SUI has experienced an impressive price increase, rising almost 20% in just two days. This sharp rise continues a roughly three-week upward trend driven by increased interest from SUI enthusiasts.

As the market shows an optimistic atmosphere, this altcoin is attracting investors' attention and setting the stage for additional price movements.

SUI Traders Expect Profits

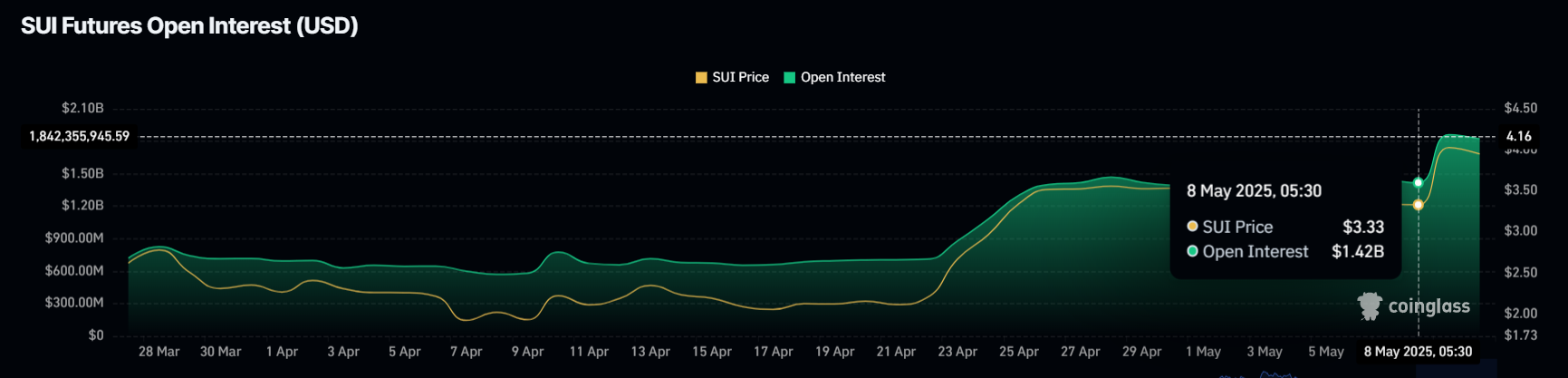

SUI's open interest increased by 28% in just 48 hours, jumping from $1.42 billion to $1.82 billion. This $400 million increase indicates growing interest in the futures market, with traders seeking to leverage the altcoin's bullish momentum.

A positive funding rate further supports this outlook, with long positions dominating short positions. This suggests that traders anticipate SUI's price will continue to rise, forming an overall bullish sentiment for the coin.

The increasing open interest and positive funding rate indicate more capital flowing into SUI, strengthening its market position. As more traders take long positions, this momentum could further drive up the price, potentially creating a positive feedback loop.

