In 2025, Bitcoin (BTC) is gaining attention as Bitcoin wallets that have been inactive for a long time, often called "old whales", are becoming active again.

Large-scale transactions from wallets unused for over 10 years and Bitcoin transfers to exchanges are drawing the attention of the crypto community. These changes reflect shifts in major investors' behavior and could signal potential price volatility.

Old Bitcoin Whales Become Active Again

Recently, 3,422 Bitcoin, amounting to $324 million, was transferred from a wallet that had been inactive for 12 years to a new address. This Bitcoin originated from Bitcoin from BTC-e, one of the oldest closed exchanges.

At the time in 2012, the initial value of this Bitcoin was only $46,000. Today, its value has increased 7,018 times, clearly showing Bitcoin's long-term growth potential.

Around the same time, another wallet holding 2,343 BTC was reactivated after 11.8 years of inactivity. The value of this wallet exceeds $221 million. Transactions from these "sleeping" wallets have drawn significant attention in the community, which may indicate that veteran investors are liquidating assets or preparing strategic moves in the market.

Bitcoin Moves to Exchanges... Increasing Selling Pressure?

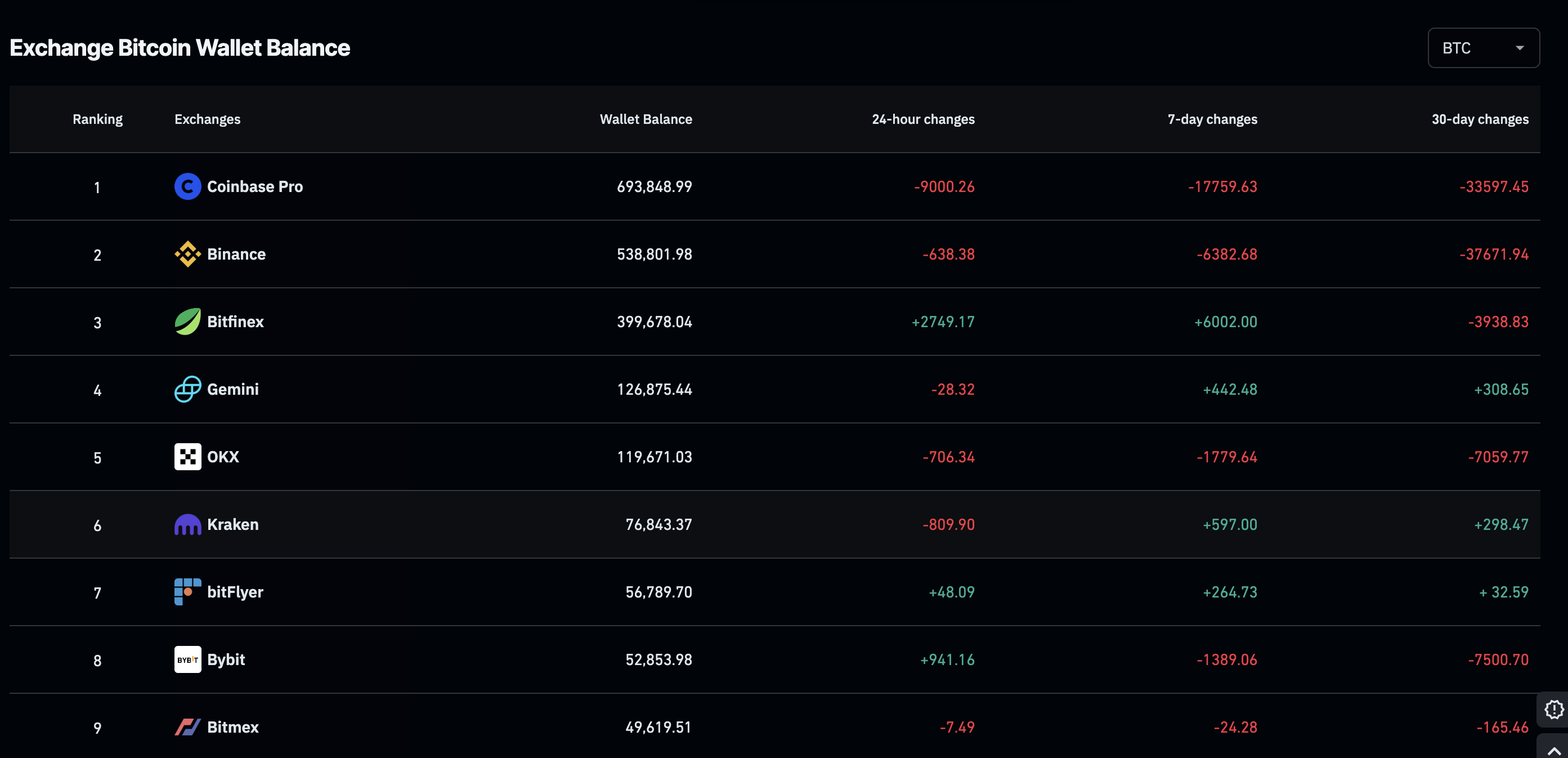

In addition to the reactivation of long-inactive wallets, large-scale Bitcoin transfers to major exchanges continue. According to Whale Alert's data, these transactions surged in early May 2025.

