Bitcoin may face three potential trend scenarios in the future, with the most optimistic scenario predicting a surge to between $150,000 and $175,000 within the next 12 months.

This prediction is supported by strong institutional capital inflows and positive investor sentiment due to the Trump administration's national Bitcoin reserve plan.

Expert Positive Outlook...Market Signals

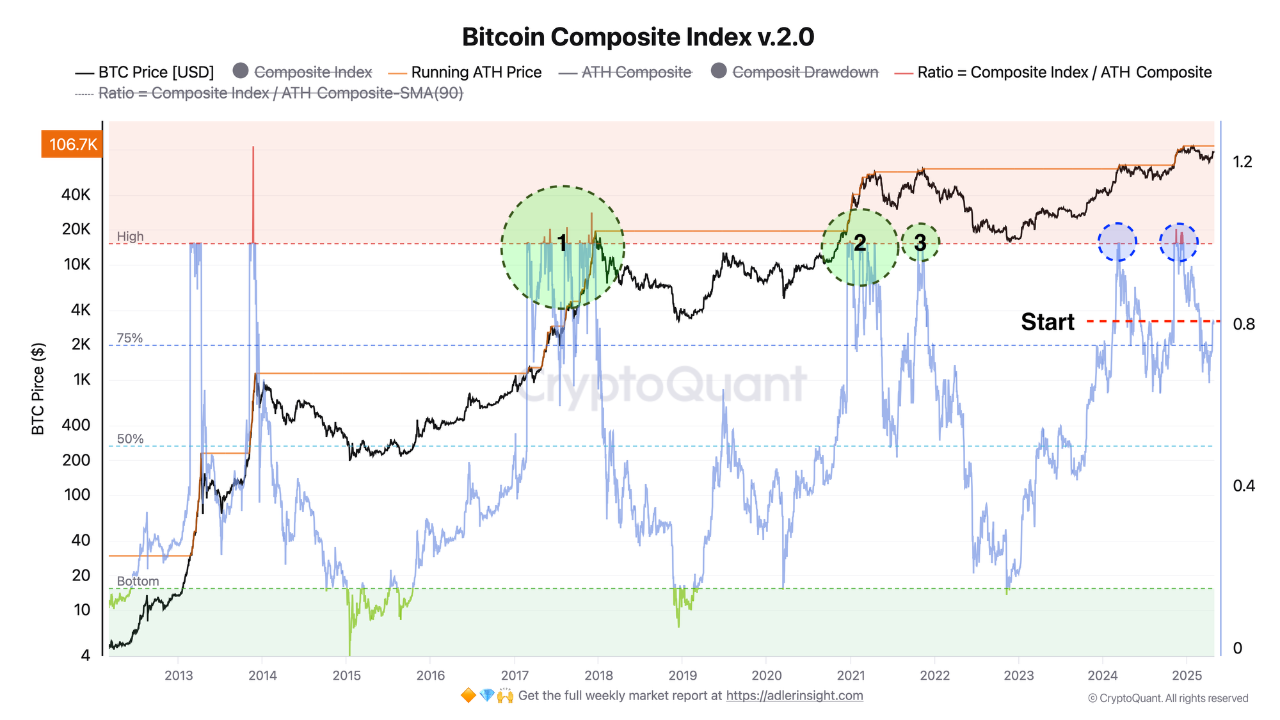

Bitcoin (BTC) is showing promising prospects. Positive market signals and expert predictions are emerging in early May 2025. According to AxelAdlerJr's analysis, the current on-chain momentum is at the upward market "start" stage.

The Bitcoin Composite Index is currently around 0.8 (80%). Based on this indicator, AxelAdlerJr proposed three possible scenarios.

In the most optimistic scenario, BTC's price could reach $150,000 to $175,000. This would occur if the Bitcoin Composite Index exceeds 1.0 and maintains that level.

If the ratio remains in the 0.8–1.0 range, the market is likely to consolidate in a broad range between $90,000 and $110,000. This means participants will maintain their positions without increasing exposure.

Conversely, if the ratio falls below 0.75, short-term holders might start taking profits, which could lead to a price adjustment to $70,000-$85,000. However, AxelAdlerJr mentions that this scenario is less likely than the other two.