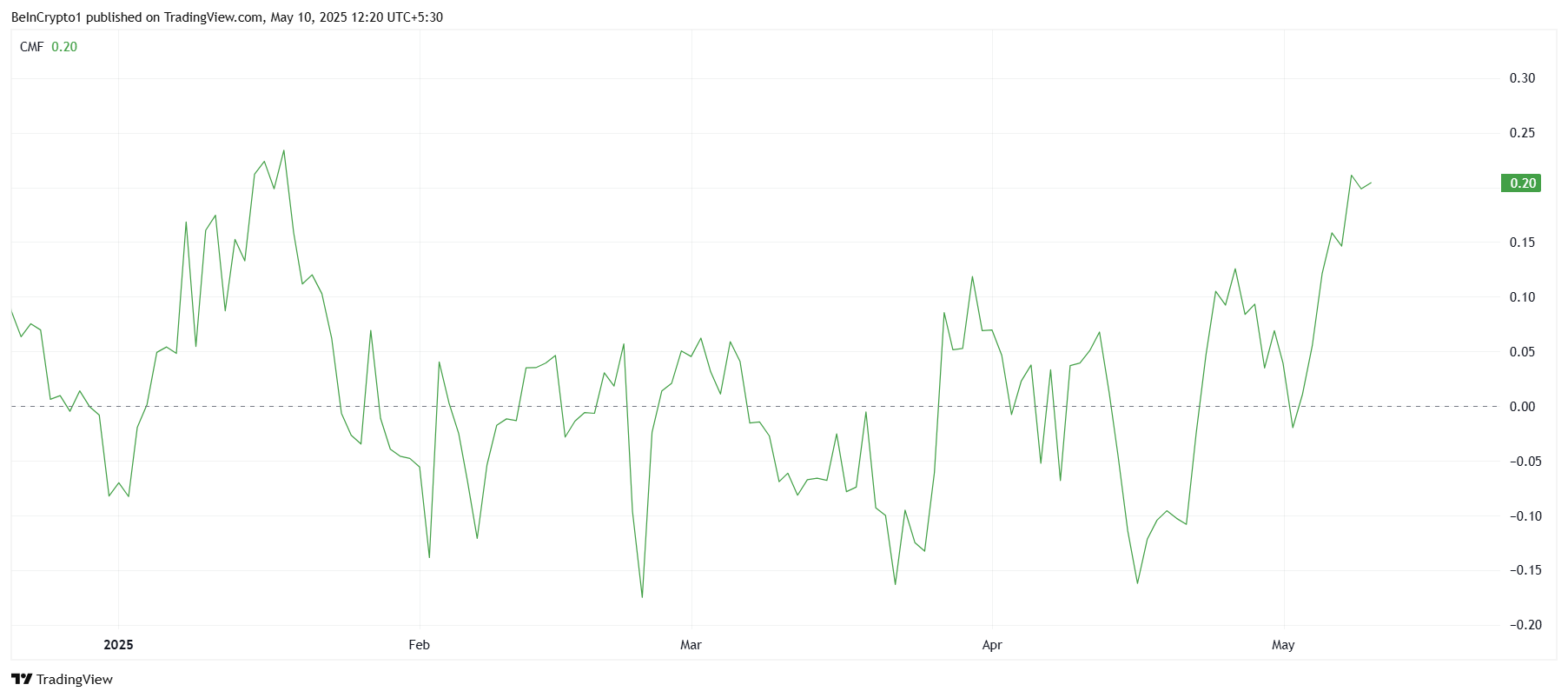

Technical indicators also support SUI's overall macro momentum. The Chaikin Money Flow (CMF) is currently near its four-month high, indicating inflows are exceeding outflows.

This rise suggests investors are actively moving to capitalize on SUI's rising price, further increasing demand.

As more capital enters the market, SUI's upward momentum could continue and potentially drive prices higher. The CMF increase reflects positive market sentiment, suggesting the altcoin's uptrend is supported by strong investor confidence.

SUI Price Continues to Rise

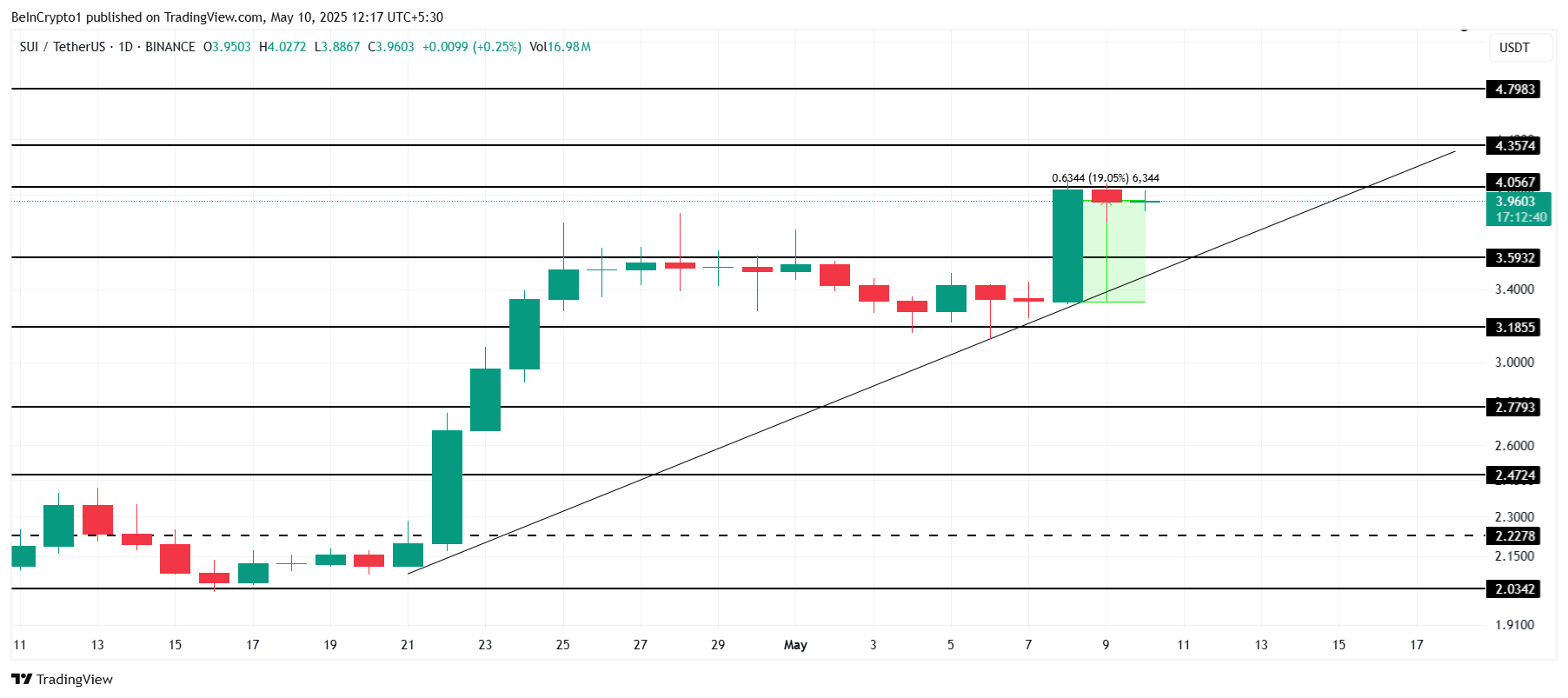

SUI's price has risen almost 20% in the past 48 hours, currently trading at $3.96. This altcoin is now approaching a key resistance level of $4.05.

Successfully breaking through this barrier could help maintain the nearly three-week upward trend and set the stage for additional price increases. This level is crucial for the rally's continuation.

If SUI can convert $4.05 into support, it could open doors for further upward movement. The next potential target could be $4.79 or higher, with $5.00 being a realistic possibility.

A sustained rally beyond this point would indicate strong bullish sentiment and suggest additional price increases.

However, if SUI fails to break through $4.05 and a reversal occurs, it could drop to $3.59. Losing this support level would indicate a potential weakening of bullish momentum, with prices potentially falling to $3.18.

In this scenario, the current upward trend could be invalidated, and market sentiment could shift to bearish.