In early May 2025, the Ethereum (ETH) market witnessed contrasting behaviors from large investors known as whales.

These whales' contrasting actions provide both risks and opportunities for investors.

Comparison of Ethereum Whale Behaviors

On one hand, several Ethereum whales are accumulating ETH in large quantities. One ETH whale purchased 3029.6 ETH, amounting to $5.74 million. However, this whale is currently experiencing a temporary loss of $142,000 as ETH price has dropped to $1,842.

On May 1st, 2025, Lookonchain reported that multiple whale addresses accumulated thousands of ETH within two hours. These actions indicate that some major investors still have confidence in ETH's long-term potential, despite short-term price volatility.

On the other hand, the selling pressure from Ethereum whales is significant. On May 2nd, 2025, OnchainLens reported that a whale deposited 2,680 ETH to Kraken, incurring a loss of approximately $255,000.

Meanwhile, analysts noted that another whale transferred 3,000 ETH to Kraken within 10 minutes on the same day, indicating a strong selling intention.

10 minutes ago, a whale 0xaDd deposited 3k $ETH (~$5.53M) into #Kraken.

— The Data Nerd (@OnchainDataNerd) May 2, 2025

Those $ETH were bought since ICO and have been dormant in 3 years before depositing.

Just now, he still has 2k $ETH (~$3.69M) in his wallet.

Address:https://t.co/sEQRwaM32n pic.twitter.com/vuLzE65V2r

Notably, a whale who received 76,000 ETH during the 2015 ICO sold 6,000 ETH, potentially securing a profit of $10.92 million.

Additionally, on May 1st, 2025, on-chain data showed a whale borrowing an additional 4,000 ETH to increase their short position. This whale holds a total short position of 10,000 ETH, equivalent to approximately $18.4 million.

These movements highlight the clear differences in Ethereum whale strategies, with accumulation and selling exerting significant pressure on ETH prices.

Market Conditions and Investor Sentiment

According to BeInCrypto, ETH price increased by 10% in a week but slightly declined in the past 24 hours. It is currently trading near $1,842, a significant drop from the March 2025 high of $2,500.

Nevertheless, market sentiment shows positive signals. Ethereum investment products recorded an inflow of $183 million last week after eight weeks of outflows. The Ethereum spot ETF recorded a net inflow of $6,493,200 yesterday. This reflects continued long-term institutional interest despite short-term whale selling pressure.

Furthermore, a whale's large 10,000 ETH short position anticipates a short-term price decline and could amplify downward pressure if market sentiment turns negative.

Retail investors appear to be affected by this uncertainty, with ETH trading volume decreasing by 10% in the past 24 hours.

Risks and Opportunities

The whales' contrasting behaviors place investors at a crossroads of risks and opportunities. From a risk perspective, the selling pressure from whales with large short positions could lower ETH prices in the short term, especially considering the overbought market conditions.