The return of YoY True MVRV to positive territory means that the average purchase price of all coins acquired over the past year is now below the current market price. The pressure from panic sellers is decreasing – many are now in profit and don't need to lock in losses. Holder… pic.twitter.com/6AgvVVTn9h

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) May 2, 2025

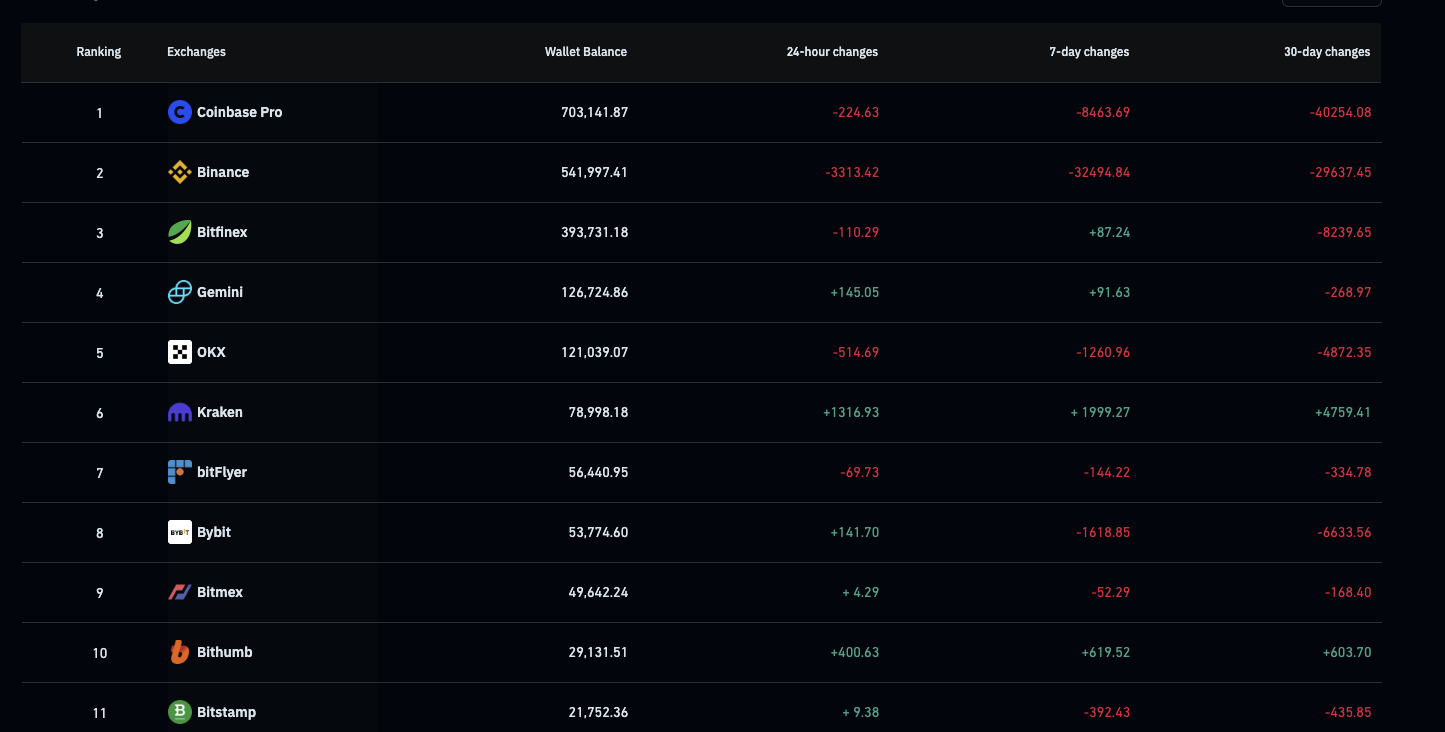

On-chain signals further strengthen the upward outlook. According to Coinglass, approximately 42,525.89 Bitcoin was withdrawn from centralized exchanges (CEX) in the past 7 days, with the exchange supply reaching a 7-year low of around 2.48 million BTC.

Bitcoin's exchange withdrawal trend is often considered a positive signal. This indicates that investors are accumulating and selling pressure is decreasing, paving the way for price increases.

