Traders and investors are focusing on several US economic indicators this week. These could impact cryptocurrency investment portfolios. These macroeconomic data are becoming increasingly important as their influence on BTC prices in 2025 grows.

Bitcoin price is still adjusting within the $94,000 range. The volatility of US economic events this week could determine the next direction.

US Economic Data Cryptocurrency Investors Should Watch This Week

Here are the US economic indicators cryptocurrency market participants can focus on this week.

ISM Services

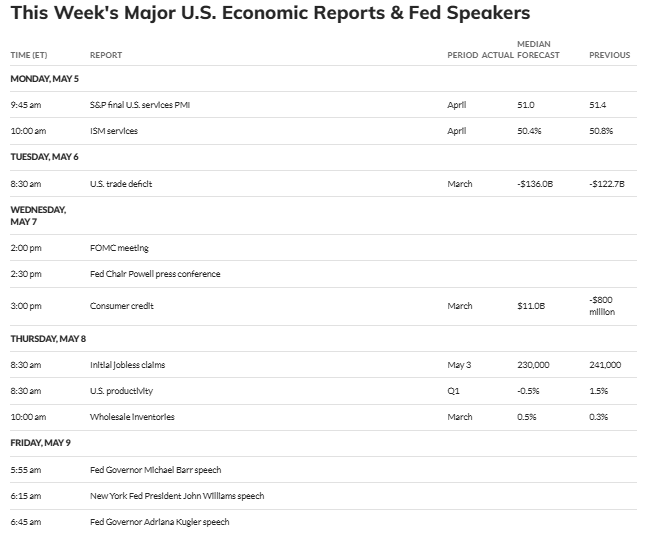

This week, ISM Services and S&P Final US Services PMI are the first US economic indicators that could impact cryptocurrencies. These macroeconomic data will assess the health of the US service sector in April.

Above 50 indicates expansion, below indicates economic contraction. According to MarketWatch, the median forecast for the S&P Final US Services PMI is 51.0. The previous figure was 51.4. Meanwhile, the median forecast for ISM Services is 50.4%. The previous figure was 50.8%.

"Tariffs have not had a significant spillover effect on the service industry. Financial conditions remain tight. The US economy has shown some cracks in its resilience, and the Fed has not quickly changed direction. We expect a low result of 50.30-50.50. This could keep the DXY weak and maintain some intraday strength in gold. A low services PMI shows signs of continued disinflation and supports rate cut bets." – Market information provider Capital Hungry

Strong data could strengthen confidence in traditional markets, reducing Bitcoin's appeal. Conversely, weak PMI could indicate economic slowdown, potentially increasing demand for Bitcoin amid uncertainty.

Considering the cryptocurrency market's reaction to macroeconomic signals, weakness in the service sector could weaken the dollar. This could support Bitcoin prices due to its inverse correlation with USD.

However, if PMI exceeds expectations, risk appetite could spread to cryptocurrencies, though less aggressively than to stocks. As Bitcoin is sensitive to economic indicators, traders will carefully watch this announcement. It could set market sentiment and impact cryptocurrency volatility and investor positioning.

US Trade Deficit

Another US economic indicator to watch this week is the US trade deficit, measuring the gap between exports and imports in March.

The median forecast is -$136 billion. The previous figure was -$122.7 billion. However, especially amid discussions of Trump's tariffs, an expanding deficit could weaken the US dollar, reflecting higher import dependence.

This generally benefits Bitcoin and cryptocurrencies, as they often move opposite to USD strength. Additionally, a larger-than-expected deficit could indicate economic imbalances, potentially driving investors to seek Bitcoin as a hedge against fiat currency value decline.

Conversely, a reduced deficit could strengthen the dollar, potentially pressuring cryptocurrency prices by encouraging investors to prefer traditional assets.

Particularly in 2025, the cryptocurrency market has been oversensitive to trade-related news amid potential policy changes based on the new administration's priorities.

Volatility is expected as traders assess whether the trade deficit trend signals more stringent monetary and trade policies.

In this context, Bitcoin's reaction depends on the data's implications for dollar strength and global trade dynamics.

"As the US trade deficit increases, the country is being sold from under our feet." – Analyst Zerohedge, quoting Warren Buffett

Reuters reported that economists have downward adjusted forecasts after the trade deficit reached an all-time high, as businesses stockpile inventory amid tariff uncertainties.