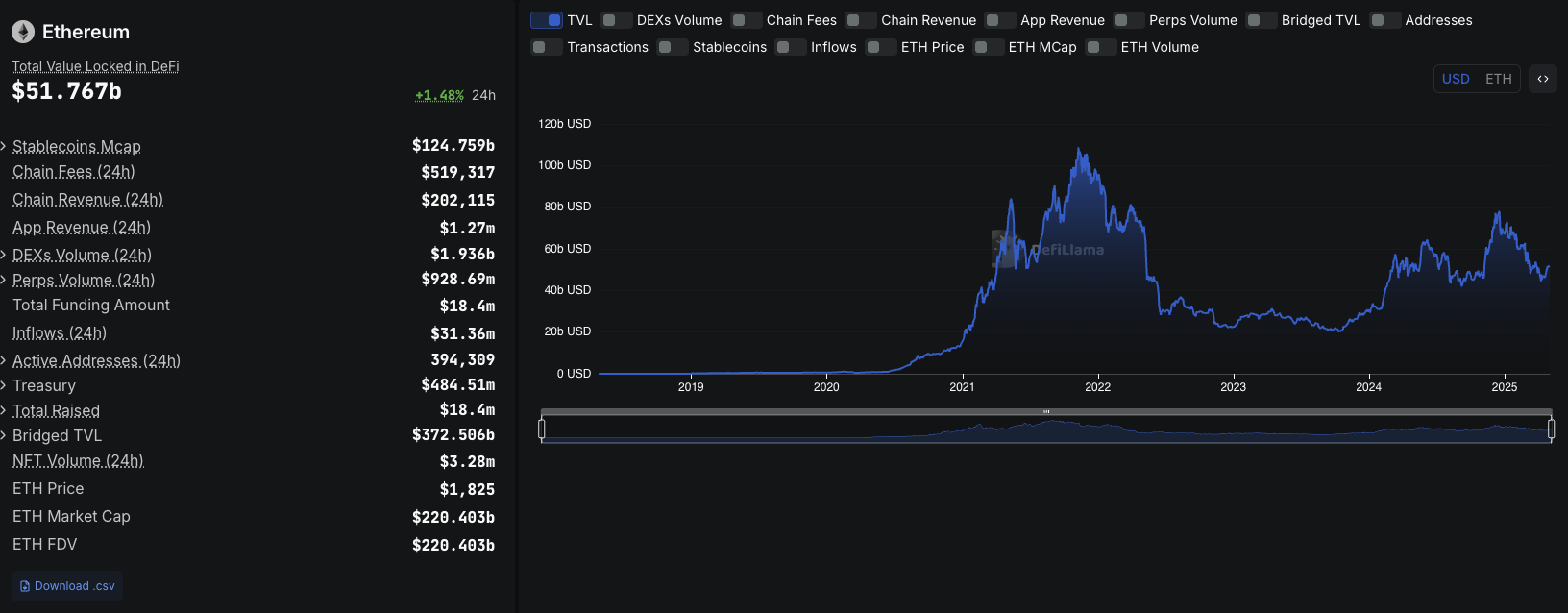

However, opportunities are abundant. Whales accumulating thousands of ETH reflect long-term confidence in Ethereum's potential, especially as the network maintains its lead in DeFi, with defillama reporting a Total Value Locked (TVL) of $52 billion as of May 2025.

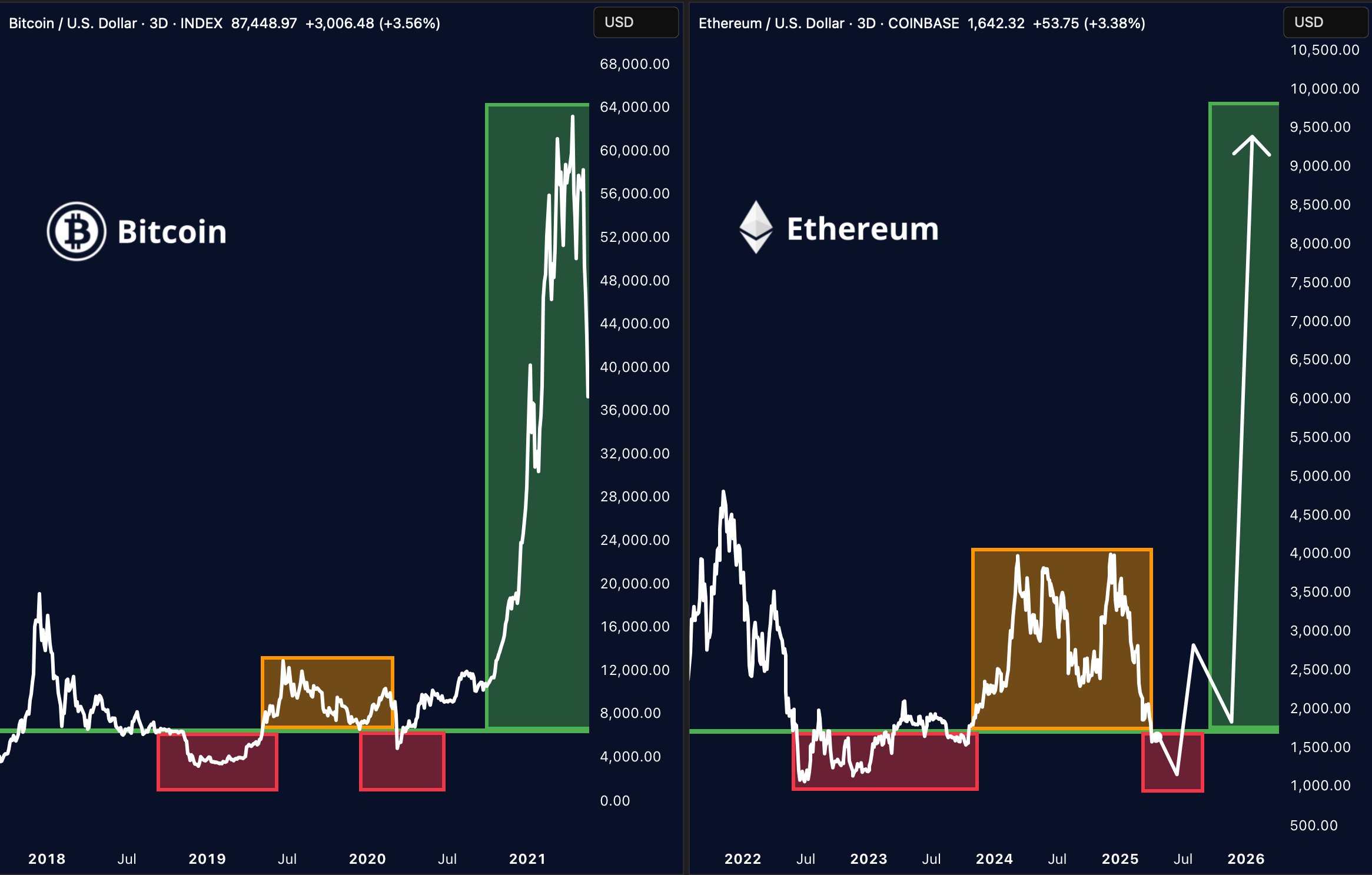

Analyst Merlijn demonstrated that Ethereum's current price structure is similar to Bitcoin's in 2020. Therefore, he believes that if history repeats, Ethereum will witness a strong boom.

Ethereum risks losing developers. Solana is gaining momentum with better startup support and a simplified user experience.

However, the growth of Ethereum 2.0 and Layer 2 solutions like Arbitrum and Optimism support ETH's long-term development.

Investors can view the current low price levels as an accumulation opportunity. However, they must closely monitor whale activity and technical indicators to mitigate adjustment risks.