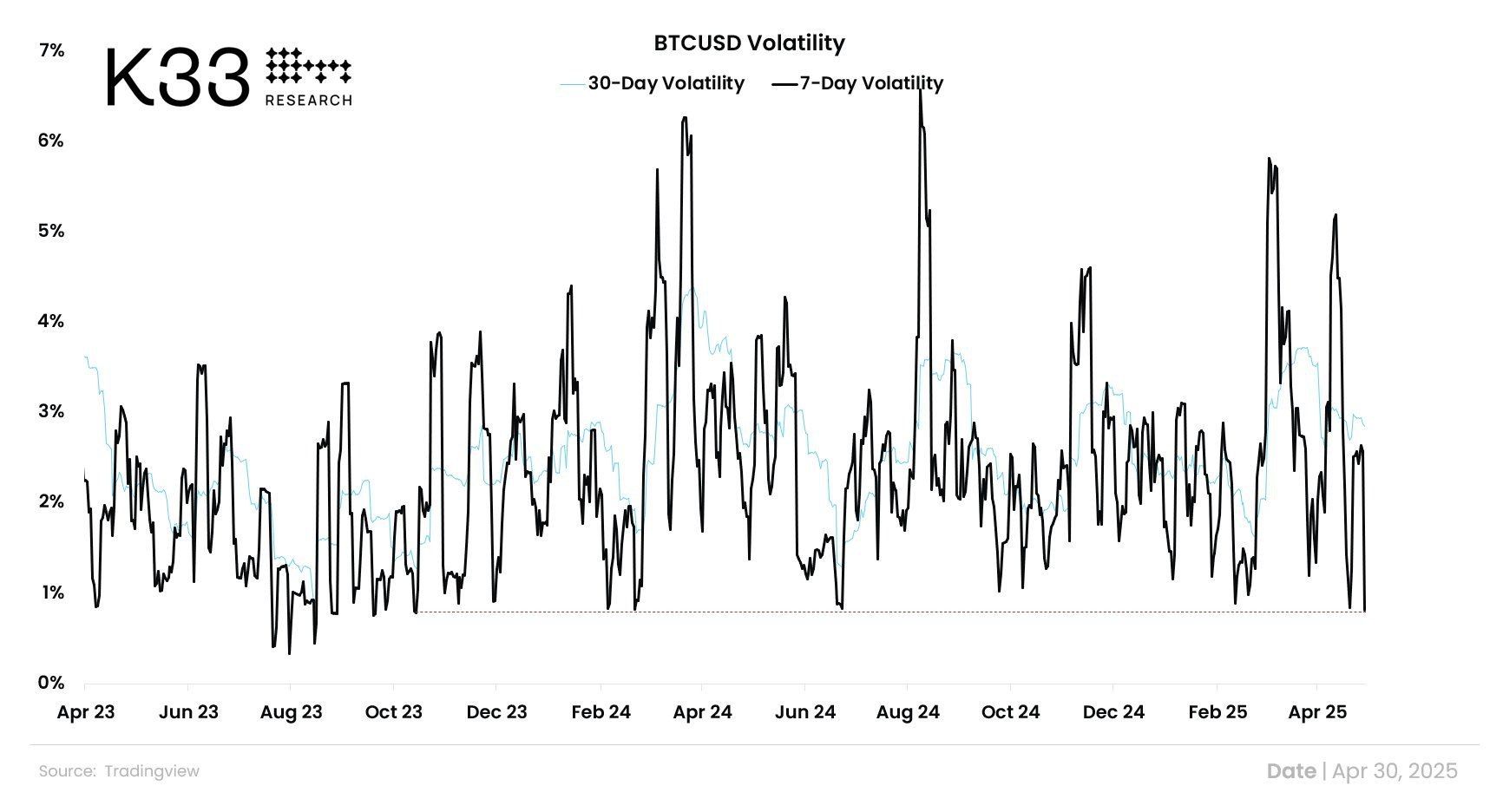

Bitcoin's 7-day volatility has also reached its lowest level in 563 days. Low volatility typically indicates an accumulation period before a price surge. This was observed in major bull markets, such as before Bitcoin reached $69,000 in 2020.

Technical Analysis and Key Price Levels

Technical analysis also supports Bitcoin's upward scenario. According to Ali's post on X, Bitcoin's key support levels are $93,198 and $83,444. This indicates strong consolidation above these thresholds.

If Bitcoin maintains levels above $93,198, the likelihood of reaching the $150,000 target becomes very high.

"The most important support levels for #Bitcoin $BTC are $93,198 and $83,444. Key zones to watch if momentum changes." Shared by Ali on X.