Specifically, 2,402 BTC was moved from Ceffu to Binance, and 600 BTC ($56.65 million) was transferred from an unknown wallet to Bitfinex. Additionally, 1,636 BTC ($154.05 million) and 1,385 BTC ($130.74 million) were sent from Cumberland to Coinbase Institutional. Another transaction recorded 1,142 BTC ($107.68 million) from an unknown wallet to Coinbase Institutional.

These movements suggest that Bitcoin whales are actively moving assets to exchanges, which can be interpreted as a signal of potential selling pressure.

Beyond individual whales, leading Bitcoin mining company Riot Platforms sold 475 BTC in April 2025 in response to industry pressures. This comes as many companies must liquidate some of their holdings to maintain operations in the face of increased operating costs in the Bitcoin mining sector after the 2024 halving. Meanwhile, institutional investor MicroStrategy, known for its Bitcoin accumulation strategy, continues to purchase Bitcoin despite criticism of its high-risk investment approach.

However, according to Coinglass data, exchanges saw a net outflow of 15,700 BTC last week, with total balance decreasing to 2.2 million BTC. This may reflect a long-term accumulation trend where large investors withdraw Bitcoin from exchanges and store them in cold wallets, reducing circulating supply.

What Does This Movement Mean for the Bitcoin Market?

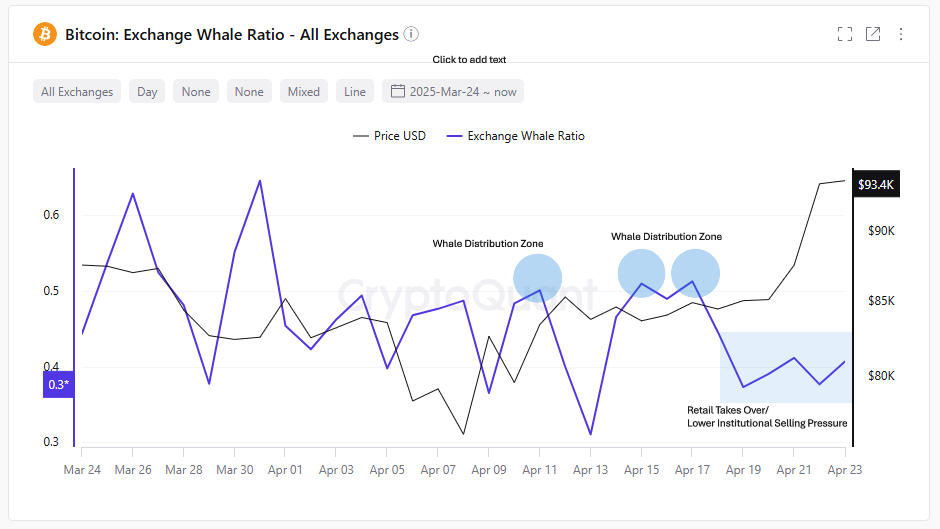

The activity of old whales and major institutions sparks speculation about the future direction of the Bitcoin market. A CryptoQuant report from March 2025 indicates a recent decrease in the whale ratio on Binance, suggesting reduced selling pressure from large investors, which is a positive signal for BTC price.

The whale ratio falling below 0.3 on April 23rd indicates a significant shift in participation from institutional or large traders to retail-driven flow.

"This suggests a reduction in whale sales and possibly a 'clean' market environment driven more by organic demand than massive selling pressure," the analysis shows.

Short-term Bitcoin holders have not yet realized enough profits to form selling pressure, and upward momentum continues to build.

"The current NUPL is 8%, and the 30-day SMA remains negative at -2%. Selling pressure from this group will be minimized until NUPL exceeds 40%, which is a positive signal," the analysis shows.

However, recent Bitcoin movements to exchanges suggest potential short-term selling pressure might increase. Especially with Bitcoin hovering around $95,000, with key support levels at $93,000 and $83,000.

The reactivation of long-inactive wallets indicates veteran investors' confidence. They appear to be preparing for a new upward cycle. These developments reveal a complex market situation with both opportunities and risks.

The revival of old Bitcoin whales, massive movements to exchanges, and actions by institutions like Riot Platforms are heating up the 2025 cryptocurrency market. These movements reflect changing sentiments among major investors and could shape Bitcoin's price trend in the coming months. Growth potential still exists, but investors must be prepared and vigilant about unexpected market fluctuations.