In the past 24 hours, approximately $150 million (about 21 billion won) worth of leverage positions were liquidated in the cryptocurrency market.

According to the currently compiled data, short positions notably accounted for a larger proportion of the liquidated positions. This is analyzed to be related to the recent rebound movements of major coins, including Bitcoin.

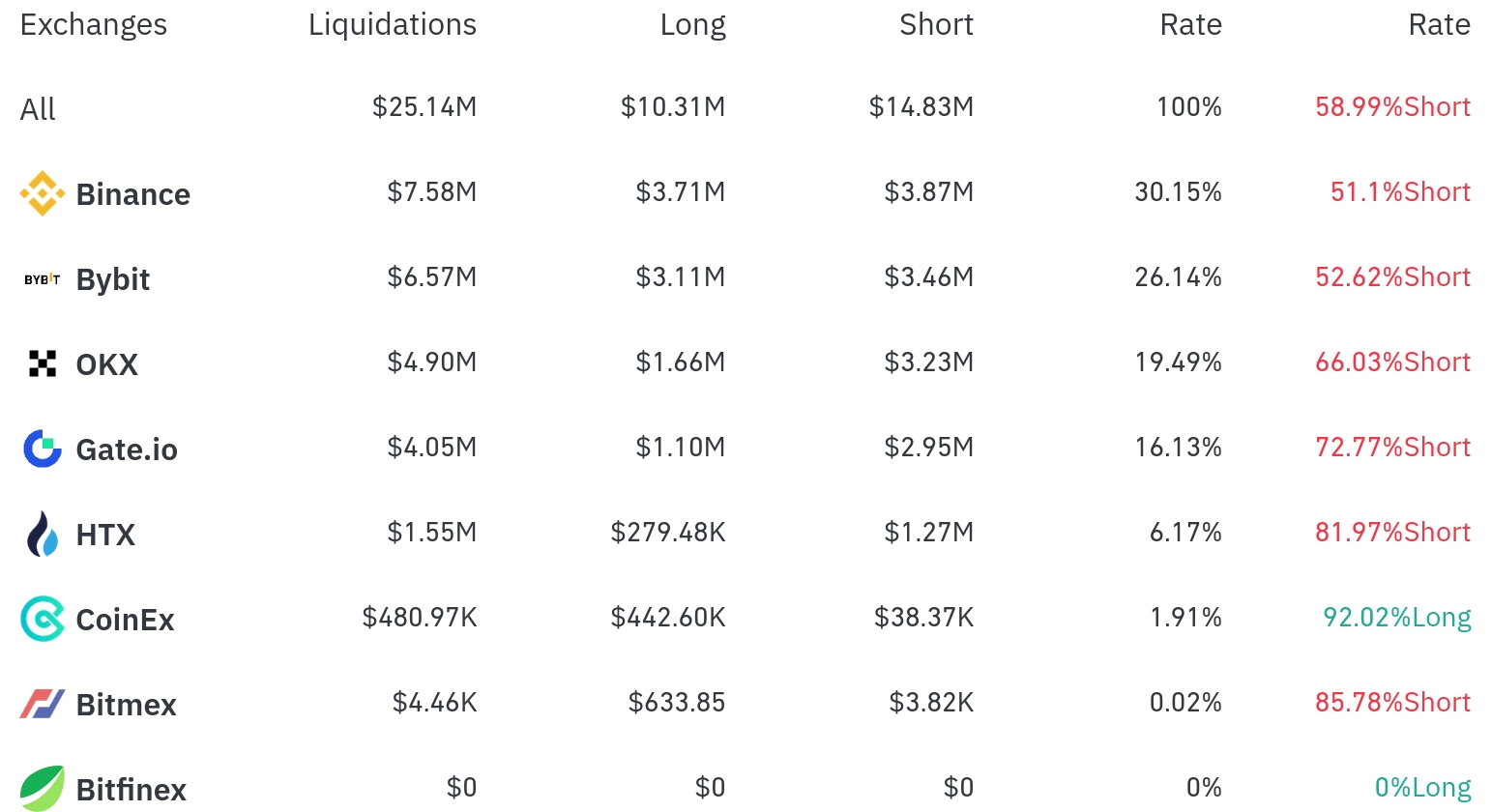

Binance experienced the most position liquidations in the past 4 hours, with a total of $7.58 million (30.15% of the total) liquidated. Among these, short positions accounted for $3.87 million, representing 51.1%, which was higher than long positions.

The second-highest liquidations occurred on Bybit, with $6.57 million (26.14%) of positions liquidated, where short positions also dominated at $3.46 million (52.62%).

OKX saw approximately $4.90 million (19.49%) in liquidations, with a notably high short position ratio of 66.03%.

Notably, Gate.io and HTX showed extremely high short position liquidation rates of 72.77% and 81.97% respectively, while CoinEx was the only exchange with an overwhelmingly high long position liquidation rate of 92.02%.

By coin, Ethereum (ETH) recorded the most liquidations. Approximately $48.89 million in Ethereum positions were liquidated in 24 hours, and despite a recent -1.85% price drop, short position liquidations were overwhelmingly high in the 4-hour timeframe.

Bitcoin (BTC) had about $35.58 million in positions liquidated in 24 hours and is currently trading at $94,637, showing a slight 0.47% increase over 24 hours. In the 4-hour timeframe, short position liquidations were much higher than long positions.

Solana (SOL) saw about $7.4 million in liquidations in 24 hours, and among other major altcoins, SUI ($7.39 million) and XRP ($5.45 million) followed with significant liquidations.

Doge (DOGE) experienced $4.46 million in liquidations and is currently trading at $0.168.

Particularly, the SUI Token saw many short position liquidations despite a significant -7.03% price drop, and the FARTCO Token experienced $1.6 million in short position liquidations over 4 hours, accompanied by a -6.40% decline.

The Trump-related token TRUMP also saw $1.67 million in short position liquidations with a -1.23% price drop, which appears to reflect volatility due to recent political changes.

A notable aspect of this data is that most exchanges had more short position liquidations than long positions. This is interpreted as forced liquidation of positions by traders who anticipated a decline during the market's recent recovery process. The market's stronger-than-expected recovery appears to have resulted in significant losses for short position traders.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>