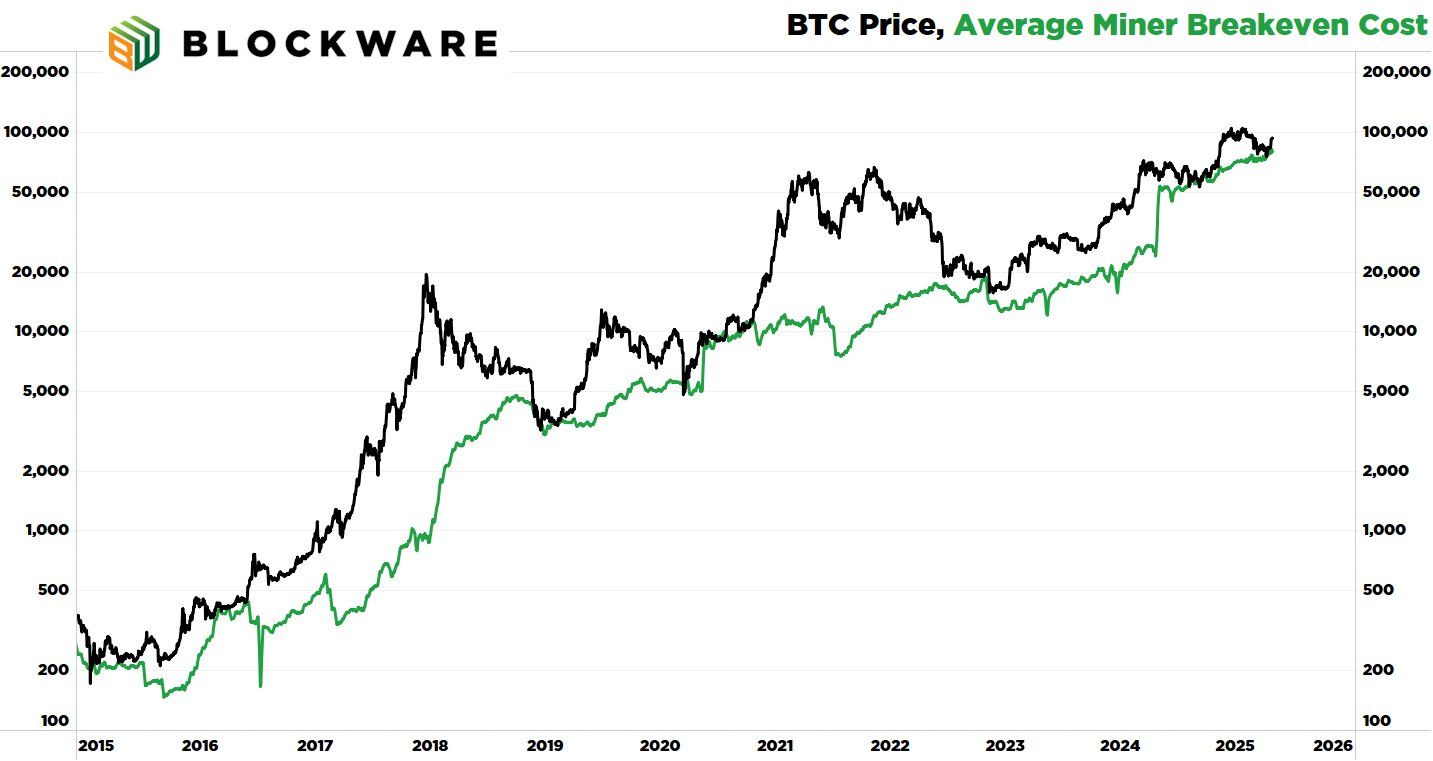

Additionally, famous analyst Breedlove22 shared three indicators on X showing optimistic signals for Bitcoin. The first is the average miner production cost. According to Breedlove22, this indicator is at the bottom, suggesting a potential major bull market is approaching.

The second indicator is the supply held by long-term holders. This measures Bitcoin that has not moved on-chain for at least 155 days. Breedlove22 mentioned that long-term holders have acquired an additional approximately 150,000 BTC in the past 30 days.

"Bitcoin is seeing fewer sellers between $80,000 and $100,000." – Said Breedlove22.

Lastly, and most importantly, is dollar liquidity. This effectively represents the demand side. More dollars in the system mean more potential bidders.

"And it's not just dollar liquidity increasing. The liquidity of all fiat currencies is increasing, and Bitcoin is a global asset." – Added Breedlove22.

Reflecting Breedlove22's perspective, another X user shared that BTC's valuation based on hash rate is supported and may have reached a local bottom.

In the optimistic scenario, Bitcoin has the opportunity to reach $150,000 to $175,000. However, investors should be prepared for risks such as short-term price adjustments.

With strong support levels at $93,198 and $83,444, Bitcoin has a solid foundation for continued growth, but caution is advised.