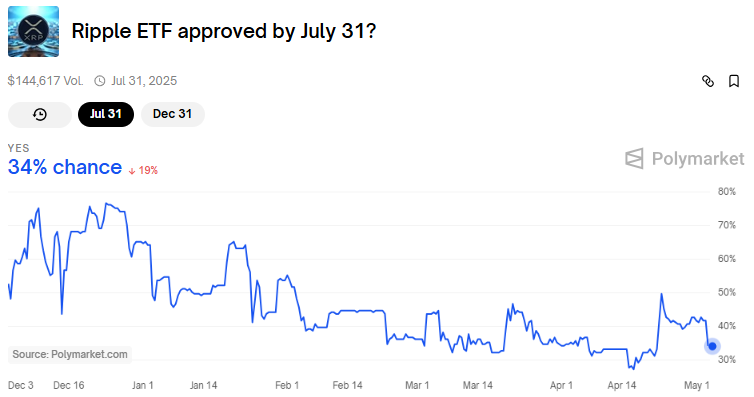

Meanwhile, according to Polymarket data, bettors see a 34% probability that this financial product will be approved by July 31st.

At the same time, they see a 79% probability that this financial product will be approved by December 31st.