FOMC Meeting… Jerome Powell Conference

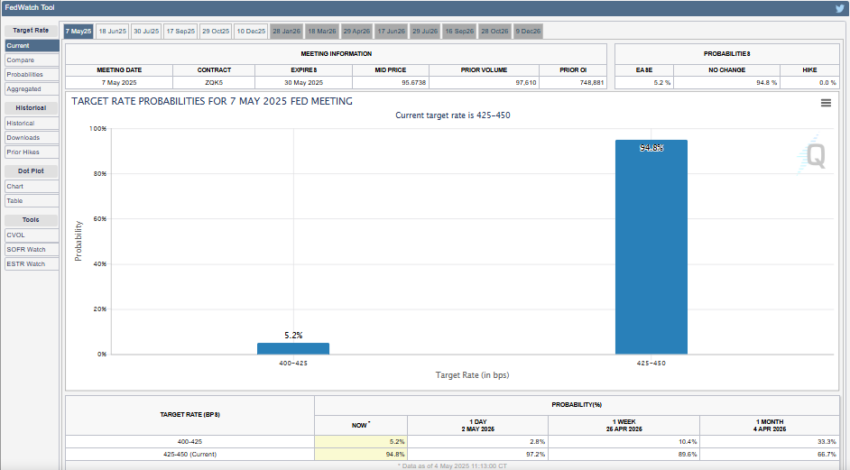

The highlight of this week's US economic indicators will be the FOMC meeting and the subsequent conference by Federal Reserve (Fed) Chair Jerome Powell. The market expects rates to remain at 4.25%-4.5%. However, the Fed's tone will drive market sentiment.

Hawkish signals showing tight policy or ongoing inflation concerns could strengthen the dollar. Such outcomes will pressure Bitcoin prices as investors move to safer assets.

Conversely, dovish statements suggesting rate cuts or economic easing could stimulate risk appetite. This would support cryptocurrencies as investors seek higher returns.

Investors will carefully examine Powell's statements on inflation, growth, and policy outlook. Bitcoin is sensitive to Fed announcements. Despite political pressure, Powell has promised to make cautious decisions. He has significantly adjusted the 2025 economic forecast downward.

Additionally, on Friday following Wednesday's FOMC and Powell's conference, numerous Fed board members are set to appear, further highlighting the week's economic indicators' importance.

"FOMC will meet on Wednesday and Powell will speak. His statements will be more important than the decision. Friday is a very important 'Fed speaker' week, packed with Fed speakers." – Market expert Peter Targa wrote.

Therefore, cryptocurrency volatility is expected, and traders will adjust their positions to find direction. Bitcoin is sensitive to monetary policy changes, so surprising shifts in the Federal Reserve's stance could amplify market movements.

Consumer Credit

Another notable U.S. economic indicator is consumer credit data. This data, to be released on Wednesday, tracks U.S. borrowing trends and reflects consumer confidence and spending capacity.

Following the previous figure of -$800 million, the median forecast is $11 billion. An increase in credit levels suggests optimism and could drive investment from speculative assets like Bitcoin to traditional markets. This occurs at a time when consumers are promoting economic growth.

These movements could reduce cryptocurrency demand, especially when combined with strong economic signals from other indicators this week.

Conversely, if credit stagnates or decreases, it could enhance Bitcoin's appeal as a hedge against economic slowdown or fiat currency instability.

The cryptocurrency market often reacts to changes in consumer behavior. Borrowing trends impact liquidity and risk appetite.

An unexpected drop in credit could trigger volatility and drive investors towards diversified assets. Bitcoin prices may vary depending on whether the data aligns with the broader economic narrative in the context of Federal Reserve policy and trade dynamics. This becomes a crucial factor in cryptocurrency market sentiment.

New Unemployment Claims

New unemployment claims are reported weekly and will be a key observation for cryptocurrency traders this week. This data measures new unemployment applications, providing a real-time snapshot of labor market health.

For the week ending April 26, reported new unemployment claims were 241,000. However, MarketWatch data shows a median forecast of 230,000.

"U.S. new unemployment claims increased by 18,000 to 241,000 for the week ending April 26, reaching the highest level since February, significantly exceeding the forecast of 224,000," – analyst Michael Guide mentioned.

Lower-than-expected claims indicate economic strength, potentially boosting traditional markets and reducing Bitcoin's appeal. A robust labor market could strengthen the dollar, putting pressure on cryptocurrency prices due to Bitcoin's inverse dollar correlation.

Conversely, high claims could indicate economic weakness and potentially increase Bitcoin demand as a hedge against uncertainty or fiat currency value decline.

Another reason the cryptocurrency market is sensitive to labor data is its impact on Federal Reserve policy expectations. A surge in claims could trigger volatility and reinforce Bitcoin's safe-asset narrative.

Meanwhile, a decrease in claims could reduce enthusiasm for diversified assets. Traders will watch how claims align with broader economic signals like the FOMC meeting. Labor market trends could stabilize or destabilize the cryptocurrency market this week.

According to BeInCrypto data, BTC is currently trading at $94,126, having declined by almost 2% in the past 24 hours.